Alert

Soon you will no longer be able to sign in with your Social Security username. You will need either a Login.gov or ID.me account.

Now, when you sign in with your Social Security username, you will be asked to create an account with Login.gov.

We encourage you to sign in to transition your account now - it only takes a few minutes. If you already have Login.gov, or ID.me account, you do not have to create another one.

Alert

Effective June 24, 2024, call 1-800-772-6270 for all BSO access, registration and wage reporting questions or problems.

How To Create a Business Services Online (BSO) Account

We have a new log in process for BSO wage reporting services.

Your personal and business accounts will remain separate, but will use the same credentials.

You only need to verify your identity once. After successful verification, your existing BSO user ID, along with any activated services, will be associated with your new credential.

If you leave your company, your credential and BSO user ID will remain associated with your identity.

Steps and Tips for Verifying Your Identity

1. Start here! Our Business Services Online (BSO) Welcome page is your starting point for the following employer services:

- Wage File Upload.

- W-2/W-2C Online.

- AccuWage Online.

- Social Security Number Verification Service (SSNVS).

- View wage report name/SSN errors.

IMPORTANT: ALWAYS start from the BSO Welcome page when attempting to access BSO.

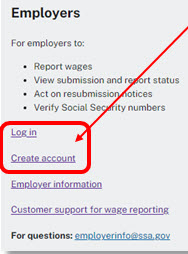

2. Select either the Log in link or the Create account link from the Employers box.

Use this option if you are:

- An employer.

- An employee submitting on behalf of your employer.

- A sole proprietor.

- A volunteer.

- A third party submitter who submits on behalf of other companies.

3. Choose one of the three sign-in options below:

Next, navigate the authentication process to verify your personal identity using ID.me or Login.gov.

Note: Your BSO User ID and password are no longer used during the sign in process. Your BSO account still exists and will be available after you verify your identity. Your personal and business data will remain separate.

Ways to Register for BSO Employer Services

Soon you will no longer be able to sign in with your Social Security username. You will need an account with one of our credential service providers, Login.gov, or ID.me. Now, when you sign in with your Social Security username, you will be presented with an option to create Login.gov account and transition your account. We encourage you to sign in to transition your account now - it only takes a few minutes. If you already have Login.gov, or ID.me account, you do not have to create another one.

Below are common paths that users may take to get registered. For more on wage reporting services, please visit our Employer W-2 Filing Instructions & Information page.

First Time User with Login.gov

Standard to Advanced Account with Login.gov

Sign in to Your ID.me Account with Extra Security

Disclaimer: The information above is current, but subject to change.

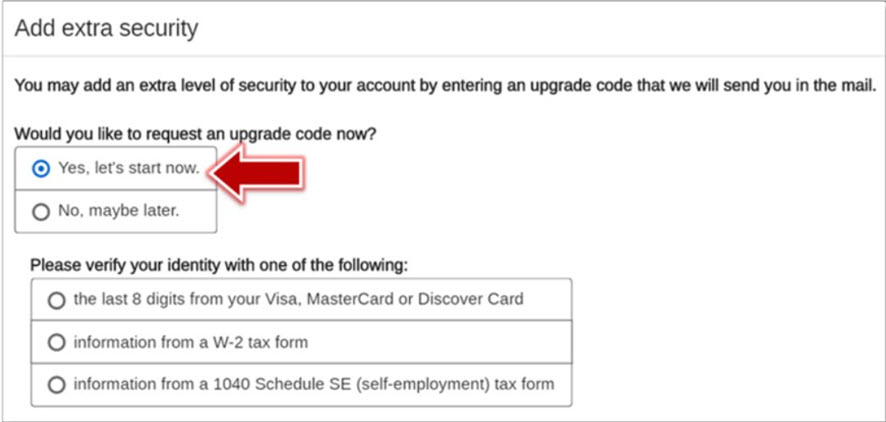

Adding Extra Security

If you are an existing user, you may be asked to add extra security. If you are asked, be prepared to take clear photos of your driver’s license or state-issued ID with a smartphone. You can also input your ID number and financial information.

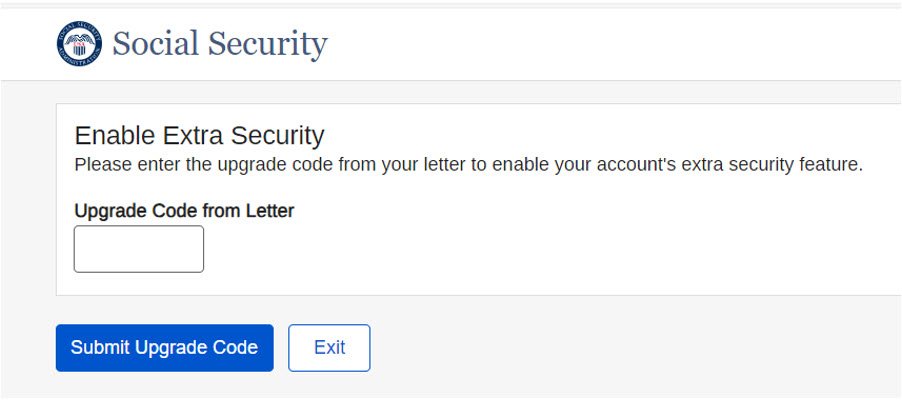

When you get to this screen you MUST add extra security:

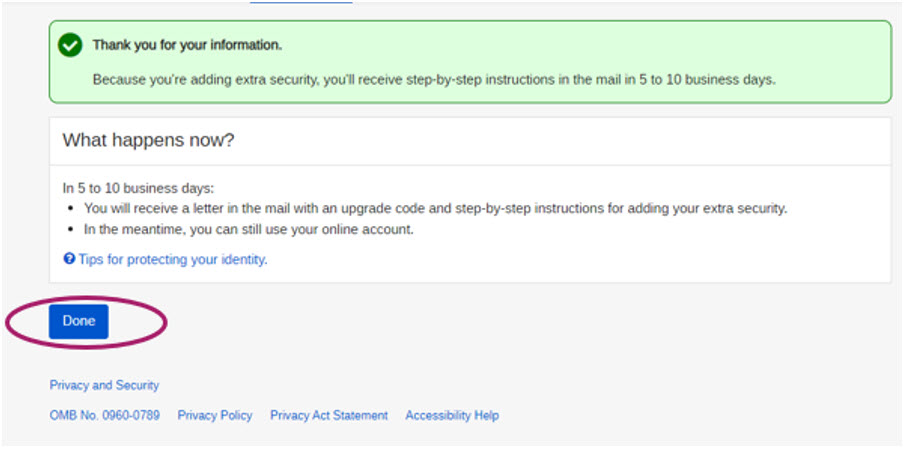

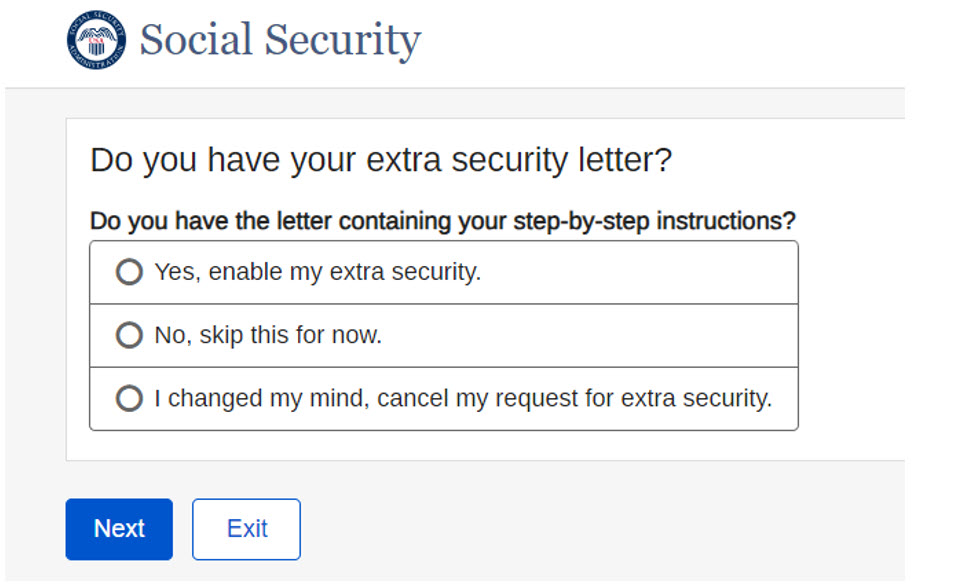

A letter with your upgrade code will arrive in the mail via USPS in 5 to 10 business days.

Select “Yes, enable my extra security.”

Enter the upgrade code from the letter, then select “Submit Upgrade Code.”

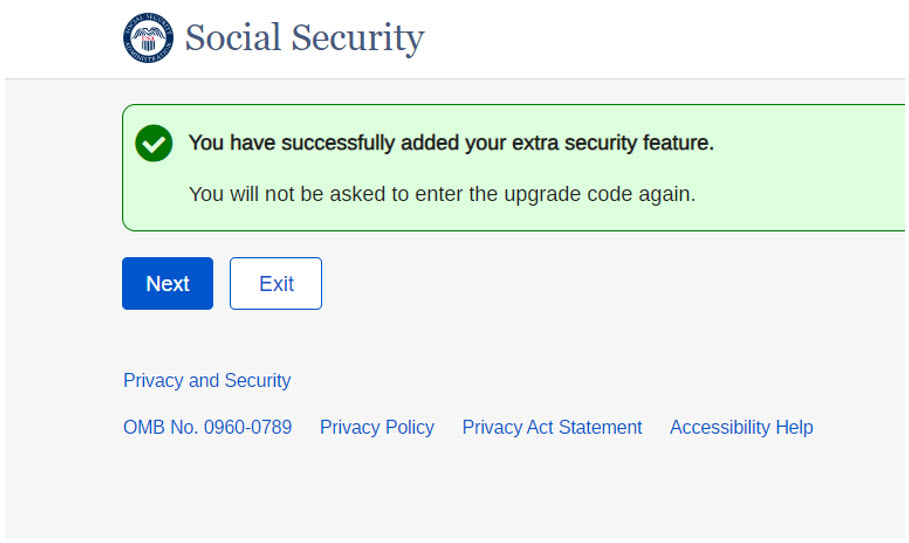

You have successfully added your extra security feature!

Requirements for a Credential with Extra Security

You may need the following to create an account:

- A valid email address.

- A Social Security number (those without an SSN can verify via ID.me).

- A working mobile phone able to receive text messages.

- Your driver’s license information or state-issued ID.

- Your full legal name as listed on your Social Security card.

You may need to provide financial information such as:

- The last 8 digits of a credit card (Visa, Mastercard, or Discover card).

- Information from a W-2 tax form.

- Information from a 1040 Schedule SE (self-employment) tax form.

NOTE: You may not be able to create a credential if you:

- Recently moved.

- Recently changed your name.

- Blocked electronic access to your personal information.

If you encounter issues with a credential service provider (CSP), please try creating an account with ID.me before reaching out for assistance.

If you are unable to create an account on your own, please visit our Customer Support for Wage Reporting page.

We are committed to protecting your information and benefits. That’s why we ask for personal information to verify your identity. We work with external CSPs to securely verify your identity. We do this to protect your data while making our online services easy for you to use.

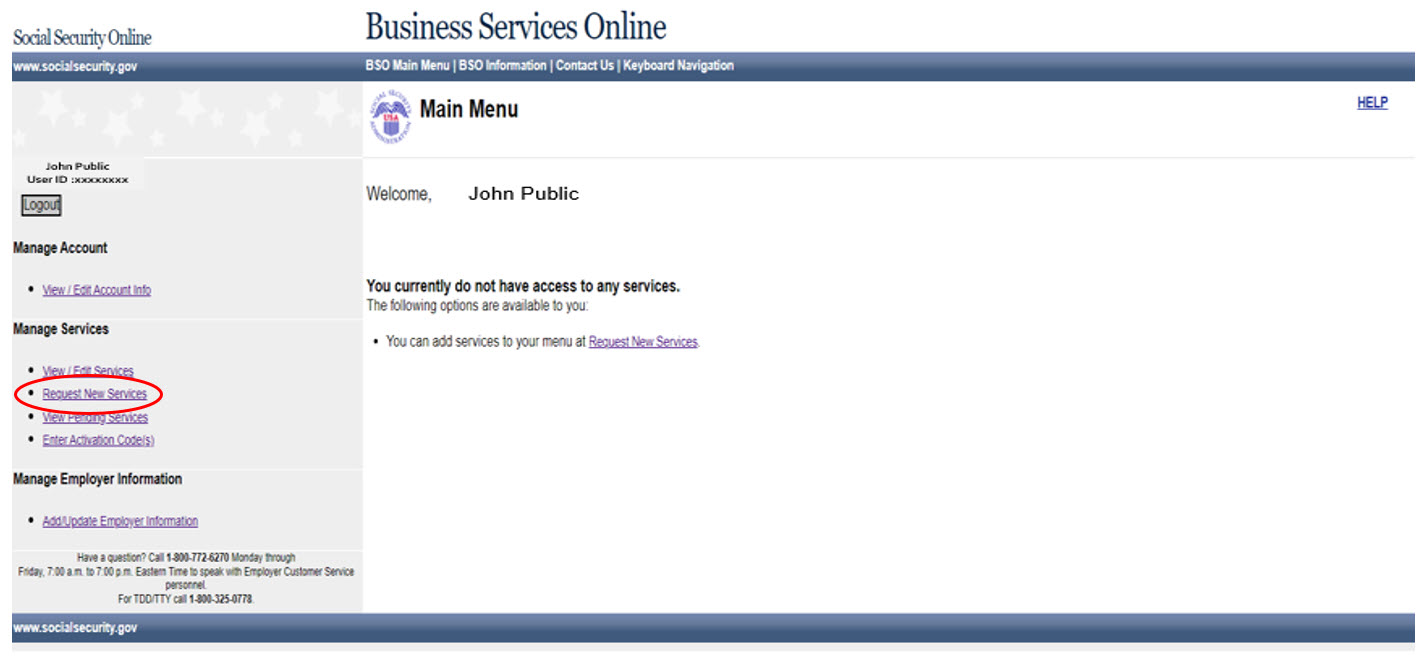

How To Request the Employer Suite of Services

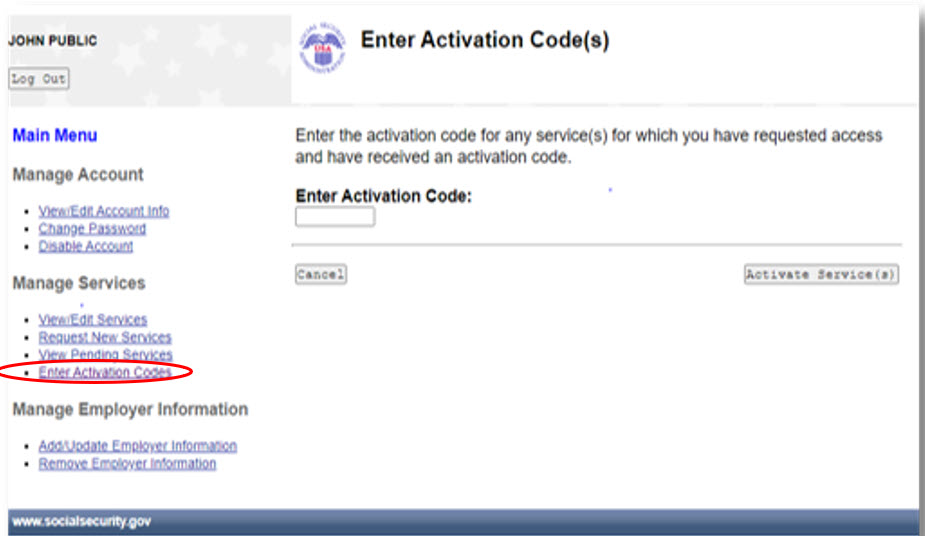

1. Select the ‘Request New Services’ link from the Manage Services menu.

Request the employer suite of services and wait for the activation code to be mailed to the employer address on file with the IRS. The activation code can take anywhere from 15 to 20 days to arrive at your employer’s address.

Once you receive your activation code:

- Log back in to BSO.

- Select ‘ENTER ACTIVATION CODES’.

- Enter the activation code.

What You Can Do Now

We recommend you start the registration and authentication process for BSO before the W-2 reporting season in January. It can take up to 2 weeks to complete registration.

If you already have a Social Security online account, Login.gov credential, or ID.me credential, visit our BSO Welcome page and select “Log in” in the “Employers” box. Use your credential to sign in and add the additional levels of security.

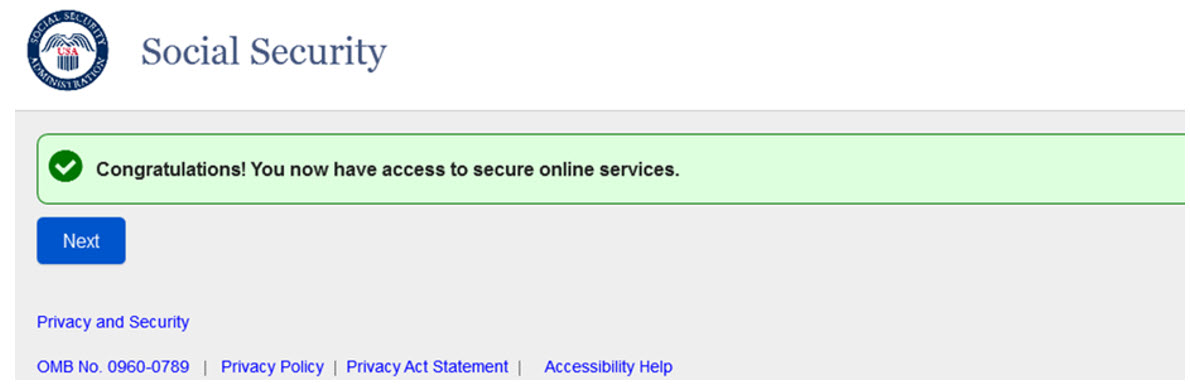

Once the credentialing and authentication process has been completed, current BSO User ID(s) will be associated with your credential.

Don’t wait until the W-2 reporting season!

Extra security is a requirement to access the following BSO employer services:

- Wage file upload.

- W-2/W-2C online.

- AccuWage online.

- Social Security Number Verification Service (SSNVS).

- View wage report name/SSN errors.

You will not be able to use these services without adding the additional levels of security to your account.

Tips to get through the process smoothly:

- Slow down! Take your time. Please navigate through the process carefully. A simple keying error could cause an authentication issue and lock you out of the system.

- When uploading images of your driver’s license be sure to provide clear pictures of the front and back. A blurry picture may cause authentication issues.

- Make sure you are using the full legal name that is recorded on your driver’s license and Social Security card.

- Make sure to clear your browser history and use the most current browser available.

Additional Information

New Registrants without an SSN

As an ID.me partner, we now accept the Individual Taxpayer Identification Number (ITIN) or a passport as an alternative to an SSN. You can register with ID.me to use BSO with an ITIN or passport regardless of your foreign or domestic address. You may access BSO by creating or using an existing ID.me account.

IDme is a Single Sign-On provider that meets the U.S. government’s most rigorous requirements for online identity proofing and authentication. Access to the BSO application requires multifactor authentication.

You must start at the BSO Welcome page. From the Employers box, select the 'Log in’ link or ‘Create account’ link to verify your identity with ID.me.

BSO Users without EIN

Users registering without an Employer Identification Number (EIN) will not be able to request an activation code for wage reporting services. We can only send the activation code to users with a valid EIN and address on file with the IRS. Instead, you will need to mail paper Forms W-2/W-3 and W-2c/W-3c to our Wilkes-Barre Direct Operations Center. Please visit the Paper Forms W-2 & Instructions page for address information.

Paper Filing Reminders

Users registering without an Employer Identification Number (EIN) will not be able to request an activation code for wage reporting services. We can only send the activation code to users with a valid EIN and address on file with the IRS. Instead, you will need to mail paper Forms W-2/W-3 and W-2c/W-3c to our Wilkes-Barre Direct Operations Center. Please visit the Paper Forms W-2 & Instructions page for address information.

Customer Support for Access and Registration

For assistance with the credential and identity verification process.

- Login.gov Help Center

- 1-844-875-6446

- ID.me Help Center

- Virtual help ONLY

- For registration issues relating to BSO accounts

- 1-800-772-6270 (TTY 1-800-325-0778)

- National 1-800 #:

- For registration information about Social Security online programs and benefits, please use our automated services by calling:

- 1-800-772-1213

Employer Reporting Service Center

Our toll-free line helps employers with W-2s, W-3s, wage reporting access and registration questions or problems.

1-800-772-6270 (TTY 1-800-325-0778) Monday through Friday, 7 a.m. to 5:30 p.m., Eastern Time

E-mail: employerinfo@ssa.gov

For additional contact information for customer support for wage reporting please visit Customer Support for Wage Reporting page.

Electronic W-2/W-2c Reporting Using the Business Services Online Website

For technical support such as connection and transmission questions or about using Business Services Online for filing Forms W-2/W-2c electronically.

Phone: 1-888-772-2970 (TTY 1-800-325-0778) Monday through Friday,

7 a.m. to 5:30 p.m., Eastern Time

E-mail: bso.support@ssa.gov