December 2022

Visit Social Security Online This Holiday Season

At Social Security, we understand that the holiday season may give some of us a break from daily routines and the time to rest and relax. We want your clients to know that our online services are available to help them do business with us in an easy, convenient, and secure way. This season, encourage your clients to sign up for a personal my Social Security account.

A free and secure my Social Security account is your clients’ online gateway to our services. Creating an account allows your clients to check their Social Security Statement, get proof of benefits or proof that they do not receive benefits, verify their reported earnings, estimate their future benefits, and much more!

We are committed to protecting your clients’ personal information and benefits. That’s why we work with credential partners to securely verify their identity to create their personal my Social Security account. We do this to protect their information while making our online services easy to use.

When your clients create their personal my Social Security account, keep in mind:

- They must be 18 years of age or older, have a Social Security number (SSN), and a U.S. mailing address.

- They will be redirected to the partner’s website when they select “Sign In with Login.gov” or “Sign in with ID.me.”

- They must provide a valid email address and some additional information.

- Once they create the credential, they will return to the my Social Security webpage for next steps.

Please have your clients visit www.ssa.gov/myaccount to see all they can do with a personal my Social Security account. We wish you and your clients a safe and happy holiday season.

Please share this information along to your clients.

Social Security Administration Establishing National Native American Office

Acting Commissioner Kilolo Kijakazi recently announced that we established an Office of Native American Partnerships within the Office of the Commissioner.

This office will elevate and centralize efforts to administer comprehensive programs and policies related to American Indians and Alaska Natives. It will enhance our relationship with Tribes and serve as the primary point of contact on Tribal affairs for all stakeholders.

Find more information on the new Office of Native American Partnerships on our blog. Please share this information with your clients.

The Ticket to Work Program

Every day, people with disabilities play an important role in a diverse and inclusive workforce. We would like to tell you and your clients about our Ticket to Work Program (Ticket).

The Ticket Program supports career development for people with disabilities who want to work. Adults ages 18 through 64 – who receive Social Security disability benefits or Supplemental Security Income (SSI) – qualify for this free and voluntary program. Through the Ticket Program, service providers offer free employment support services.

To learn more about the Ticket Program, ask your clients to visit choosework.ssa.gov where they can see a list of service providers. Or your clients can call the Ticket to Work Help Line at 1-866-968-7842 or 1-866-833-2967 (TTY), Monday through Friday, 8 a.m. to 8 p.m. ET, and ask for a list of service providers.

Your clients can also learn more by registering for a free, online Work Incentives Seminar Event (WISE) webinar at choosework.ssa.gov/wise. Or they can text TICKET to 474747 to receive Ticket Program texts. Standard messaging rates may apply, and your clients can opt out at any time.

Your clients can see how the Ticket Program helped Amy on her path to financial independence through work on our blog at https://blog.ssa.gov/disability-part-of-the-equity-equation.

Please share this information about our Ticket Program and Amy’s story with your clients.

New: Self-Attestation of Sex Marker in Social Security Records

We now offer people the choice to self-select their sex on their Social Security number (SSN) record.

People who update their sex marker in our records will need to apply for a replacement SSN card. They will still need to show a current document to prove their identity, but they will no longer need to provide medical or legal documentation of their sex designation.

Please let your clients know they can find more information on our blog.

Social Security Cards Are Safer at Home

Scams to steal your clients’ personal information are at an all-time high. The need to safeguard important personal documents such as their Social Security card continues to be very important.

A Social Security card is not an identification document. In many situations, your clients only need to know their Social Security number (SSN). Please advise your clients that their physical card is not necessary for most business needs.

Do your clients need evidence for work? There are several documents they can use instead of their card. Other acceptable evidence includes the following:

- Birth Certificate.

- Permanent Resident Card or Alien Registration Receipt.

- Employment Authorization Document.

- Form I-94 or Form I-94A.

Your clients do not need to show their physical card to apply for certain benefits. Your clients can simply provide their SSN for benefits like:

- Housing.

- Health insurance.

- Food assistance.

Your clients should also know their physical card is not required as evidence for the Department of Motor Vehicles or Driver License (REAL ID). The only state that requires a physical card is Pennsylvania. For all other states, other acceptable evidence includes:

- W-2 forms.

- Form SSA-1099.

- Non-SSA-1099 forms.

- Pay stubs.

Keeping their card at home reduces the risk of loss or theft – and helps your clients keep their information safe.

Holiday Closings of Local Social Security Offices

We want you to know that our offices and phone lines will be closed to the public on December 26 and January 2. However, your clients can still access and use our automated telephone services or our online services every day during the holiday season.

Please visit www.ssa.gov/onlineservices for a list of our secure and convenient online services. Our Contact Social Security by Phone lists automated telephone services available to your clients.

November 2022

Social Security Benefit Payment Increase in 2023

Approximately 70 million Americans will see an 8.7% increase in their Social Security benefit payments and Supplemental Security Income (SSI) payments in 2023. On average, Social Security benefit payment will increase by more than $140 per month starting in January.

Federal benefit rates increase when the cost-of-living rises, as measured by the Department of Labor’s Consumer Price Index (CPI-W). The CPI-W rises when inflation increases, leading to a higher cost-of-living. This change means prices for goods and services, on average, are higher. The cost-of-living adjustment (COLA) helps to offset these costs.

We will mail COLA notices throughout the month of December to retirement, survivors, and disability beneficiaries, SSI recipients, and representative payees. But if your clients want to know their new benefit payment amount sooner, they can securely obtain their Social Security COLA notice online using the Message Center in their personal my Social Security account. Your clients can access this information in early December, prior to receiving the mailed notice. Benefit amounts will not be available before December. Since your clients will receive the COLA notice online or in the mail, they don’t need to contact us to get their new benefit amount.

Your clients who already have a personal my Social Security account can opt out of receiving a mailed COLA notice and other paper notices that are available online. They can also choose to receive a text or email alert when there is a new message by simply updating Preferences in the Message Center at www.ssa.gov/myaccount. For those who don’t have an account yet, they must create one by November 15, 2022, to receive the 2023 COLA notice online.

“Medicare premiums are going down and Social Security benefits are going up in 2023, which will give seniors more peace of mind and breathing room. This year’s substantial Social Security cost-of-living adjustment is the first time in over a decade that Medicare premiums are not rising and shows that we can provide more support to older Americans who count on the benefits they have earned,” Acting Commissioner Kilolo Kijakazi said.

January 2023 marks when other changes will happen based on the increase in the national average wage index. For example, the maximum amount of earnings subject to Social Security payroll tax in 2023 will be higher. The retirement earnings test exempt amount will also change in 2023. Your clients can read our COLA fact sheet at www.ssa.gov/news/press/factsheets/colafacts2023.pdf.

Please encourage your clients to be among the first to know. They can sign up for or log in to their personal my Social Security account today at www.ssa.gov/myaccount. Your clients can find more information about the 2023 COLA at www.ssa.gov/cola.

Attorney Fee Cap Increase

Acting Commissioner Kilolo Kijakazi recently announced a change to the Attorney Fee Cap—the first in 13 years. The maximum dollar amount limit for fee agreements approved under the Social Security Act will increase from $6,000 to $7,200.

Effective November 30, 2022, we may approve fee agreements up to the new dollar limit, provided that the agreements otherwise meet the statutory requirements.

Please tell your clients that if a fee agreement is not filed, their representative can submit a fee petition after completing work on their claim(s). We’ll review the value of the representative’s services—and let your client know the fee the representative is authorized to charge and collect.

Find more information in our publication, Your Right to Representation, at www.ssa.gov/pubs/EN-05-10075.pdf.

SSI: 50 Years of Financial Security

We’re celebrating 50 years of the Supplemental Security Income (SSI) program.

President Nixon signed the SSI program into law on October 30, 1972. Two years later, in January 1974, the agency began paying SSI benefits to people who meet the eligibility requirements. SSI recipients have limited income and resources, and this monthly payment helps meet basic needs for food, clothing, and shelter.

Fifty years later, SSI remains a lifeline program for millions of people and households. SSI helps children and adults under age 65 who have a disability or are blind and who have income and resources below specific financial limits. People age 65 and older without disabilities–who meet the financial qualifications–may also receive SSI payments.

If you know someone who wants to apply for SSI, it’s best to start the process online. The online process takes about five to ten minutes, and no documentation is required to start. We will need the following basic information about the person applying or the person helping someone to apply:

- The name, date of birth, Social Security number, mailing address, phone number, and email address (optional) of the person who is interested in applying for SSI.

- If helping another person, we need the name, phone number, and email address (optional) of the person helping.

Once you or your client provide this information and answer a few questions, we will schedule an appointment to help them apply for benefits. We will send a confirmation with the appointment date and time by mail and email (if provided). In some cases, we may call to schedule the appointment.

If you or your client are unable to begin the process online, your client may schedule an appointment by calling 1-800-772-1213 (TTY 1-800-325-0778) from 8:00 a.m. to 7:00 p.m. local time, Monday through Friday. Your client may also contact their local Social Security office. You and your clients can find the phone number for their local office on our website.

Please share this important information with your clients who need it.

my Social Security: It’s Not Just for Retirees

Your clients don’t have to be retired or even close to retirement to benefit from a personal my Social Security account. Calling or visiting a local Social Security office is rarely necessary once they have one. Your clients can do much of their business with us online.

With a personal my Social Security account, clients who do not receive benefits can:

- Request a replacement Social Security card (in most states and the District of Columbia).

- Estimate their future benefits to compare different dates or ages to begin receiving benefits.

- Check the status of their Social Security application when they do decide to apply.

- Get proof they do not receive Social Security or Supplemental Security Income benefits.

- Review their work history.

If your clients already receive benefits, they can:

- Request a replacement Social Security card (in most states and the District of Columbia).

- Get a benefit verification or proof of income letter.

- Set up or change their direct deposit (for Social Security beneficiaries only).

- Change their address (for Social Security beneficiaries only).

- Request a replacement Medicare card.

- Get a Social Security 1099 form (SSA-1099).

- Opt out of receiving certain notices by mail and receive them in the secure Message Center.

Please help us spread the word. Let your clients know that they can create a personal my Social Security account today at www.ssa.gov/myaccount.

Social Security is Thankful for the Opportunity to Serve You

Thanksgiving is a time to reflect on our blessings and share memories with loved ones. We are thankful that we can help your clients learn about and access Social Security programs to assist them with life’s journey. Our services, benefits, tools, and information can help.

We are more than a retirement program. Our services help many families across this country. We are there for joyous moments like the birth of a child and issuing their first Social Security card. We are also there during times of hardship and tragedy, to provide disability, spouses, and survivors benefits. And we’re there to help your clients celebrate retirement, too.

We are available to serve your clients online, by phone, and in person in our local offices. Learn more at https://blog.ssa.gov/we-remain-committed-to-serving-you/.

Please share this information with your clients and others you care about who need help.

Veteran and Active Military Members: Social Security is Here for You!

Social Security provides resources and benefits that support veterans and active military members. Our Wounded Warriors webpage at www.ssa.gov/woundedwarriors answers many commonly asked questions about Social Security and disability benefits.

You and your clients can learn how Social Security Disability Insurance (SSDI) benefits are different from Department of Veterans Affairs benefits, which require a separate application. This information is available at www.ssa.gov/pubs/EN-64-125.pdf. We also explain how we expedite the processing of SSDI claims for people who developed a disability while on active military service on or after October 1, 2001. We quickly process these claims regardless of where the disability occurs.

Active-duty military service members may continue to receive pay while in a hospital or on medical leave. They should consider applying for SSDI benefits if they’re unable to work due to a disabling condition. Active-duty status and receipt of military pay don’t necessarily prevent payment of SSDI.

We honor veterans and active-duty military members every day by giving them the respect they deserve. Please let our heroes know they can count on Social Security when they need us most. They’ve earned these benefits! Our webpages are easy to share on social media and by email. We encourage you to check out our updated Information for Military and Veterans page at www.ssa.gov/people/veterans/index.html.

Please pass this information along to someone who may need it.

October 2022

SSA is Dedicated to Helping the People We Serve

There are few, if any, federal agencies that positively impact the lives of people in the way the Social Security Administration (SSA) does. Millions count on SSA—retirees who worked hard their whole lives, people who are no longer able to work due to disability, and many more. Our programs touch the lives of almost every person in the nation. And our employees work diligently to ensure that the people we serve receive critical benefits and other services. It is my honor and privilege to lead them in their efforts.

We are nearing the end of the fiscal year. While this past year has not been without its challenges, I am proud to say that our accomplishments have far exceeded anyone’s expectations.

Read the full statement from Acting Commissioner Kijakazi at https://blog.ssa.gov/ssa-is-dedicated-to-helping-the-people-we-serve/.

New Start Dates for Medicare Part B Coverage Coming in 2023

Let your clients know that changes are coming next year for when Medicare Part B coverage starts.

What is not changing:

If your client is eligible at age 65, their Initial Enrollment Period (IEP) will still:

- Begin three months before their 65th birthday.

- Include the month of their 65th birthday.

- End three months after their 65th birthday.

If your client is automatically enrolled in Medicare Part B, or if they sign up during the first three months of their IEP, their coverage will start the month they’re first eligible. If your client signs up the month that they turn 65, their coverage will start the first day of the following month. This won’t change with the new rule.

What is changing:

Starting January 1, 2023, your client’s Medicare Part B coverage starts the first day of the month after they sign up, if they sign up during the last three months of their IEP.

Before this change, if your client signed up during the last three months of their IEP, their Medicare Part B coverage started two to three months after they enrolled.

If your client doesn’t sign up for Medicare Part B during their IEP, they have another chance every year during the General Enrollment Period (GEP). The GEP lasts from January 1 through March 31. Starting January 1, 2023, their coverage starts the first day of the month after they sign up.

Your clients can learn more about these updates on our Medicare webpage at www.ssa.gov/medicare and our Medicare publication at www.ssa.gov/pubs/EN-05-10043.pdf. Please share this important information with your clients.

Save the Date! Upcoming National Disability Forum on October 19, 2022

We will host the next virtual National Disability Forum (NDF) on Wednesday, October 19. The title is “Homelessness: Working with Stakeholders to Improve Access to SSA Benefits and Services Part II.” The event will take place via Microsoft Teams from 1:00 p.m. – 3:00 p.m. ET.

For more information about the NDF, we encourage you and your clients to visit our What’s New page at www.ssa.gov/thirdparty/groups/whatsnew.html. You and your clients can email questions to OEA.Net.Post@ssa.gov.

National Savings Day Reminds Us to Plan for the Future

National Savings Day is October 12. The day serves as an important reminder for your clients to plan for their financial future.

Social Security is a vital part of any financial plan. We have online tools to help your clients understand their potential Social Security benefits and how they fit into their financial future.

Your clients should periodically review their Social Security Statement (Statement) using their personal my Social Security account at www.ssa.gov/myaccount. The Statement is an easy-to-read summary of the estimated benefits your clients and their families could receive, including potential retirement, disability, and survivors benefits.

Our Plan for Retirement tool in your clients’ personal my Social Security account allows them to check various benefit estimate scenarios. Your clients can compare the effect different future earnings and retirement benefit start dates have on their future benefit amount.

Please let your clients know they can take steps to improve their financial knowledge by signing in to their personal my Social Security account. If they don’t have an account, they can easily create one at www.ssa.gov/myaccount.

How Your Clients Can Protect Loved Ones from Elder Abuse

Are your clients concerned about protecting their older relatives and friends from elder abuse? The pandemic highlighted the disproportionate impact of tragedy on underserved communities, including older adults. Unfortunately, older adults face high rates of elder abuse, fraud, and nursing homes deaths.

It’s important to remember that elder abuse can happen to anyone, regardless of race, ethnicity, gender, or financial status. We are committed to helping and preventing further victimization – especially in underserved communities.

A recent Federal Bureau of Investigation report showed that elder fraud has increased. Older adults in the United States reported more than $1.6 billion in losses in 2021. This includes victims of COVID-related scams. Older adults in the United States, also lose nearly 25 times more money to scammers than other groups – an estimated $113.7 billion a year!

Reporting fraud can be difficult and older adults tend to underreport – especially when money is lost. Many older Americans are unsure about the reporting process or feel too embarrassed to report. Understaffed Adult Protective Services offices can also cause long processing times and underreporting.

We work hard to protect beneficiaries from Social Security and government imposter scams. Your clients can learn more about protecting their loved ones at blog.ssa.gov/slam-the-scam-how-to-spot-government-imposters and our Protect Yourself from Social Security Scams webpage at www.ssa.gov/scam.

Please share these important resources with your clients.

There’s Still Time! Claim Your 2021 Child Tax Credit

Thanks to the American Rescue Plan, the Child Tax Credit was increased and expanded for 2021. Most families are eligible to receive the credit for their children. For families with qualifying children who did not turn 18 before the start of this year, the 2021 Child Tax Credit is worth $3,000 to $3,600 per child, depending on their age.

If your clients haven’t filed taxes for their family to claim their full 2021 Child Tax Credit, there’s still time. Please have your clients visit our blog at https://blog.ssa.gov/theres-still-time-claim-your-2021-child-tax-credit/ for more information.

September 2022

Three Social Security Online Musts

It has never been easier to do business with us online. Often, there is no need to call or visit an office. Here are three of our webpages that can make your clients’ lives easier:

- They can create or sign into their personal my Social Security account to instantly verify their earnings, get future benefit estimates, or a benefit verification letter, and more, at www.ssa.gov/myaccount.

- Is your client ready to apply for retirement benefits? They can complete and submit their online application in as little as 15 minutes at www.ssa.gov/retirement.

- Our blog is the place to go for Social Security news. Encourage your clients to visit blog.ssa.gov and subscribe today.

Our online resources don’t end there. If your clients’ needs aren’t listed above, visit us at www.ssa.gov/onlineservices.

If You or Your Clients Fall Victim to a Scam

If your client is a victim of a scam, they should never feel embarrassed. Anyone can become a victim of fraud. The important thing is to report the scam immediately. Advise your clients to:

- Stop communications with the scammer.

- Notify financial institutions and protect their accounts.

- Contact local law enforcement and file a police report.

- File a complaint with the FBI Internet Crime Complaint Center (IC3) at www.ic3.gov and on the FTC website at ReportFraud.ftc.gov.

- Report Social Security-related scams to our Office of the Inspector General at oig.ssa.gov.

- Retain financial transaction information and records of all communications with the scammer.

Please share this information with your clients so they can help their friends, family, and community.

Why It’s Important to Report Life Changes to Us When You Receive Supplemental Security Income (SSI)

Did you know that certain life changes can affect your Supplemental Security Income (SSI) payments? Sometimes your circumstances may change after you apply for or begin to receive SSI. When that happens, it’s important for you to tell us about these changes. This will ensure that you receive the benefits to which you’re eligible.

Common changes you must report to us include:

- Changes in income, wages, or self-employment income;

- Starting, stopping, or changing jobs;

- Changing your address;

- People moving in or out of the household;

- Changes in marital status (including any same-sex relationships);

- Having more than $2,000 if you are single or $3,000 if you are married in resources that you can cash in, sell, or use to pay for food and shelter; and

- Changes in resources, including money in financial accounts and buying or selling extra vehicles, stocks, investments, or property.

Please visit our blog to learn more about your clients’ reporting responsibilities and how they can report changes in wages.

Save the Date! Upcoming National Disability Forum on September 21, 2022

We will host the next virtual National Disability Forum (NDF) on Wednesday, September 21. The title is “Homelessness: Working with Stakeholders to Improve Access to SSA Benefits and Services Part I.” The event will take place through Microsoft Teams from 1:00 p.m. – 3:30 p.m. ET.

For more information about the NDF, we encourage you and your clients to visit our What’s New page at www.ssa.gov/thirdparty/groups/whatsnew.html. You and your clients can email questions to OEA.Net.Post@ssa.gov.

Social Security Services for the Hispanic Community

Every September 15 through October 15, we celebrate National Hispanic Heritage Month to recognize the contributions and cultural richness of the Hispanic community.

We strive to deliver great customer service and helpful information to everyone, including people who are more comfortable reading and speaking Spanish. We invite your clients to:

- Visit our Spanish-language website at www.segurosocial.gov to learn about our programs and services.

- Learn why Social Security is so important to the Hispanic community.

- Follow us on our Spanish-language Facebook and Twitter.

We also provide many publications in Spanish at www.ssa.gov/espanol/publicaciones on popular topics such as:

- Retirement, Disability, and Survivors benefits;

- Medicare; and

- Supplemental Security Income.

Please share this information with your clients.

August 2022

Federal Law Enforcement Agencies Warn of Impersonation Scam Involving Credentials and Badges

New reports show that scammers are reviving an old tactic to gain your client’s trust. Scammers are emailing and texting pictures of real and doctored law enforcement credentials and badges to potential victims. They do this to ‘prove’ that they are legitimate and scam people out of money. Scammers may change the picture or use a different name, agency, or badge number, but the basic scam is the same.

Federal law enforcement agencies are warning the public to be skeptical of emails and text messages claiming to be from a government or law enforcement agency. No one in federal law enforcement will send photographs of credentials or badges to demand any kind of payment, and neither will government employees.

For more information about scams, visit the Federal Trade Commission Scams page at consumer.ftc.gov/scams.

Your Clients’ my Social Security Account Gets a New Look

We have exciting news to share! We redesigned my Social Security!

It’s now easier for your clients who receive Social Security or Supplemental Security Income (SSI) to do business with us online and find the information that they need.

With the new design, people who receive Social Security benefits or SSI are now able to update their telephone number online and see more information under the Benefits and Payments section. People who receive Social Security benefits can also change their address and direct deposit information under the My Profile tab.

While signed into their personal my Social Security account, your clients can continue to:

- Get their Benefit Verification or proof of income letter.

- Obtain replacement SSA-1099/SSA-1042S tax forms, if applicable.

- View their Social Security Statement.

- Request a replacement Social Security card.

Your clients can access their redesigned my Social Security account at www.ssa.gov/myaccount.

How Your Clients Can Apply Online for Benefits

Your clients do not need to wait for an appointment to apply for benefits or appeal a disability decision. They can apply online for the following benefits:

If your client disagrees with our decision on their claim, they can appeal the decision at www.ssa.gov/benefits/disability/appeal.html.

If your client does not want to apply online for benefits, or if they need to speak to us for any other reason, they can schedule, reschedule, or cancel an appointment by:

- Calling us at 1-800-772-1213 (TTY 1-800-325-0778) between 8:00 a.m. – 7:00 p.m. local time, Monday through Friday.

- Contacting their local Social Security office. They can find the information for their local office at www.ssa.gov/locator.

Direct Your Clients to Social Security Online

More people are accessing information remotely. Our secure and convenient online services make it easy for your clients to do business with us from their preferred location. Please encourage your clients to visit www.ssa.gov/onlineservices.

Your clients will also benefit from opening a free, personal my Social Security account at www.ssa.gov/myaccount, where they can:

- View their personalized retirement benefit estimates.

- Instantly check the status of their application for benefits.

- Set up or change their direct deposit information if they receive Social Security benefits.

- Instantly get a letter proving they do or do not receive benefits.

- Request a replacement Social Security card.

- Choose to receive some notices online instead of in the mail.

Please share these helpful resources with your clients today.

Japan’s National Pension Recipients Subject to the Windfall Elimination Provision

Do you have a client who receives Japan’s National Pension? Is their benefit subject to the Windfall Elimination Provision (WEP)? We recently updated the way we calculate Social Security benefits for recipients of Japan’s National Pension who are subject to WEP.

WEP reduces Social Security benefits for people who receive a foreign or domestic pension based on employment that was not subject to the Social Security payroll tax. WEP does not apply to residency-based pensions. We determined Japan’s National Pension is residency-based. For a person who is receiving Japan’s National Pension and is subject to WEP, their employer most likely deducted contributions for their pension.

However, people who receive payments from Japan’s Employees’ Pension Insurance (EPI) are subject to WEP. Unlike Japan’s National Pension, the EPI is based on a person’s earnings for which they did not pay U.S. Social Security payroll taxes. If a person receives payments from Japan’s National Pension and the EPI, we will only consider the EPI when determining whether WEP applies.

We are reviewing and correcting earnings records for beneficiaries who receive Japan’s National Pension and who are subject to WEP. If we owe benefits to a beneficiary, we will automatically credit their account.

Please share this information with your clients, members, colleagues, affiliates, and other interested parties. Our factsheet at www.ssa.gov/pubs/EN-05-10045.pdf provides more information on the Windfall Elimination Provision.

July 2022

Information for People Helping Others Facing Barriers

At Social Security, we strive to provide accessible information about our benefits and our application process to everyone. We are committed to serving people who face barriers that prevent them from getting the help they need. We are also here to help your clients who assist and support people facing barriers.

Our People Helping Others webpage at www.ssa.gov/thirdparty provides useful information about our programs, services, and processes.

Please encourage your clients to share this webpage on social media and with their family, friends, and community. You never know who might be a lifeline to someone who needs help.

Celebrating Disability Pride Month and the Americans with Disabilities Act

Social Security is committed to the principles and spirit of Disability Pride Month, and celebrates the 32nd anniversary of the Americans with Disabilities Act (ADA). We work every day to help improve the lives of our beneficiaries and employees with disabilities.

Each July and throughout the year, we celebrate disability pride and honor uniqueness and individuality. We also promote the contributions of the disability community – including those advancing the cause of access and inclusion.

Please remind your clients that our disability program is here for them. We provide financial and medical benefits for those who qualify. Your clients can use these to pay for doctors’ visits, medicines, treatments, and more.

We invite you and your clients to learn more about our Social Security Disability Insurance and Supplemental Security Income programs. Please share our Disability Benefits page at www.ssa.gov/disability with your clients.

Providing Greater Access to Our Services

We continue to welcome people back to our offices for in-person service with or without an appointment. As we help more people in person, we want to highlight the best ways and times to access our services. We’re committed to helping them by telephone and in person. We also encourage them to visit our website to conduct their business online if they can. Our online services are secure and convenient. Going online or calling us can save your clients a trip to a busy office.

Please visit our blog to learn how to get help by telephone and in person and what to expect if your client needs to visit an office.

Social Security Survivors Benefits Explained

When a worker dies, we are here for their surviving family members. Your client should know that, in the event of their death, certain members of their family may be eligible for survivors’ benefits, including: widows and widowers, divorced widows and widowers, children, and their dependent parents.

The amount of benefits your clients’ survivors receive depends on their lifetime earnings. The higher your clients’ earnings, the higher their survivors’ benefits.

To learn more, please visit our blog or read our publication on Survivors Benefits.

Fraudsters Never Go on Vacation

Although your clients may be enjoying the summer sun and fun, they should keep in mind that fraudsters don’t go on vacation. Seniors and younger people are particularly vulnerable to scammers who claim to represent Social Security. To protect themselves and their loved ones, your clients can:

- Visit our Fraud Prevention and Reporting webpage at www.ssa.gov/fraud to learn about how we fight scammers.

- Visit our Protect Yourself from Social Security Scams webpage at www.ssa.gov/scam for information on what tactics scammers use and how to report them.

- Check out the Federal Trade Commission’s page at consumer.ftc.gov/features/scam-alerts for additional scam-related information.

Please share these useful resources with your clients.

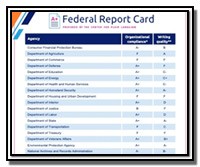

SSA Receives Certificate of Excellence in Accountability Reporting

The Association of Government Accountants awarded Social Security the Certificate of Excellence in Accountability Reporting (CEAR) for our fiscal year 2021 Agency Financial Report. The CEAR program aims to improve accountability through reporting that clearly demonstrates a federal agency’s accomplishments and challenges.

We have received the CEAR award for 24 consecutive years – which is unprecedented! Check out our Honors and Awards webpage at www.ssa.gov/agency/awards for information on this achievement and others.

June 2022

2022 Trustees Report

On June 2, 2022, the Social Security Board of Trustees released its annual report on the long-term financial status of the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) Trust Funds.

The Trustees project the combined trust funds will become depleted in 2035, with 80% of benefits payable at that time. The Trustees project the DI Trust Fund will not become depleted during the 75-year projection period.

In the 2022 Report to Congress, the Trustees also announced:

- The asset reserves of the combined OASI and DI Trust Funds declined by $56 billion in 2021, to a total of $2.852 trillion.

- The projected actuarial deficit over the 75-year long-range period is 3.42% of taxable payroll — lower than the 3.54% projected in last year’s report.

The full 2022 Trustees Report is available at www.ssa.gov/OACT/TR.

The Most Popular Baby Names of 2021 are Here

For all the most popular baby names of 2021, and to see where your or your client’s name ranks, visit our Baby Names page at www.ssa.gov/oact/babynames.

While enjoying the top baby names list, we encourage you and your clients to create a personal my Social Security account at www.ssa.gov/myaccount. Free and secure, my Social Security, born 10 years ago last month, is a personalized online account that people can use beginning in their working years and continuing while receiving Social Security benefits.

A New – and Faster – Way to Request a Social Security Card

We’re continuously expanding our services to put your clients in control and help them secure today and tomorrow.

Do your clients need to apply for an original or replacement Social Security number card? We now have a new – and faster – way for them to do so.

When your clients visit our Social Security Number and Card webpage, they will answer a series of questions that will determine whether they can:

- Complete the entire application process online; or

- Start the application process online, then bring any required documents to their local office to complete the application, typically in less time.

We will mail the card after we process their completed application. Please remind your clients that we don’t issue cards at our offices.

Your clients can learn more about this new process on our blog post.

National Disability Forum in June

We are pleased to announce the next National Disability Forum (NDF), Food for Thought: How Nutrition and Fitness Impact Disability Across the Lifespan. The NDF will be on Wednesday, June 8, 2022, from 1:00 p.m. to 3:30 p.m. ET and is open to everyone. We will learn from stakeholders, advocates, researchers, medical experts, and the public how nutrition and fitness impact disability across the lifespan.

We will offer two online Engage SSA opportunities to submit comments before and after the NDF. Please visit www.ssa.gov/ndf to learn more about the NDF. You and your clients can email questions to OEA.Net.Post@ssa.gov.

Social Security’s Equity Action Plan

On January 20, 2021, President Biden signed Executive Order (EO) 13985, Advancing Racial Equity and Support for Underserved Communities Through the Federal Government. The EO requires all federal agencies “to pursue a comprehensive approach to advancing equity for all including people of color and other people who have been historically underserved, marginalized, and adversely affected by persistent poverty and inequality.”

Our programs touch the lives of nearly all Americans including people who face barriers. These programs provide income security for the diverse populations we serve, including:

- People with disabilities.

- People who are widowed.

- Retirees.

- Their families.

We are committed to administering our programs in a way that promotes equity and fairly treating all individuals who interact with us. We recognize that access to our administrative system can pose barriers to people who need our programs the most.

You and your clients can read more in our blog at Social Security’s Equity Action Plan Social Security Matters (ssa.gov). Consider following our blog to stay informed about Social Security news and updates.

World Elder Abuse Awareness Day

World Elder Abuse Awareness Day (WEAAD) is June 15. WEAAD provides an opportunity for communities around the world to raise awareness about elder abuse and neglect. With fraud against seniors on the rise, it’s more important than ever to protect our loved ones.

To avoid falling victim, your clients can:

Your clients may also want to attend the webinar: Federal Partners Take on the WEAAD 6-1-5 Challenge! The webinar will be on Wednesday, June 15, from 1:00 p.m. to 2:30 p.m. ET. Agencies will share six facts about elder abuse, one action the agency will take, and five resources or tips you can use to promote elder justice. To register, visit https://us02web.zoom.us/webinar/register/WN_OYsYMO9nSD6xGsxt910zVg.

Please let your clients know we take preventing scams and fraud against everyone seriously.

Social Security’s Commitment to the LGBTQ+ Community

June is Pride Month. It’s a time to acknowledge the struggles of the LGBTQ+ community, and also celebrate diversity, love, and respect. On June 26, 2015, the U.S. Supreme Court issued a decision in Obergefell v. Hodges, holding that same-sex couples have a constitutional right to marry in all states.

We recognize same-sex couples’ marriages in all states, and some non-marital legal relationships (such as some civil unions and domestic partnerships). This recognition is important to determine entitlement to benefits.

Your clients can find information on our newly redesigned webpage for the LGBTQ+ community at www.ssa.gov/people/lgbtq/. You can also read our publication What Same-Sex Couples Need to Know at www.ssa.gov/pubs/EN-05-10014.pdf.

May 2022

Providing Greater Access to Our Services

We continue to welcome people back to our offices for in-person service with or without an appointment. As we help more people in person, we want to highlight the best ways and times to access our services. We’re committed to helping them by telephone and in person. We also encourage them to visit our website to conduct their business online if they can. Our online services are secure and convenient. Going online or calling us can save your clients a trip to a busy office.

Please visit our blog to learn how to get help by telephone and in person and what to expect if your client needs to visit an office.

Equitable Relief for Medicare Enrollment and Disenrollment

The Centers for Medicare & Medicaid Services is providing equitable relief to individuals who could not submit premium-Part A or Part B enrollment or disenrollment requests timely due to challenges contacting us by phone. This relief applies to the 2022 General Enrollment Period, Initial Enrollment Period, and Special Enrollment Period.

If your clients were unable to enroll or disenroll in Medicare because they could not reach us by phone after January 1, 2022, they will be granted additional time, through December 30, 2022.

Let your clients know to call 1-800-772-1213 or use our Office Locator to find the number for a local office for more information.

The Affordable Connectivity Program Can Help SSI Recipients Get Internet Access

Internet access is now necessary for work, school, healthcare, and more. However, for many households, it remains unaffordable. The Federal Communications Commission wants everyone to access reasonably priced internet services. They recently launched a new program to reduce the cost of getting online.

The Affordable Connectivity Program (ACP) provides a discount of up to:

- $30 per month toward internet service for eligible households.

- $75 per month for households on qualifying Tribal lands.

Eligible households can also receive a one-time discount of up to $100 toward purchasing a laptop, desktop computer, or tablet from participating providers. To qualify for this one-time discount, households must contribute more than $10 and less than $50 toward the purchase price.

If your clients receive SSI, please encourage them to visit the ACP’s website to see if they’re eligible. Your clients can also learn more about applying for ACP on our blog: The Affordable Connectivity Program Can Help SSI Recipients Get Internet Access Social Security Matters (ssa.gov).

Older Americans Month and Protecting Seniors from Fraud

Every May, the Administration for Community Living leads our nation’s observance of Older Americans Month. At Social Security, we use this time to strengthen our connections with older Americans and help protect them. Seniors are especially vulnerable to scammers who pretend they represent Social Security.

Here are five easy-to-use resources your clients can use to prevent Social Security fraud:

Please share this information with your clients to help spread awareness about Social Security imposter scams.

Asian American and Pacific Islander (AAPI) Heritage Month

May is Asian American and Pacific Islander (AAPI) Heritage Month. Congress passed the law in 1992 designating the month of May to commemorate the arrival of the first Japanese immigrants in the United States on May 7, 1843.

Social Security’s programs serve as financial protection for millions of Americans of every race and background. In honor of this month, we are shining a spotlight on our AAPI page at www.ssa.gov/people/aapi. Please share it with your clients today.

We recognize the cultural and language challenges that some members of the AAPI community face. We provide free interpreter services for AAPIs in their preferred languages. We also supply publications in Chinese, Korean, Tagalog, and Vietnamese. Your clients can find this information at www.ssa.gov/site/languages/en/.

Celebrating A Decade of my Social Security!

It has been 10 years since we launched my Social Security. Since then, more than 69 million people have signed up for and benefited firsthand from the many secure and convenient self-service options. We’ve added and upgraded features that make your life easier when doing business with us. We take great pride in providing this – and all – our services.

If your clients don’t have a personal my Social Security, they’re missing out. A secure account provides personalized tools for everyone, whether they receive benefits or not. If your clients don’t currently receive benefits, they can:

- Estimate their future benefits and compare different dates or ages to begin receiving benefits.

- Get instant status of their Social Security application.

- Review their work history.

- Request a replacement Social Security card if they meet certain requirements.

If they receive benefits, they can also:

- Get an instant benefit verification or proof of income letter for Social Security, Medicare, and Supplemental Security Income (SSI).

- Set up or change their direct deposit.

- Change their address and telephone number.

- Request a replacement Medicare card.

- Request a replacement Social Security card if they meet certain requirements.

- Get an instant Social Security 1099 form (SSA-1099).

- Report their wages if they work and receive disability benefits or SSI.

Please encourage your clients to visit www.ssa.gov/myaccount today and join the millions who take advantage of their own personal my Social Security accounts.

New Statement Fact Sheet for People with Limited Earnings

If your clients have a personal my Social Security account, they can view their Statement online to learn about their future benefits and recent earnings history. Included with the Statement are fact sheets that provide useful information based on a person’s age group and earnings situation.

We’re pleased to announce we’ve released a new fact sheet specifically for people with limited earnings.

The new fact sheet covers how your clients and their family members may qualify for benefits, including:

- Supplemental Security Income.

- Social Security retirement benefits.

- Children’s benefits.

- Supplemental Nutrition Assistance Program.

- Help with health care costs – including Medicare, Medicare Savings Programs, Extra Help with Medicare prescription drug costs, and Medicaid.

We’re committed to helping your clients learn about all their benefit options. Our Benefits Eligibility Screening Tool at ssabest.benefits.gov is a convenient way to find potential benefits that may best fit their situation.

To learn more, encourage your clients to visit our Social Security Statement webpage at www.ssa.gov/myaccount/statement.html.

April 2022

How to Get Help from Social Security

On April 7, our local offices will add more in-person appointments and offer in-person service for people without an appointment.

Throughout the pandemic, millions of people have used our secure and convenient online services and received help by phone. People who have access to the internet should first try our online services before calling us or visiting an office.

To learn more, please visit our blog.

Get started Applying for SSI

If your clients want to apply for Supplemental Security Income (SSI), it’s best to start the process online at www.ssa.gov/benefits/ssi/start.html. This online process takes about five to ten minutes, and no documentation is required at the start. We will need the following basic information about your client and, if applicable, the person they are helping:

- The name, date of birth, Social Security number, mailing address, and phone number of the person interested in applying for SSI. We also offer the option to provide an email address.

- If helping another person, we need the helper’s name and phone number. We also offer them the option to provide an email address.

Once your client completes this short process, we will schedule an appointment to help your client apply for benefits. We will send a confirmation with the appointment date and time by mail and email (if an email address is provided). In some cases, we may call your client to schedule the appointment.

If your client is unable to begin the process online, they may schedule an appointment by calling 1-800-772-1213 (TTY 1-800-325-0778) from 8:00 a.m. to 7:00 p.m. local time, Monday through Friday. They may also contact their local Social Security office. They can find the phone number for their local office at secure.ssa.gov/ICON/main.jsp.

New Rules for Survivors Benefits for Same-Sex Partners

Do you have a client who was in a long-term same-sex relationship with a partner who passed away? If so, they may be entitled to Social Security survivors benefits based on their partner’s record. More surviving same-sex partners may now qualify for Social Security survivors benefits.

Same-sex partners may qualify for survivors benefits if they meet any of the following:

- They would have been married at the time of their partner’s death if state laws hadn’t prevented them from marrying.

- They would have been married longer if not for state laws that prevented them from marrying earlier.

If your client thinks that they may be entitled to benefits, encourage them to contact us right away. Please have them call 1-800-772-1213 (TTY 1-800-325-0778) or contact their local Social Security office at secure.ssa.gov/ICON/main.jsp.

After they apply, they can check the status of their application with their personal my

Social Security account. If they don’t have a personal my

Social Security account, they can create one today in just a few minutes.

What is Advance Designation?

Millions of people who get monthly Social Security benefits or Supplemental Security Income (SSI) payments may need help managing their monthly payments. If your client needs help, we will assign a representative payee to help. When assigning a representative payee, our goal is to identify and select a responsible person who knows your client and wants to help. Our publication, A Guide for Representative Payees, available at www.ssa.gov/pubs/EN-05-10076.pdf, provides helpful information about being a representative payee.

Your client should know they also have the option to identify someone now whom they trust to help manage their benefits in the future, should the need arise. Our process, called Advance Designation, allows your client to designate one or more individuals who could serve as their representative payee(s) in the future. We will only contact advance designees if we need to find a representative payee to assist your client in managing their benefits. We provide more information about this important program at www.ssa.gov/payee/advance_designation.htm.

Online Reporting Form for Scam Calls

Scammers’ tactics continue to evolve. They call and pretend to be government employees to trick victims into providing personal information or money in cash, wire transfers, or gift cards. The scammers often make threats, including arrest.

They may send your clients emails with fake letters or reports that appear to be from Social Security, our Office of the Inspector General (OIG), or other agencies. The letters may appear to use official letterhead and government jargon to look legitimate.

Encourage your clients to remain vigilant against scams. Real Social Security employees will never:

- Tell your client that their Social Security number has been suspended.

- Contact your client to demand an immediate payment.

- Ask for credit or debit card numbers over the phone.

- Require a specific means of debt repayment, like a prepaid debit card, a retail gift card, Internet currency (Crypto), or cash.

- Demand that your client pay a Social Security debt without the ability to appeal the amount they owe.

- Promise a Social Security benefit approval, or increase, in exchange for information or money.

- Email sensitive information.

Please ask your clients to use the online form at oig.ssa.gov to report Social Security-related phone and email scams. The information they provide — even if they do not fall for the scam — helps the OIG fight this type of fraud. People who submit the form can create a unique Personal Identification Number (PIN), so if OIG contacts them, they will know the call is legitimate.

If you or your clients receive a suspicious call or email, hang up. Do not respond or share any information or provide any form of money. Report it at oig.ssa.gov. Awareness and education are vital to protecting people.

Also, please let your clients know they have nothing to be embarrassed about if they shared personal financial information or suffered a financial loss. It’s important that they report it right away.

Please encourage your clients to read our FAQ at faq.ssa.gov/en-US/Topic/article/KA-10018 and our recent blog post, Slam the Scam: How to Spot Government Imposters, at blog.ssa.gov. Continue to help us get the word out.

Also encourage your clients to watch the replay of our Facebook Live from March 10 about Social Security-related scams and other government imposter scams. The replay is available at https://youtu.be/1_Mkj--DOms. Please share these scam resources to help us spread the message on social media.

March 2022

As Tax Day Approaches, Get Your Benefit Statement Online

Your clients’ Benefit Statement is a tax form from Social Security that shows the total amount of Social Security benefits they received in the previous year. It’s also referred to as an SSA-1099. Noncitizens who live outside of the United States receive the SSA-1042S instead of the SSA-1099. Your clients should report the amount of Social Security income they received to the Internal Revenue Service on their federal tax return.

The Benefit Statement isn’t available for people who only receive Supplemental Security Income (SSI) payments because SSI payments aren’t taxed.

If your clients receive Social Security benefits, we mailed their Benefit Statement to their address on file with us. If they didn’t receive it, or if lost, they can get their SSA-1099 or SSA-1042S instantly online with their personal my

Social Security account at /www.ssa.gov/myaccount/replacement-SSA-1099.html.

Encourage your clients to read our blog, Tax Season: What to Know If You Get Social Security or Supplemental Security Income, to learn more.

National Slam the Scam Day Approaching on March 10

Chances are you or someone you know has received a call or message from someone pretending to be a government employee. These calls often allege that your information has been compromised or they demand immediate payment. Ignore it. This is just one of the tips that Social Security’s Office of the Inspector General (SSA OIG) is sharing to warn consumers about these scams through our National Slam the Scam Day initiative on March 10, 2022.

Slam the Scam Day will increase public awareness of the pervasive scams that continue to plague the nation and is part of the Federal Trade Commission’s (FTC) National Consumer Protection Week, happening March 6-12, 2022. The initiative, which began in 2020 to combat Social Security-related scams, is now expanding to include other government imposter scams. In a government imposter scam, someone claims to be a Social Security or another government employee and may ask for personal information, demand payment, or make threats. These scams primarily use the telephone, but scammers may also use email, text messages, social media, or U.S. mail.

Tips for spotting scams is a major goal of this year’s campaign. SSA OIG partners with other government agencies, non-profit organizations, and the private sector to increase awareness about how to spot government imposter scams and avoid becoming a victim. In 2021, the Federal Trade Commission (FTC) received over 396,000 complaints of government imposter scams. Nearly 9% said they lost money to a scammer—more than $442 million.

We encourage you to help us Slam the Scam by sharing our resources at www.ssa.gov/scam, with your clients.

National Women’s History Month

Throughout March, our nation celebrates Women’s History Month. Today, more women work, pay Social Security taxes, and earn credit toward monthly retirement income than at any time in our history. Women also face greater economic challenges than men in retirement.

Social Security is a cornerstone of financial stability for millions of women. We have played a vital role in the lives of women and all Americans for more than 85 years. According to the U.S. Census Bureau, a female born today can expect to live more than 80 years. With longer life expectancies than men, women tend to live more years in retirement and have a greater chance of exhausting other sources of income. Women need to plan early and wisely to protect themselves in retirement.

Share our publication Social Security: What Every Woman Should Know with your clients. You can find it at www.ssa.gov/pubs/EN-05-10127.pdf. They can also view our People Like Me page for women at www.ssa.gov/people/.

Celebrating National Professional Social Work Month

You or some of your clients may be social workers or volunteers in your communities. We’ve created webpages that speak directly to people who may need information about our programs and services. You can give your clients the tools they need to keep the people they serve informed with our Outreach Materials for People Facing Barriers at www.ssa.gov/thirdparty/groups/vulnerable-populations.html. We also have resources available for People Helping Others at www.ssa.gov/thirdparty/.

Do your clients include parents, guardians, or guidance counselors? A useful publication to share with groups who work with youth as they transition from foster care is What You Need to Know About Your Supplemental Security Income (SSI) When You Turn 18. To share with your clients, you can find it at www.ssa.gov/pubs/EN-05-11005.pdf. They can also view our People Like Me page for parents and guardians at www.ssa.gov/people/.

Social Security's Top 5 Data Privacy Resources

We are committed to protecting your clients’ personal information and take this responsibility seriously. We keep this commitment in mind when we collect information from your clients to carry out our mission.

Please share our top five privacy resources:

- A great first resource is opening a personal my Social Security account at www.ssa.gov/myaccount/. Your clients’ my

Social Security account helps them keep track of their earnings records and identify any suspicious activity.

- Our Privacy page at www.ssa.gov/privacy is a central source of information on our Privacy Compliance Program. Your clients can learn more about the Privacy Act of 1974, submit a Privacy Act request, and review our privacy policies and reports.

- In our blog post, 10 Ways to Protect Your Personal Information at blog.ssa.gov/10-ways-to-protect-your-personal-information, we cover steps your clients can take to protect their data.

- Our factsheet, How You Can Help Us Protect Your Social Security Number and Keep Your Information Safe at www.ssa.gov/pubs/EN-05-10220.pdf, provides details to safeguard your clients’ private information.

- Our Guard Your Card infographic at www.ssa.gov/ssnumber/assets/EN-05-10553.pdf helps your clients understand when they need to show their Social Security card – and when they do not.

Please encourage your clients to review these resources and partner with us to protect their most important information.

February 2022

my Social Security: What to Know about Signing Up or Signing In

We want to help your clients get the services they need as quickly and safely as possible. Their personal my Social Security account at www.ssa.gov/myaccount is their gateway to doing business with us online.

Whether your clients receive benefits now or in the future, they will want to create their personal my Social Security account or use the one they may already have. They can watch our brief video about the benefits of having an account at www.youtube.com/watch?v=2hjJqUAFSXI.

We are committed to protecting your client’s information and benefits, and we take this responsibility seriously. That’s why we ask for personal information to verify your client’s identity to create a personal account. We work with external partners to securely verify their identity. We do this to protect their data while making our online services easy for them to use.

Your clients can now create their new my Social Security account through either of these two credential partners: Login.gov or ID.me.

- Login.gov is the public’s one account for simple, secure, and private access to participating U.S. government agencies.

- ID.me is a single sign-on provider that meets the U.S. government’s online identity proofing and authentication requirements.

You can read our blog at blog.ssa.gov to learn more. Please encourage your clients to create their personal my Social Security account today at www.ssa.gov/myaccount!

Save the Date! Upcoming National Disability Forum on Thursday, February 17 2022

We will host the next virtual National Disability Forum (NDF) on Thursday, February 17 from 1:00 p.m. to 3:00 p.m. ET. The forum is titled “Equitable Access to Social Security Disability Programs for LGBTQIA+ Communities.” Topics will include:

- Challenges gender diverse individuals face in finding and receiving healthcare;

- Challenges gender diverse individuals face accessing SSA programs;

- Self-attestation of gender markers;

- Challenges gender diverse individuals face in finding work or re-entering the workplace; and

- Issues gender-diverse children face.

For more information on the upcoming NDF on Thursday, February 17, encourage your clients to visit our What’s New page at www.ssa.gov/thirdparty/groups/whatsnew.html. You and your clients can email questions to OEA.Net.Post@ssa.gov.

Social Security Update 2022

Every year, Social Security provides new information about Social Security taxes, benefits, earnings limits, and Medicare costs. By law, many of the numbers automatically change each year to keep up with changes in prices and wage levels. This information is important for people who:

- Work and want information on taxes and work credits;

- Receive Social Security benefits and want to know the earnings limits; and

- Receive Supplemental Security Income and want information on payment maximums.

Share the 2022 Social Security data updates with your clients, available at www.ssa.gov/pubs/EN-05-10003.pdf.

An Important Update to the Goldberg Kelly Payment Continuation Period

The COVID-19 pandemic has made it more difficult for Supplemental Security Income (SSI) recipients to file a request for reconsideration within the time required to qualify to continue their benefits. The pandemic has also impacted our ability to receive and process these requests quickly. In recognition of these challenges, we are announcing a change to our procedures for requesting reconsideration following receipt of a Notice of Planned Action (NOPA), also known as a Goldberg Kelly notice.

SSI recipients who file a reconsideration request more than 15 days after the date of a NOPA, but within 65 days of the date of the NOPA, will receive unreduced benefits unless they waive it in writing. For these cases, we will find that there is good cause for the late filing of the request for unreduced benefits.

Your clients can find more information about our revised procedures at secure.ssa.gov/apps10/reference.nsf/links/10292021100254AM.

Social Security Celebrates Black History Month

This February, during Black History Month, we echo President Biden’s Proclamation as we “honor the extraordinary contributions made by African Americans throughout the history of our Republic and renew our commitment to liberty and justice for all. Their fight for equality, representation, and respect motivates us to continue working for a more promising, peaceful, and hopeful future for every American.”

Our People Like Me pages at www.ssa.gov/people/ showcase our commitment to support all Americans while they plan for their financial future. Please encourage your clients to visit us at www.ssa.gov/people/africanamericans and our other People Like Me pages today.

America Saves Week and Social Security

This year, America Saves Week (ASW) runs from February 21 through 25 with the theme Building Financial Resilience. The week is an opportunity for organizations to promote good financial habits, and for people to assess their own saving status. Encourage your clients to join the #ASW20 movement and use this hashtag when posting about their savings goals.

Planning and saving are key to a successful retirement. The earlier you start saving for retirement, the better off you will be. People with a plan are twice as likely to save successfully. Set a goal, make a plan, and save automatically. We encourage you and your clients to pledge to save for ASW at www.americasavesweek.org.

We have many retirement planning tools to help your clients with their retirement saving goals, such as our infographic, Anytime is the Right Time to Save for Your Future. Your clients can access our online information and resources at www.ssa.gov/benefits/retirement.

January 2022

Send Your Clients to SSA.gov

Our online services make it easy for your clients to do business with us conveniently and securely. Please direct them to www.ssa.gov/onlineservices.

Your clients will benefit from opening their personal my Social Security account at www.ssa.gov/myaccount. Your clients can access their Social Security Statement, get personalized retirement benefit estimates, check their benefit application status, set up or change their direct deposit, request a replacement Social Security card, and much more.

If your client cannot use our online services, please tell them to call our National 800 Number or their local Social Security office for assistance. If we cannot help them by phone, we can determine if an in-person appointment or other option may be available.

Please share our flyer, How to Get Help from Social Security, with your clients.

Medicare Advantage Open Enrollment

Let your clients know that, from January 1 through March 31, Medicare Advantage enrollees can switch from one Medicare Advantage plan to another at www.Medicare.gov.

Please encourage your clients to apply for Medicare online if they:

- Are three months away from age 65.

- Want to sign up for Medicare but do not currently have ANY Medicare coverage.

- Do not want to start receiving Social Security benefits at this time.

- Are not currently receiving Social Security retirement, disability, or survivors benefits.

Let your clients know they can learn more about how Social Security and Medicare work together at www.ssa.gov/benefits/medicare, where they can also sign up for Medicare.

Representative Payee Manages Your Client’s Money

Millions of people who get monthly Social Security benefits or Supplemental Security Income (SSI) payments may need help managing their money. If your client needs help managing their Social Security or SSI benefits, we will assign a representative payee to help. When assigning a representative payee, our goal is to identify and select a responsible person who knows your client and wants to help.

Our publication at www.ssa.gov/pubs/EN-05-10076.pdf provides helpful information about being a representative payee.

Your clients may want to consider designating someone now whom they trust to help manage their benefits in the future, should the need arise and they are not able to make that decision at that time. Our process, called Advance Designation, allows your clients to designate up to three individuals who could serve as their representative payee. We will only contact advance designees if we need to find a representative payee to assist your client in managing their benefits. We provide more information about this important program at www.ssa.gov/payee/advance_designation.htm.

Retirement Planning Online

Our online retirement portal at www.ssa.gov/benefits/retirement is a great place for your clients to start mapping out their retirement plan. We provide important information to answer questions like:

- When should I apply to start my retirement benefits?

- What documents do I need to provide SSA for my retirement application?

- Which factors may affect my retirement benefits?

- What should I do after I apply for retirement benefits?

Please remind your clients to use their personal my Social Security account at www.ssa.gov/myaccount to get an instant estimate of their future retirement benefits. They can also see the effects of starting their retirement benefits at different ages.

Honoring the Life and Legacy of Martin Luther King Jr.

On January 15, we come together as a nation to celebrate and honor the life and legacy of Dr. Martin Luther King, Jr. He dedicated his life and made immeasurable contributions toward civil, human, and economic rights for all people. Dr. King saw diversity as America’s strength, fought for systemic change in our country, and lost his life trying to make his dream a reality.

In honor of Dr. King’s legacy, we encourage you to find ways to volunteer and help improve your community. Please visit our People Helping Others web page to learn about our benefits and application process, and how you can help a family member, friend, or someone through a group or organization. You can share our materials with your clients and anyone in your community who may need it.

Our offices and phone lines will be closed on January 17 in observance of the federal holiday that honors Dr. King. However, your clients can still access our online services at www.ssa.gov/onlineservices.