Alert

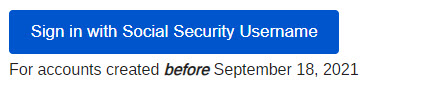

Soon you will no longer be able to sign in with your Social Security username. You will need either a Login.gov or ID.me account.

Now, when you sign in with your Social Security username, you will be asked to create an account with Login.gov.

We encourage you to sign in to transition your account now - it only takes a few minutes. If you already have Login.gov, or ID.me account, you do not have to create another one.

Alert

Effective June 24, 2024, call 1-800-772-6270 for all BSO access, registration and wage reporting questions or problems.

Alert

Learn more about Social Security's NEW access and registration process for Business Services Online (BSO). You can access the pre-recorded webinar video, presentation, and frequently asked questions on our Wage Reporting Community Meetings and Webinars webpage.

Quick Reference Guides

- BSO Authentication is Transitioning

- Helpful Tips

- Here's what BSO can do for you

- Taxpayer First Act

- How to Register and Get an Activation Code (New)

BSO Registrants without an SSN

SSA will now accept the Individual Taxpayer Identification Number (ITIN) or a passport as an alternative to an SSN for an ID.me credential. You can register with ID.me to use BSO regardless of your foreign or domestic address.

ID.me is a Single Sign-On provider that meets the U.S. government’s most rigorous requirements for online identity proofing and authentication. Access to the BSO application requires multifactor authentication.

Start at the BSO Welcome page. From the Employers box, select either 'Log in’ or ‘Create account’ to verify your identity with ID.me.

Tips to remember:

- If you already have an ID.me account, DO NOT create a new one.

- You can have multiple email addresses connected to your ID.me account.

- Use your legal name as printed on your passport or ITIN.

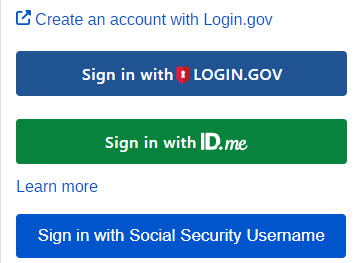

Changes are coming to how you access BSO

Soon, you will no longer be able to sign in with your Social Security username.

- Applies to accounts created more than 3 years ago.

- Access requires an ID.me or Login.gov credential.

- No action needed if you already have an ID.me or Login.gov credential.

Taxpayer First Act – 10 or more returns: E-filing now required

- Starting tax year 2023, if you have 10 or more informational returns, you must file them electronically, unless the IRS grants a waiver or exemption.

- This new regulation reduces errors and helps to avoid delays in processing your reports.

- For more information on informational returns, please visit:

A guide to information returns | Internal Revenue Service (irs.gov)

The Business Services Online (BSO) access and registration

Allow at least 2 weeks to complete the registration process, well ahead of the January filing deadline.

SSA updated how you access a BSO account for the following services:

- Wage file upload

- W-2/W-2C online

- AccuWage online

- Social Security Number Verification Service (SSNVS)

- View wage report name/SSN errors

Your BSO User ID and password is no longer used to access BSO wage reporting services.

BSO users can use their existing Social Security account, a Login.gov or ID.me credential.

If you do not have a Social Security online account or a Login.gov or ID.me credential, you will need to create one from our Social Security Sign in page. This is a requirement to access BSO employer services.

Once the credentialing and authentication process has been completed, current BSO User ID(s) will be associated with your new credential.

Frequently Asked Questions

Can I sign in with my personal my Social Security account username and password?

Yes. However, soon you will no longer be able to sign in with this option. If you have created a Social Security Online account (such as my Social security) you can

use the username and password to sign in. Your username and password will be associated with your BSO User ID.

Why do I need to add extra security?

Social Security uses different levels of security depending on the sensitivity of the information being accessed. These additional levels of security are to ensure your information is protected.

Can I use SSA’s BSO to submit a 1099?

No. The Form 1099 is submitted to the IRS for processing. Please view FIRE (1099) Filing Information Returns Electronically for more information.

Can I register for BSO as an employer to view the report from my third-party submitter?

Yes, you can register for BSO as an employer even if you have a third-party submitter. You must register for a credential and request wage reporting services; this will allow you to view the report from any third-party submitter.

Registration and Access to Services Handbook

Do I need to register for a BSO credential if I have a 3rd party submitting my W2’s?

No, you do not need to register for a BSO credential, although your third-party submitter will need to register for a credential to access BSO wage reporting services.

Activation Code: We added an extra layer of security to keep your data safe and secure

- If you are a new user or need to add wage reporting to your existing account, we will mail an activation code.

- The activation code is sent via the United States Postal Service (USPS) to the employer’s address registered with the Internal Revenue Service (IRS). Your employer will usually receive it within two (2) weeks.

- Your employer should give you the instructions and activation code as soon as received. You will need this information to complete your account registration or the change to your existing account.

- Activation codes are time sensitive.

- We recommend registering for BSO before the W-2 reporting season in January 2025.

Registering Without an Employer Identification Number (EIN) means you are unable to file electronically.

- Apply with the IRS here for an EIN or see how to mail your paper forms W-2/W-3 and W2c/W-3c’s to Social Security's Wilkes-Barre Direct Operations Center. Paper Forms W-2 & Instructions.

Currently, we are unable to mail an activation code to new users registering without an EIN. This includes Household and Self-employed registrants. Registration and Access to Services Handbook.

Remember, starting tax year 2023, if you have 10 or more informational returns, you must file them electronically, unless the IRS grants a waiver or exemption.

- As a reminder, we can only process Forms W-2 that are Copy A (for SSA), red and white ink or black and white ink, and two to a page.

Electronic Filing Options (EFW2)

- Wage File Upload

- Process your file and provide results in real-time. Receive a receipt right away

- Track your submission to completion

- Know if you have errors immediately after submission

- Must be in the EFW2/EFW2c Format

- For more information on Wage File Upload there are a variety of options:

- Read the tutorial

- View the infographic

- View the video

- Our new application provides a receipt and an immediate notification whether your file passed our edits or if you must fix any errors. You will receive the results in less than 60 seconds.

- W-2 Online - Create, save, print, and submit up to 50 Forms W-2 for Tax Years 2021 - 2024.

- Electronic Wage Reporting Web Service (EWRWS) (ssa.gov) - Developers of payroll and tax reporting software, as well as payroll service providers, can use this to create a web service client to electronically file wage reports.

- Note: SSA is currently not accepting new EWR Web Service users/consolidators. Wage File Upload and W2 Online remain available to use through Business Services Online.

For smaller businesses, we also have a FREE W-2 Online service

- Key up to 50 W-2s and 25 W-2cs and submit electronically.

- Review and print completed report with your employees.

- No need to send paper!

For more information, go to How to Use SSA's Free W-2 Online Website to view the video.

Truncated SSNs

- You may shorten the SSN on W-2s, except on Copy A.

- We will not accept shortened SSNs that only show the last four digits (XXX-XX-1234) on Copy A Form W-2 or in the SSN field when using the EFW2. Show all nine digits for proper processing.

IRS instructions on Truncated Taxpayer Identification Numbers

Verify SSNs

- If you need information about whether your employee's reported name and SSN match our records, please view our Verify SSNs page.

Find Helpful Information Online

Go to our employer page for videos, tutorials, and other useful information and links.

Customer Support for Access and Registration

For assistance with the credential and identity verification process.

- Login.gov Help Center

- 1-844-875-6446

- ID.me Help Center

- Virtual help ONLY

- For registration issues relating to BSO accounts

- 1-800-772-6270 (TTY 1-800-325-0778)

- National 1-800 #:

- For information about Social Security online programs and benefits, please use our automated services by calling:

- 1-800-772-1213