President Tours Bureau of Public Debt

Bureau of Public Debt

Parkersburg, West Virginia

April 5, 2005

10:00 A.M. EDT

THE PRESIDENT: See, what's interesting is a lot of people believe that

the Social Security trust is -- the government takes a person's money,

invests it, and then pays it back to them upon retirement. It doesn't

work that way.

MS. CHAPMAN: That's right, that's exactly right.

THE PRESIDENT: This is what exists. And it's very important, then, to

make sure that in the future that there's real assets for retirees.

But I want to thank you all for having me come. I want to thank all the

workers here for representing the mighty United States. I'm proud to work

with you. I thank you for what you do. And my message here in town is

that we have an obligation to take the system that Franklin Roosevelt

created and make it work for a younger generation of Americans. I'm looking

forward to working with Congress to do that. That's what the American

people expect. They expect us to modernize the system.

Anyway, thanks for having us.

MS. CHAPMAN: Well, thank you for coming. We're proud to have you visit

us.

THE PRESIDENT: Thanks.

END 10:52 A.M. EDT

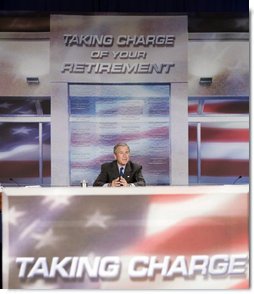

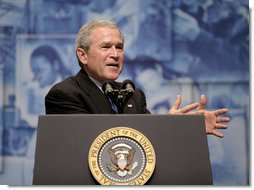

President Participates in Social Security Conversation

in West Virginia

West Virginia University at Parkersburg

Parkersburg, West Virginia

April 5, 2005

11:14 A.M. EDT

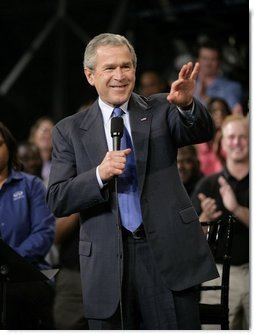

THE PRESIDENT: Thank you all. Thanks for coming. (Applause.) Thank you

all. Please be seated. (Applause.) Thank you all. It is nice, nice to

be back in Parkersburg. Thanks for having me. (Applause.) It just seems

like yesterday that I was here. (Laughter.) It's great to be back in West

Virginia, as well. I'm struck by the -- every time I come here I'm struck

by the beauty of this state. And of course, you put on a beautiful day,

for which I'm grateful.

One of these days I'm going to bring my mountain bike. (Applause.) I

love to exercise. I'm doing -- I'm doing it to make sure that I do the

job you expect me to do, and I'm doing it to set an example, as well.

I think people need to get out all around our country, walk every day,

or ride your mountain bike every day, get a little exercise every day.

Stay fit and healthy. (Applause.)

Speaking about staying fit and healthy, that's what we need to make sure

we do for our Social Security system, too. (Applause.) I'm here to remind

the good folks of West Virginia that we have a problem and we have a duty

to renew one of great -- America's great institutions, and that's the

Social Security system.

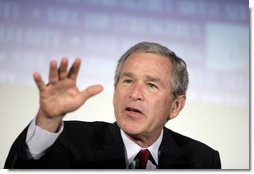

I've now traveled to 20 states to talk about Social Security, 20 states

in two months, all aimed at making sure that the American people understand

the situation with Social Security. And more and more Americans understand

there is a problem, and I hear from more and more Americans that they

expect those of us who are honored to serve in Washington to fix the problem.

(Applause.)

I have just come from the Bureau of Public Debt. I want to thank Van

Zeck, Keith Rake, and Susan Chapman. Susan was the tour guide there at

the Bureau of Public Debt. I went there because I'm trying to make a point

about the Social Security trust. You see, a lot of people in America think

there's a trust, in this sense -- that we take your money through payroll

taxes and then we hold it for you, and then when you retire, we give it

back to you. But that's not the way it works.

There is no "trust fund," just IOUs that I saw firsthand, that

future generations will pay -- will pay for either in higher taxes, or

reduced benefits, or cuts to other critical government programs.

The office here in Parkersburg stores those IOUs. They're stacked in

a filing cabinet. Imagine -- the retirement security for future generations

is sitting in a filing cabinet. It's time to strengthen and modernize

Social Security for future generations with growing assets that you can

control, that you call your own -- assets that the government cannot take

away. (Applause.)

I'm sorry that Laura is not traveling with me today. (Applause.) She's

doing great. She and I will be taking off tomorrow morning to pay -- to

pay our country's respects to a great world leader in His Holiness. He

shows that one man can make an enormous difference. And I look forward

to honoring the memory of Pope John Paul II. (Applause.) So she's packing

her bags. (Laughter.)

I want to thank the President of West Virginia University at Parkersburg.

Madam President, I'm sorry I missed your inauguration. (Laughter.) But

thank you for serving. Dr. Marie Gnage is with us. I appreciate you letting

us use this facility. (Applause.)

Before coming out here I had the honor of saying hello to a lot of folks

who are involved with the community college system of West Virginia. I'm

a strong believer in the community college system around our country,

because I understand that the community college system is a -- provides

a great opportunity for many of our young and for many of our workers

to gain the skills necessary to fill the jobs of the 21st century. The

community college system provides a wonderful opportunity for states and

communities to say to potential employers, we have got a fantastic asset

in our midst to make sure that the workers can fill the jobs that you

desire.

And so for those of you involved in the community college system around

the state of West Virginia, thanks for being here and thanks for what

you're doing. (Applause.)

I want to thank -- I want to thank the Secretary of State, Betty Ireland,

for joining us. I'm proud you're here, Madam Secretary. Thanks for taking

time. (Applause.) I want to thank Mayor Jimmy Colombo for joining us.

Mr. Mayor -- there he is. Thank you, Jimmy. (Applause.) I appreciate the

way the Mayor approaches his office. He doesn't care whether I'm a Republican

or Democrat or independent, he just -- he's a hospitable fellow. (Laughter.)

Every time I come to this part of the world he says, welcome. And I appreciate

you, Mr. Mayor, and I appreciate you being here today. Thanks for coming.

(Applause.)

I want to thank all the state and local officials for joining us today.

When I landed, I met June Roberts. She's a volunteer with the Retired

and Senior Volunteer Program. We call it R.S.V.P. They exist all around

the country. In 2001, she founded Senior Stitchers. Listen to what these

good folks do: They prepare sewing and craft projects, including wheelchair

pads, blankets for local child service agencies, senior centers and hospitals.

These are good folks. They're taking time out of their lives. (Applause.)

June and her buddies -- I think she said there's eight or nine of them

-- take time out of their day to volunteer to help make somebody's life

better.

Let met tell you one way you can help the good folks in Parkersburg.

A way to serve our country is to find somebody who hurts, take time out

of your life, surround them with love, feed the hungry, find shelter for

the homeless, listen to that universal call to love a neighbor just like

you'd like to be loved yourself and you'll be serving America. (Applause.)

So where is June? (Applause.) I think June is here somewhere. June, thank

you for coming. Thank you for setting such a good example. (Applause.)

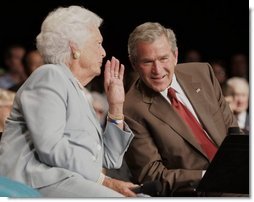

On my trips around this country I have made it as clear as I possibly

can that the government will keep its promise to those who have retired

or near retirement. And that's very important for a lot of people to hear.

I understand how important the Social Security check is to a lot of our

citizens. A lot of people depend on that Social Security check. And, therefore,

I understand that when it comes time to talking about making sure the

system is strong for a younger generation, sometimes the message can get

confused. In other words, when a senior hears the President talking about

Social Security, he or she may be concerned about whether or not that

check that they're getting today is going to continue to come tomorrow.

I understand that.

And I can understand why people are sometimes confused because there's

a lot of propaganda in the mix. In other words, people are saying things

that simply aren't true. They're saying, well, if you try to reform the

system for a younger generation of Americans, then you may not get your

check.

I'm here to tell you those who've retired are going to get their check.

Those who are near retirement are going to get their check. (Applause.)

The system will not change in any way

for people who have been born prior to 1950. And I'm going to keep saying

it over and over again.

The problem is that the government is making promises to younger Americans

that it cannot keep. And that's important for folks to hear. You see,

Social Security was designed as a pay-as-you-go system, not as a trust

system. Pay-as-you-go, you know, the workers will pay into Social Security

through the payroll taxes, and then it immediately gets paid out. It gets

paid out to pay for benefits; and if there's any money left over, it pays

for a lot of other government programs. What goes in, goes out. Right

now, more money is coming into the Social Security system than going out.

And that's how we help fund the programs. A lot of people in West Virginia

don't understand that, that the system is a pay-as-you-go system. And

this works fine, so long as you got enough workers paying for the benefits

of those who've retired.

In 1950, there were 16 workers paying into the system for every beneficiary.

In other words, the government promised you your retirement check and

there's 16 people paying for that check. That kind of keeps the load relatively

light. Today, there are three workers paying for each beneficiary. In

other words, one of the things that's happened to the Social Security

system that people must understand is that there are fewer people paying

into the system per beneficiary. In a relatively short order, there will

be two workers paying into the system for every beneficiary.

And that's just only half of the equation. And here's the other half:

Americans are living longer, and enjoying longer retirement. Life expectancy

has increased. They're collecting benefits for longer periods of time.

In other words, if you've retired and you're living longer, the system

must pay your benefits longer -- fewer people paying in the system and

people are living longer, collecting their benefits longer. So you're

beginning to get a sense to where the bind is coming.

And not only that, there's a lot of us who are getting ready to retire.

We are called the baby boomers. There's a big bulge of baby boomers, when

you look at the charts. I know; I'm one. As a matter of fact, my retirement

age -- or when I become eligible for retirement benefits is 2008. That's

when I turn 62. It's quite a convenient date in my case. (Laughter and

applause.) And to compound the issue even further, a lot of people running

for office in the past have said, vote for me, I will increase your Social

Security benefits. And so my generation has been promised greater benefits

than the previous generation. So you've got a lot of people living longer,

getting greater benefits, with fewer people paying into the system.

And when I start drawing out, and when my generation starts drawing out

of the system, instead of paying in the system, the stresses on the system

will really begin to grow. And that's important for you to understand.

In other words, when you start thinking about whether or not the system

is solvent for younger Americans, think about this: In each passing year,

we'll have fewer workers paying even higher benefits to a larger number

of retirees. And therein lies the problem.

Social Security is going to be fine for those of you who have received

your check. It's going to be fine for people who have retired, or who

will retire and your birth date is prior to 1950. You're -- nothing is

going to change. The system is in good shape for you. It is not going

to be fine for younger workers coming up. In 2017, the Social Security

system will go into the red. That means more money will be going out of

the system than coming in. In other words, baby boomers will be retiring,

start to living longer, greater benefits promised to us, and the pay-as-you-go

system goes negative. More money will be going out than coming in through

payroll taxes. And every year after that the shortfall gets worse. In

other words, it's an accelerating problem.

As a matter of fact, according to the Social Security trustees, waiting

just one year adds $600 billion to the cost of fixing Social Security.

The longer we wait, the more the problem becomes severe. In 2027, there

will be $200 billion going out more than coming in. Somebody is going

to have to pay for that. Somewhere there's got to be a give in the system.

We have a real problem.

The good news is more and more Americans are beginning to understand

we have a real problem. And more and more Americans -- (applause.) And

more and more Americans who are receiving a Social Security check are

being reassured that nothing will change. And when that happens, there's

a fundamental question that's being asked. A lot of grandparents are now

starting to ask, what are you going to do for my grandchildren? I believe

this is a generational issue. This is an issue where once folks understand

nothing is going to change, and they understand we have a problem, the

logical question to people like me and others in Washington, D.C. is,

how are you going to take care of my grandchildren? It's a natural inclination

for grandparents, to start worrying about their grandchildren. And it's

a legitimate concern.

I met with Betty Earl coming in. She's lived in Parkersburg for about

40 years -- or the area for 40 years. She has two daughters in their 30s.

She doesn't think the Social Security system will be there when they retire.

She represents the attitude of a lot of folks, now that this issue is

becoming clarified. She said, "It doesn't take an Einstein to see

where Social Security is headed." And she doesn't want Congress to

wait until Social Security goes bust before starting to fix it.

I appreciate that understanding. I appreciate Betty Earl -- I doubt she's

got a Ph.D. in economics -- maybe she does. But it doesn't retire -- doesn't

require much education and brilliance to figure out we've got a serious

problem, when you think about the math: More people living longer, with

greater benefits, and fewer people paying into the system.

And so Betty wants to know, like a lot of other people want to know,

what you going to do about it? And I'm here to tell you, I'm willing to

listen to any idea. This isn't a Republican problem, or a Democrat problem;

this is a problem for the United States of America. (Applause.) And I

think now is the time for people in Congress to stop playing politics

with the issue and come to the table with how they think it ought to be

fixed. (Applause.)

I recently traveled the country on some stops with former Democrat Congressman

Tim Penny, a Democrat from Minnesota, who has some good ideas. As a matter

of fact, I mentioned his name, I think, in my State of the Union address.

I mentioned former President Clinton's name in the State of the Union

address, because when he was President he put forward some interesting

ideas as what we ought to consider as to how to fix this issue permanently.

He spoke of increasing the retirement age. Then he talked about tying

Social Security benefits to prices rather than wages.

In 2001, I put together a commission in anticipation of Social Security

becoming a greater issue. As a matter of fact, I campaigned on the issue

in 2000. And I asked the Democratic

-- former Democrat Senator Daniel Patrick Moynihan of New York to chair

the commission. He's a thoughtful fellow. He -- I put Republicans and

Democrats on the commission; I said, why don't you all come together and

make some recommendations, which they did, all aimed at strengthening

Social Security for a younger generation, and permanently fixing the problem.

And there's some basic principles that ought to guide our efforts. First,

we should not raise the payroll tax rates, in order to make sure that

-- (applause.) The reason I say that is that it would cost our economy

jobs. One of the things, when we put policy in place, we ought to make

sure that policy encourages economic vitality and growth, and that we're

stimulating the small business sector of our economy. We must make sure

that Social Security continues to provide dignity and peace of mind for

low-income Americans. In other words, the system ought to be structured

so low-income Americans are -- have got dignity in retirement. (Applause.)

Americans must reject temporary measures. In other words, you'll hear

people in Washington say, well, we got a 75-year fix, for example. You

know, in 1983, the issue came to focus, and President Reagan and Speaker

Foley, as well as other Republicans and Democrats, set aside their partisan

differences and said, look, we have an obligation to act on behalf of

the country. And they came together and put what they thought was a 75-year

fix to the problem. The problem is that the 75-year fix wasn't a 75-year

fix, because here we are, 22 years later, talking about it again. See,

that's a misnomer.

What was -- I like the spirit of them coming together, trying to work

it out. But they didn't permanently solve the problem. See, the job of

the President is to fix problems, not pass them on to future Presidents

and future Congresses. (Applause.)

And so I'm going to continue to call upon Congress and say, one, I'm

going to work with you, I'm interested in your ideas, and when we get

together let's permanently fix the problem; let's do our duty; let's do

that which the American people expect of us.

The Senate I thought passed an interesting resolution the other day;

on a 100-to-nothing vote, they called for a permanent fix. That was constructive.

(Laughter.) That was step one. (Laughter.) Step two is, now let's just

follow through and deliver one.

As we make Social Security permanently solvent for a younger generation

-- senior citizens are receiving their check today, going to get their

check, nothing will change. People, baby boomers, like me, are -- born

prior to 1950, the system is strong enough to take care of us. We must

worry about a younger generation of Americans. And as we work to make

the system permanently reformed, we need to make it a better deal for

our younger workers, too. And here's an idea that I think people ought

to consider.

I think people ought to have a -- given an opportunity to have more control

over their own retirement funds, the chance to tap into the power of compound

interest; the ability, if they so choose, to watch their money grow in

an account, a savings account of bonds and stocks. That's why I proposed

that Congress consider allowing younger workers to set aside part of their

Social Security contributions in a voluntary personal retirement account.

A voluntary account -- you notice I keep saying "voluntary."

I mean, doesn't it make sense for government to say to a younger worker

"if you so choose" you should be allowed to take this option?

Nobody is saying you "must take the option" or you "can't

take the option." What we're saying is, if you decide to, you should

be allowed the opportunity to invest about a third of your payroll taxes

in a conservative mix of bonds and stocks. The money would grow over time.

It could provide a better rate of return than anything the current Social

Security system can provide. And that's important. It's that difference

between what the current system provides and what you can earn in a conservative

mix that makes a big difference about what you have when it comes time

for you to retire.

A younger work earning an average of $35,000 a year over a career could

retire with a nest egg, under this plan, of nearly a quarter million dollars

-- a nice addition to that worker's Social Security check. You see, the

savings account is in addition to, a part of the retirement plan -- not

the retirement plan, it's a part of a Social Security retirement plan.

(Applause.)

Since 1983, the last time Congress tried to reform stock investments

-- tried to reform, the stock investments on average have returned more

than a thousand percent. That's how your money grows. Notice I said "conservative

mix." You can't -- you can't take your money and put it in the lottery,

or take it to the track. I mean, there's a conservative mix. When I say

"conservative mix," I mean conservative mix. But a conservative

mix will get you a better return on your money than the current system.

And it's that differential, that rate differential which grows over time

to enable a younger worker who only makes $35,000 over his or her lifetime

to end up with a nest egg of $250,000 as part of a retirement package.

And that's your money.

Again, I repeat, younger workers can choose to join this if they want

to. You know, a lot of folks say, well, you know, the investment may be

too difficult. But just think about what's changing in America today.

Mayor, when you and I were coming up, they didn't talk much about 401(k)s.

The 401(k) now is available for a lot of workers. A lot of workers are

watching their own money grow through a 401(k) account. They understand

what the investment world is like. I don't remember, when I was growing

up, worrying about the solvency of the Social Security system. I hear

from a lot of younger folks, a lot of your grandchildren are saying, what

you going to do about it, Mr. President, and, by the way, just give me

a chance to make decisions for myself; give me a chance to build up hard

assets, instead of paper assets in a file cabinet.

We've got to make sure that there are strict guidelines. We've got to

make sure the earnings aren't eaten up by hidden Wall Street fees. We'll

make sure the good options to protect investment from market swings on

the eve of retirement -- there are ways to make sure the system works.

You're not going to be able to empty all your account out when you retire;

it's going to be a part of a retirement plan.

But this concept isn't new, and this is what people must understand.

You see, we've had what's called the Thrift Savings Plan for federal employees

and members of Congress for a long period of time. And you know what the

Thrift Savings Plan says? It says members of Congress, United States senators,

people who work in Washington or elsewhere for the federal government

can set aside some of their own money as part of their retirement plan

-- in a conservative mix of bonds and stocks.

I found that to be really interesting. You see, it's pretty interesting

that Congress a while ago thought this was a good idea, to allow their

money to grow at a decent rate of return in a conservative mix of bonds

and stocks. And it seems to make sense to me that if it's all right for

the United States Congress and the United States Senate to give people

the option of watching their own money grow, then it ought to be good

enough for workers all across the United States. (Applause.)

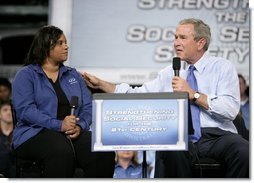

I just talked to Drew Kefeli. He's a single dad. He became interested

in Social Security reform because of his 16-month-old daughter. Interestingly

enough, he named his daughter Jenna. (Laughter.) The guy has got great

taste. (Laughter.) He likes the idea of personal accounts because he wants

to build, to leave something to Jenna. Under the present system, the government

will keep the money it's putting in Social Security if he dies before

he can collect.

Think about the system today. I met with widows whose husband pre-deceased

them -- and he might not have been 62 years old when he died, and there

she is, with maybe family members and nothing but a small amount of money

for burial. Yet, all the money that the person put in the system is just

kind of -- it's not around. Or you take a spouse who's been working all

his or her life, and both spouses worked, which is very common in America

today, both contributing to the Social Security system. One dies early,

and then the remaining spouse gets to keep their survivor benefits, or

his or her own retirement benefits, but not both. In other words, one

of the two have been contributing to the system and they get nothing for

the contribution.

See, if you're allowed to set aside some of your money, like Drew wants

to do, into your own asset base, if a tragedy strikes early it will give

you an asset to leave to somebody you love. It's your money. You get to

decide what to do with it. As Drew said, he said the personal account

would give him greater peace of mind about Jenna's future. I like that

idea. I like the idea of making sure inheritance is not just a privilege

limited to the wealthy. I like the idea of encouraging an ownership society,

where a mother or father, as a result of hard work, can set aside money,

if he or she chooses, in a personal account that he or she can leave to

whomever she wants, or ever [sic] he wants. I think it's healthy for a

society to have assets passed on from one generation to the next. (Applause.)

The American Dream is built on the independence and dignity that come

from ownership. Ownership shouldn't be restricted in America. We want

more people owning their own home, and that's happening all across our

country. Do you realize more minority families own a home today than ever

before in our nation's history? And that's important. I want more people

owning their own business. I love the idea of people saying to me, Mr.

President, I'm proud of my business, I started my own business. And I

think it makes sense to have people being able to own and manage their

own money -- a part of their own money in the Social Security system.

After all, the payroll taxes are contributed -- that's not government

money, that's your money. And the government ought to give you -- be wise

enough to let you manage some of it. (Applause.)

I'm going to continue to discuss this issue around the country. It's

an important issue. Once the grandmoms and granddads understand that they're

going the get their check, a lot of them are going to start saying to

the elected officials, what are you going to do about my grandchildren?

Franklin Roosevelt did a good thing when he created the Social Security

system. It's worked. But the math has changed. A lot of people are getting

ready to retire. They're going to live longer, receive greater benefits

and fewer people paying in the system. The longer we wait, the more costly

it's going to be to a future generation of Americans. And now is the time

-- and now is the time to act. Because your retirement security is a lot

more important than partisan politics.

Thanks for letting me come by. (Applause.) God bless. Thank you all.

(Applause.)

END 11:46 A.M. EDT

President Participates in Social Security Roundtable

in Ohio

Lakeland Community College

Kirtland, Ohio

April 15, 2005

1:03 P.M. EDT

THE PRESIDENT: Thank you all for coming. Please be seated. I appreciate

you coming, Steve, thanks. Glad to give you a ride home on Air Force One.

(Laughter.) I really do like working with Steve. He's a thoughtful fellow

who cares about issues, and this is -- what we're going to talk about

is an important issue, which is Social Security.

Before I do, I want to thank the community college for hosting us. I'm

a big believer in community colleges. Community colleges have got the

capacity to change curriculum to meet the needs of a local work force,

for example. And one of the real challenges of the 21st century is to

make sure people have got the skills necessary to fill the jobs of the

21st century. And a fabulous place to find those skills is our community

colleges.

So, thanks for what you do; thanks for being a host; thanks for letting

us come and have a -- what I think you'll find to be a really interesting

educational experience about a vital issue confronting the country.

I want to thank Lt. Governor Bruce Johnson for joining us. I appreciate

State Treasurer Jennette Bradley for joining us today. I want to thank

the Mayor, Ed Podojil, who is here. I appreciate you, Mr. Mayor. And I

want to thank Dave Anderson. The last time I saw Dave, I said to Dave,

I said, "Dave, fill the potholes." (Laughter.) That's just a

piece of advice. (Laughter.) And so I saw him in line coming in. He said,

"I'm just here to report for duty Mr. President. I did fill the potholes."

(Laughter.) You'd get reelected if you want to run again. (Laughter.)

Anyway, I want to thank Anita Isom, who's with us. Anita is a young lady

I met when we landed there at the airport in Cleveland. She is a volunteer

and she has helped, and been awarded because of her reading-related activities

that benefit others. The reason I like to mention a soul like Anita is

that, no matter what your age, no matter where you live, you can help

this country by becoming a volunteer, by helping somebody who hurts, by

teaching somebody to read, or feed somebody who's hungry, or put your

arm around somebody who needs love.

I like to remind people that the greatest strength of this country is

the heart and souls of our fellow citizens, and the great compassion of

our people. And so if you're interested in serving America, do so by becoming

a volunteer in the community in which you live, and help change this country

one heart and one soul at a time.

So, Anita, thanks for coming. Thanks for meeting me at the airport.

Let me talk about Social Security. I could be talking about a lot of

things -- peace and freedom. The world is changing right now because societies

are becoming more free. And as societies become more free, more democratic,

the world will become more peaceful.

Today I went to a little restaurant, and the owner happens to be Lebanese

American. And he said, thank you, Mr. President, for staying focused on

a country like Lebanon and insisting that Lebanon be allowed to have free

elections. And I assured him, like I'll assure you, that when America

speaks, we mean what we say; when we say free elections to the Syrians,

we mean free elections. Get out of Lebanon and let this good country have

a free election, as scheduled. When I say, get out of Lebanon, I mean

out of Lebanon with all your troops and all your security services and

all the people trying to influence that government. It is in the world's

interest that Lebanon be allowed to have free elections, because a free

society will help spread the peace. (Applause.)

We're dealing with a lot of issues, and in Washington, D.C. I've submitted

a tough budget and expect the Congress to be wise about how you spend

your money. I also know that Congress needs to stop debating and get an

energy bill to my desk -- now, during this session. (Applause.)

Congress also needs to take serious this issue about Social Security.

People say, well, why did you bring it up? I said, I brought it up because

I see a serious problem that needs to be fixed now before it's too late.

I also brought it up because the job of a President is to confront problems,

and not pass them on. The easy route in politics is to say, well, we got

us a problem, we'll just let the next person handle it. The easy route

for a member of the United States Senate is to say, there is a problem,

but it perhaps can wait. We'll just let another United States Senate fix

it, or send it to the House. That's not the way I think. I think I got

elected because people expect me, when I see a problem, to bring it to

the fore and to work with people to get it solved.

And here's the problem in Social Security. There's a lot of people like

me getting ready to retire. (Laughter.) As a matter of fact, I'm retiring

in four years -- at least I hit retirement age in four years -- which

is convenient -- (laughter) -- in my case. I turn 62 in 2008. And I'm

not the only one turning 62 in 2008. As a matter of fact, there's a lot

of us. We're called the baby boomer generation. And not only is my generation

fixing to retire, we are living longer than previous generations. And

not only are we living longer than previous generations, we have been

promised greater benefits than the previous generation. In other words,

people running for office say, put me in office and I'll increase your

Social Security benefits for you. And guess what -- they did.

And so a lot of us are getting ready to retire. And the problem comes

because there's not a lot of people paying into the system. See, in 1950,

there were 16 workers for every beneficiary. So you can imagine the load

was somewhat lighter than today, when there's now 3.3 workers for every

beneficiary. And soon there's going to be two workers for every beneficiary.

You've got fewer workers paying into a system that is going to require

more and more out-flow, because a lot of us are retiring, living longer,

and been promised greater benefits. And the math just doesn't work.

It's a pay-as-you-go system, by the way. That means, when the money goes

in, it comes right out. It's not a trust. I mean, some people in America

I suspect think that the federal government all these years has been collecting

your payroll taxes and we're holding it for you. And then when you get

ready to retire, we give it back to you. That's not the way it works.

The way it works is, is that we collect your payroll taxes and we pay

the current retirees their benefits, and then with leftover money we spend

it on other things. That's the way the system works. It's pay-as-you-go.

And in 2017, the pay-as-you-go system is going to go negative. In other

words, more money goes out than comes in through payroll taxes. And every

year thereafter, if we don't do something, it gets worse and worse and

worse and worse. To give you an example of how bad it gets, in 2027, the

federal government is going to have to come up with $200 billion more

a year just to make good on the payments. And it gets worse the next year,

and the next year, and the next year.

I also want to assure those of you who are on Social Security, you will

get your check. See, nothing changes for somebody born prior to 1950.

And that's very important for people in Ohio to hear, because I fully

understand a lot of people count on that Social Security check. That Social

Security check means a lot to a lot of people in America, and they're

counting on it. That's why, for example, in some political campaigns people

try to say to seniors, you know, if so-and-so gets into office, he's going

to take your check away from you. That's the old scare tactics. Sometimes

during this debate it seems like people are resorting to those scare tactics.

They're telling seniors, really what they're talking about is taking your

check away. Let me just tell you, point-blank: If you're receiving a Social

Security check in Ohio, this government of ours will continue to honor

you, honor that commitment.

This issue isn't about you. This issue is about your grandchildren. The

issue confronting the Social Security system is an issue for young workers,

young people coming up. One time I was having a discussion and the person

said, I saw a survey -- I said, oh, yeah, what did it say? It said young

workers like me are more likely to see -- think we're more likely to see

a UFO than get a Social Security check. (Laughter.) That may be pretty

close to accurate.

I'll tell you this: If this federal government doesn't act, your bill,

your payroll taxed are going to have to go up a lot in order to pay the

promises made to me. Or the government is going to have to slash the benefits.

Or the government is going to have to make dramatic cuts in other programs.

And so I see a problem. I think the math is clear. And so now is the time

to get something done.

And so I stood up in front of the United States at my State of the Union

address and said to the Congress, here's the problem. And I'm going to

put some ideas on the table, ideas that I didn't necessarily think of;

ideas that President Clinton had thought of, or Senator Moynihan, a great

member of the United States Senate from New York, who, unfortunately,

has passed away -- or former congressman Tim Penny -- good ideas about

different ways to permanently fix the problem. And that's what Congress

must do; it must permanently fix the problem.

In 1983, one of my predecessors, President Ronald Reagan, got together

with Speaker O'Neill from Massachusetts, and they said, we got a problem,

let's fix it. See, the math wasn't working then either. It was called

a 75-year fix. They signed a bill -- I love the spirit, by the way, of

Republicans and Democrats setting aside their political parties and focusing

on getting something done for the American people. And the President did

that, the Speaker did that for the 75-year fix. The only problem is, 22

years later we're still talking about it. And so now is the time to bring

people together from both parties to have a permanent fix. And all ideas

are on the table. And I'm looking forward to discussing any good idea

with a Democrat or a Republican.

I imagine there's some people fearful in Washington, D.C. about maybe

laying out an interesting idea and that one of the political parties will

get all over them for laying it out. If I had anything to do with it,

it would be political amnesty for people bringing good ideas forward.

Now is not the time to play political "gotcha" with a member

of any political party, for stepping up and bringing forth ideas to do

what they think is right to help solve this problem permanently for generations

of Americans to come.

Now, one of the ideas that I think is important for the Congress to consider

is to allow a younger worker to be able to set aside some of her, or his

own money in a personal savings account, as a part of a Social Security

solution. See, I think government ought to say, we'll give you an opportunity,

if you want to -- your choice. We're not saying, you must set aside money.

We're saying you ought to have the opportunity to, it ought to be voluntary

to set aside some money so that you can earn a better rate of return on

your money. People ought to be given a chance to invest in a conservative

mix of bonds and stocks.

In other words, it's part of a permanent solution in order to make sure

the younger worker gets a better deal. The younger worker ought to be

allowed to set aside some of the payroll taxes. And this is a concept,

by the way, that has been tried before. I haven't invented the idea. As

a matter of fact, the federal -- Congress before has said, we ought to

allow people working in the United States Congress, and congressman and

United States senators to do just what I described. The Federal Employee

Thrift Savings plan allows members of Congress and the United States Senate

to take some of their money and set it aside in a personal savings account.

Why? Because they know they'll get a better rate of return on their money

than if the federal government held it. And it seems fair to me that if

setting aside money in a personal savings account is good enough for a

member of the United States Congress, it's good enough for workers all

across America. (Applause.)

Okay, so I went to school with a guy who made all A's. It's probably

recognized by now I didn't do all that well in college at times. (Laughter.)

And I brought him with me. He's an expert. He's my National Economic Advisor.

But I want you to notice, you students out there, who's the President

and who's the advisor. (Laughter and applause.)

I've got a fabulous staff. People need to judge the President based upon

who he listens to. And as you know in foreign policy matters, I listen

to some really capable people -- Condi -- Condoleezza Rice, the Secretary

of State; Secretary Rumsfeld. And on the domestic side, I've got great

people working with me. One of them is Al Hubbard, a business guy out

of Indiana, started businesses, ran businesses, entrepreneur. He's agreed

the come and serve as the National Economic Advisor to the President.

He briefs me on a regular basis. And one of the big issues that I've got

him working on is Social Security.

I want to thank for coming, Al. And if you got something to say, now

is your opportunity. (Laughter.) Please don't try to defend yourself because

the President always has the last word. (Laughter.)

MR. HUBBARD: Yes, sir, I've learned that very quickly. Thanks for giving

me this opportunity.

* * * * *

THE PRESIDENT: You're the guy who authored the bill?

MR. SINES: I had the first bill in 1994.

THE PRESIDENT: Really.

MR. SINES: Introduced it.

THE PRESIDENT: If you got any spare time, you might want to come up to

Washington and work the issue with me. (Laughter.)

MR. SINES: Well, Mr. President -- I really like Lake County. (Laughter.)

* * * * *

MR. SINES: I have three daughters, and kind of in the same mode as you,

we're in a special club when you raise daughters.

THE PRESIDENT: Yes. Your hair is about as white as mine. (Laughter.)

MR. SINES: Yes, it is and it's getting whiter. And it's getting whiter.

* * * * *

THE PRESIDENT: It must make you feel good to be able to sit here in front

of all these TV cameras and say, I saw a problem, I worked with people

from both sides of the aisle to fix it, and it's working. That's the spirit

the people in the United States Congress must hear. It's not time to play

politics, it's time to fix the problem. It's time to set aside all this

business about, my party may look good, or so-and-so may look good, and

so-and-so may look bad -- we've really got an opportunity, a need to fix

it.

And secondly, I am -- I just want you to know that like you went through,

there were some moments as to whether or not you thought the thing would

pass. Yes, well, you know something -- I'm going to be relentless on the

subject because I believe the American people, once they understand there's

a problem, once they understand the math, and once seniors understand

that nothing is going to change, the next question to members who have

been elected is why aren't you doing something about it? See, if there's

a problem, you saw the problem, and people begin to recognize the nature

of the problem and the size of the problem and the cost of inactivity,

and senior citizens understand that the propaganda they may have heard

about somebody taking away their check simply isn't true, the next logical

extension of the debate and the discussion is, say, if we got a problem,

and I'm going to get my check, what are you going to do about my grandkids?

It's a generational issue.

And we're just starting. So don't worry about me, Ray. I'm feeling pretty

good about -- feeling pretty good about where we stand. The American people

are wise. They just need to know the facts.

Part of the facts is understanding we have a problem, and part of the

facts is what you're going to do about it. And today, this is an interesting

opportunity for people to see a system that is -- I bet most people in

America don't understand what happens here in Ohio when it comes to the

retirement system. And so, thank you, for being an innovator, and thank

you for being a leader.

Now, who's next, Hubs.

MR. HUBBARD: Mr. Scott Johnson, who is very involved with the Ohio Public

Employees Retirement System. And he can describe this new innovation that

Ray provided through the legislature.

THE PRESIDENT: Good, tell us what you do.

MR. JOHNSON: Thank you, Mr. President. I'm Scott Johnson, I'm Governor

Taft's director of administrative services. That's a central services

organization similar to your General Services Administration, only added

human resources and personnel.

* * * * *

THE PRESIDENT: By the way, I went to West Virginia the other day and

saw the asset base of the so-called Social Security trust: You know what,

it was about four or five file cabinets full of paper. (Laughter.) It

was the IOU left behind from one hand of government to the other hand

of government.

MR. JOHNSON: We've been operating since 1935, but of course, society

has changed a bit over that period of time.

* * * * *

THE PRESIDENT: Sorry to interrupt you. Presidents do that sometimes.

(Laughter.) Portability -- so if somebody is listening and they're not

exactly sure what that means and why that would be important to them --

MR. JOHNSON: University professors typically move around.

THE PRESIDENT: Right.

MR. JOHNSON: And in mid-career may move from one university to another.

And so they've already gotten some sort of retirement system underway

and would like to move that from where they are, to where they're going.

THE PRESIDENT: If they change jobs they could take their retirement account

with them.

MR. JOHNSON: Exactly.

THE PRESIDENT: Yes. That's important for people to know. That's a concept

that's an important part of any good plan, would be to recognize the needs

of the person that is receiving a part of their retirement. They can move.

Go ahead.

* * * * *

THE PRESIDENT: I think that's a reasonable concept, don't you, folks?

Government says to the people you have a choice to make, you know? (Applause.)

MR. JOHNSON: So what you, therefore, have with that combined program

is a system where the portion that the employer -- the state, or the county,

or the city -- contributes is administered by the professionals at the

system. And the amount that the employee himself or herself contributes

could be managed by that employee.

* * * * *

THE PRESIDENT: Yes, I guess, you can't take the money and put it in the

lottery?

MR. JOHNSON: Well, even though we run a lottery --

THE PRESIDENT: Or on the trotting jockey -- trotters or whatever it is

next door here.

MR. JOHNSON: No, sir, you can't do that.

THE PRESIDENT: The point is that there is a relatively conservative,

or conservative mix of what's available for people to invest in. Is that

an accurate assessment of the choices people have to make?

MR. JOHNSON: The choices are all responsible ones, Mr. President.

THE PRESIDENT: I don't know about the lottery being irresponsible --

(Laughter.)

MR. JOHNSON: But there is a great deal of variety and individual ability

to be aggressive or not so aggressive as one chooses.

THE PRESIDENT: That's right. See, it's an interesting concept that the

people of Ohio have put in place. And the government basically said, hey,

why don't we trust people. After all it's their own money. Why don't we

give them a chance to -- (applause.) But you just can't go -- there is

a certain set of parameters, I presume, Scott, that -- just like there

is for the federal employees, by the way. In other words, here's some

options for you.

Some people think about whether or not people ought to be allowed to

invest. They call it risky. I don't think it's risky to let people earn

a better rate of return on their money, but obviously there's some parameters,

there's some go-bys. And as you said I think there's eight different options

-- nine different options.

MR. JOHNSON: Nine, yes.

THE PRESIDENT: In other words, the government says -- the government

does play a role and says here's nine different opportunities for you

to have a mix of stocks and bonds, or it can go totally bonds, totally

stocks, or is it generally a mixture? How does it --

MR. JOHNSON: Mr. President, there are layers of choices you can make.

You could if you wish choose one of three pre-mixed options.

THE PRESIDENT: Got it.

MR. JOHNSON: One would be conservative, one less conservative, and one,

frankly, aggressive. Or you could if you wish develop your own asset mixture.

You could have some bonds. You could have some equities. You could have

TIPS. Conceivably, you could invest it all in bonds.

THE PRESIDENT: Yes.

MR. JOHNSON: You could do that if you wish to do so.

THE PRESIDENT: Okay, you got any average rate of return on these programs?

Or is that impossible to do?

MR. JOHNSON: It's not impossible to do, but it's beyond my level of expertise.

(Laughter.)

THE PRESIDENT: Okay. Well, I was talking with Senator McCain who told

me that he thought his rate of return I think was over 7 percent, in his

employee retirement Thrift Savings Plan, over time. In other words, a

conservative mix of stocks and bonds that the government -- federal government

allows federal employees to make, a rate of return over 7 percent. You

see, if you're keeping you money in the Social Security system, it's about

1.8 percent. And the difference for a younger worker between 7 percent

and 1.8 percent over time is a lot of money because interest compounds.

It grows. Money grows over time.

And I think that's one of the reasons why the employees said if it's

good enough for professors, why don't you let me have a taste of this,

too? Why don't you give me a chance to watch my money grow and let me

control it, and let me own it.

So, I appreciate you bringing that forward, Scott, thank you.

MR. JOHNSON: Yes, sir.

THE PRESIDENT: Very good job. (Applause.)

Betty Young, welcome. What do you do, Betty?

MS. YOUNG: Thank you, Mr. President, and it's an honor and a pleasure

to be here. I'm the executive director of Human Resource Services for

the University of Cincinnati.

* * * * *

THE PRESIDENT: First, you notice that Betty talked about 401(k)s and

IRAs. I don't remember 401(k)s when I was growing up. In other words,

there is a new culture in America when it comes to people managing their

own assets -- 401(k)s encourage management of your own assets -- IRAs.

In other words, more and more people in America are now becoming used

to controlling their -- managing their own money.

I presume you find a certain reticence initially, when -- that says I'm

not so sure I can do this.

MS. YOUNG: But you don't have to be a Wall Street wiz.

THE PRESIDENT: Right.

MS. YOUNG: For example, the university requires that the different providers

that offer these programs, that they provide educational materials.

* * * * *

THE PRESIDENT: That's good. You know interesting thing that Betty talked

about was encouraging people to open up a quarterly statement, or if you

so choose, you can look at your wealth on a daily basis. I think that's

an interesting concept. It seems like to me we'd like all of America doing

that, watching their assets grow. Not just Wall Street wizzes, but everybody.

I mean, if more people owned something -- (applause.) I like the idea

of having a program in Ohio where it encourages ownership. Not just one

type of person, but all people have got access to ownership.

It seems like to me a more hopeful America is going to be one in which

people say, I'm watching my assets grow and I'm more -- let me just say,

politicians will be -- their actions will be a lot more scrutinized when

somebody is watching whether or not the decisions made in Washington is

affecting their work, on a daily or quarterly basis. In other words, the

more people paying attention to their assets, the more people will be

paying attention to what happens in Washington, D.C., or in Columbus,

Ohio.

So thanks for bringing that to my mind. Let me ask you this: Obviously,

there's a certain role for the state, and that is the state has chosen

the providers -- is that right -- screened and chosen the providers?

MS. YOUNG: Yes. The Ohio Department of Insurance screens and chooses

the providers that participate in the Ohio Alternative Retirement Program.

THE PRESIDENT: So the charge that somehow a fly-by-night is going to

get a hold of somebody's retirement account and fritter it away is frivolous.

MS. YOUNG: Correct, because if there's ever a problem, for example, with

one of the providers, then as the person that manages the program at the

University of Cincinnati, then I can contact the Department of Insurance,

or go directly to that company about any issues that we may have.

THE PRESIDENT: One of the other things that Betty talked about was mixing

risk. And people need to understand that you can constantly change the

risk of your asset base -- that, for example, if you're 20 years old,

you can take a little more risk. And when it comes time for fixing to

retire, you switch from, perhaps, stocks -- mix up stocks and bonds to

a greater mix of bonds to stocks, so that you're able to decide for yourself

what kind of asset base you have, relative to where you are in the retirement

-- how close you are to retirement age. And I presume people are doing

that, constantly switching in and out all the time to manage their assets.

* * * * *

MS. YOUNG: I have funds in a portion that is guaranteed 6 percent --

that won't change during the life of the account.

THE PRESIDENT: About 6 percent. It's a lot better than 1.8 percent in

the Social Security system. And the difference between the 6 percent and

the 1.8 percent over Betty's lifetime is a significant amount of money.

And that's important for people to understand. What we're trying to do

is to learn lessons from a state like Ohio, apply it at the federal level,

so workers get a better deal. And part of a better deal is a better rate

of return. And part of a better deal, by the way, is saying, I own it.

You listen to Betty's language -- she's talking about her assets. She's

not relying upon the government, she says, these are my assets and I own

these assets. And that's important. The more people own an asset, and

the more people are able to say, I'm going to pass it on to my son or

daughter, whoever I choose, the better off America is. You see, being

able to spread wealth. (Applause.)

Thank you, Betty. Good job.

Let me say one thing about the Social Security system before we get to

Rick. Do you realize the system today is structured so that if you die

early and you leave behind a spouse -- say, you started working and contributing

to the system at age 21, and you died at 51, 30 years of work, and you

leave behind a spouse, and the spouse works, like many families in America,

there's two spouses working -- that the -- and the spouse is the same

age as the husband or wife, there are no death benefits if you're younger

than 62 years old. And secondly, when the surviving spouse retires, he

or she will get to choose between the survivor benefits or the contributions

that he or she has made -- is owed by the government, whichever is greater,

but not both.

Now, think about that. That's a system in which the person who's worked

for 30 years, put in the money and it's just gone. I don't think that

makes sense for a good retirement system. The system here in Ohio essentially

says that, if the principle were applied to the federal government, you

have an asset. It grows. You watch it, you manage it, and if you pass

away you can leave it to your spouse to help that person transition, then

help that person live life. It's an asset. This asset doesn't exist in

a file cabinet in West Virginia, it's yours. It's an asset that you call

your own, that can help you.

Now, when people retire here, I presume you can't spend all your asset

base at once.

MS. YOUNG: You could take a withdrawal on a lump-sum basis, but normally,

again, your AARP provider is going to work with you to design how you

should now start drawing down on your money to ensure a level of income

throughout your remaining lifetime.

THE PRESIDENT: That's what the -- that's the vision at the federal level

for a personal account, is that there will be a draw-down to help complement

the check, however big it's going to be from the federal government. All

I'm telling you is we made promises to younger workers we can't keep.

In other words, we've said we can pay you; we can't. Do you realize that

in order to make sure that the payments that we promised to retirees are

kept, that a younger worker may have to pay upwards of an 18-percent payroll

tax. Try that on if you're a small business owner. Try that on if you're

struggling to get ahead. We need to fix it now, and one way to -- a part

of making sure the retirement system works well is to listen to the example

right here in the state of Ohio.

Rick, ready to roll?

MR. STENGER: I certainly am.

THE PRESIDENT: Okay. What do you do?

MR. STENGER: I'm currently one of the directors of the Lake Metropark

System. We want to welcome you back to Lake County. The last time you

were here --

THE PRESIDENT: Yes, I know -- thank you.

MR. STENGER: You and 20,000 friends came and had a good day. (Laughter.)

THE PRESIDENT: I hope LaTourette stayed behind to clean up. (Laughter.)

MR. STENGER: Steve got busy. He was there, but he was watching us. (Laughter.)

THE PRESIDENT: Okay. He was an executive. (Laughter.)

* * * * *

THE PRESIDENT: How did your money do in the Social Security system?

MR. STENGER: Yes, 1.8, I think, right?

THE PRESIDENT: Yes. You take a 6-percent differential, or 5.2 percent

differential over a number of years, and you're going to see some serious

money. And it ought to grow. The government ought to give opportunities

to our fellow citizens to have their money grow in a conservative mix

of stocks and bonds just like they did. It seems to make sense to me.

(Applause.)

MR. STENGER: Mr. President, one of the things that I found very helpful

and interesting is the system does a good job of educating, because you

come in and you're not sure what to do, and many people are afraid of

change -- they had a battery of questions to answer, I think 20-some questions,

and it sort of guided you as to where you fit on the investment scale.

If you answered the questions, it would give you a score, and the score

would sort of catagorized you into you're okay to aggressively do it,

conservatively do it, moderately do it. So people who are afraid of it

don't know -- you answer this batter of questions and it gives you a pretty

neat answer.

THE PRESIDENT: Yes. See, that's an interesting point. I think some people

are fearful of the obligation, I guess is what it -- of investing their

own money. They're not exactly sure what the words mean. It's kind of

an interesting assumption here in America, the investor class is only

a certain type of person. I don't buy into that. I think all people are

capable of learning what investment means. People from all walks of life,

all neighborhoods have got the capacity to manage their own money. And

you say the system helps people learn the words and learn what all this

means. I mean, it's kind of fancy -- rate of return, bonds and stocks.

MR. STENGER: And the nice thing about it, too, as Betty mentioned earlier,

you can change. If you realize, well, I went real aggressive and your

lifestyle changes for whatever reason and you want to change, you can

get on-line. You can do it daily, if you so desire. You can take your

quarterly statement, analyze it, make changes appropriately if you so

desire. It's not like you're stuck with the choice you made.

THE PRESIDENT: How do you make sure like these firms don't gouge you

when it comes to fee? They've got a captive audience, they've got you

pretty well roped in once you make the decision. How does Ohio make sure

that these fees aren't going up, that they're reasonable?

MR. STENGER: Scott would know more than I do, but if I read right, the

fees are defined, depending on the plan you chose. I think the plan I

chose they're about .24, if I'm not mistaken.

THE PRESIDENT: -- .24, sounds reasonable.

* * * * *

THE PRESIDENT: I appreciate that. Listen, thanks for sharing this with

us.

I got on the airplane, I started paying attention to what I was going

to hear today, and I was amazed at the willingness of the great state

of Ohio to think differently on behalf of the people who live here. And

it struck me about how relevant this conversation was going to be, for

others to listen to what is possible for Social Security.

Now, look, we need to come together in Washington and we need to work

on a permanent fix, all options are on the table. But part of that solution,

in order to make it a better deal for younger workers, is for people of

both parties to trust people with their own money, to devise a system

that would work similar to the state of Ohio, that would say, we're going

to let you earn a better rate of return for your money, that would enable

a mom or a dad to pass on their assets to whomever they chose, that would

encourage portability, but that makes sense. It makes sense. The more

somebody owns something in America, the more they're going to have a vital

stake in the future of this country.

The state of Ohio has incorporated a lot of really important principles

in this bill, Ray, and I want to thank you for that. One of the key principles

is government has got to trust people. The more government trust people,

trust people with their own money, the more content, the more prosperous

our society will be.

And so I want to thank you all for sharing with us. I hope you found

it as educational as I have. I look forward -- (applause.) I look forward

to continuing to take this message to the people of the United States

of America. I have great faith in the wisdom of the people of this country,

and I fully understand that when the people of this country understand

the depth of the problem that a young generation of Americans is going

to face, and when senior citizens understand that they're going to get

their check, the question is going to start to be to members of Congress

of both political parties, how come you're not fixing it. Because America

is going to realize that every year we wait it's going to cost the young

generation of Americans $600 billion to make this right.

And here's a fascinating idea, started right here in the great state

of Ohio, sponsored by both Republicans and Democrats, that's working.

And Congress needs to pay attention to things that work.

Thank you all for coming, and God bless. (Applause.)

END 1:55 P.M. EDT

Discusses Strengthening Social Security in South

Carolina

South Carolina Statehouse

Columbia, South Carolina

April 18, 2005

12:17 P.M. EDT

THE PRESIDENT: Thank you all very much. Mr. Speaker, thank you for that

kind and short introduction. (Laughter.) I appreciate Governor Sanford

being here. I want to thank the Lt. Governor. I appreciate President Pro

Tem McConnell, Majority Leader Leatherman, members of the South Carolina

legislature. I appreciate my traveling party from Washington. Hope you

appreciate them, too. That would be Senator Lindsey Graham, Senator DeMint,

members of the United States House of Representatives from the great state

of South Carolina. I appreciate the justices of the South Carolina Supreme

Court being here. I thank those of you who have taken time to come and

listen. I appreciate your warm welcome.

It is an honor to be speaking in this chamber. It is great to be back

in the capital of South Carolina. The last time I came to this city I

gave the commencement speech at USC. I was proud to have received an honorary

degree. When I told Laura about it, she said, "I thought your first

degree was honorary." (Laughter.) She sends her best and she sends

her love. She's, by the way, a fabulous First Lady. She is -- (applause.)

I appreciate our escort committee. I told the members that this is the

first time I have spoken to a legislative body, state legislative body

since I was the governor of Texas. So thank you for having me. It's --

there's some differences, of course. There are a lot of cowboy hats back

in Austin. (Laughter.) And I'll be honest with you, a lot of us didn't

know anything about dancing the shag. (Laughter.) And I imagine we could

have a pretty good debate about which of our states has the best barbecue.

(Laughter.) Now is not the time. (Laughter.)

But one thing is, no matter whether you serve at the federal level or

the state level, we share serious responsibilities. See, our constituents

have put us into office to solve problems now. That's what they've done.

They said, we've elected you to go to your statehouse, or in my case,

Washington, D.C., to solve problems. The people expect us to confront

problems without illusion. They expect us to lead with conviction and

confidence, not by reading the latest poll or listening to the latest

focus group. And above all, they expect us to deliver results.

And here in South Carolina, you've delivered results. You've faced serious

challenges, especially in your economy. Listen, we've had a stock market

decline, we've had a recession, we've had corporate scandals, we had a

terrorist attack on September the 11th, 2001, we've had the demands of

war. And all these have tested our nation's economy. And they hit particularly

hard here in your state. South Carolina's economic growth slowed; small

businesses moved out or shut down; workers lost their jobs; and state

finances were headed toward a free fall.

The people of South Carolina look to you and they look to your Governor

for leadership. And you delivered. You set clear priorities for your budget,

and you made hard decisions when it came to spending. To rein in the rising

costs of health care, you became one of the first states in the nation

to offer health savings accounts to state employees. To reward hardworking

families and job creators, you refused to raise taxes on the working people

of South Carolina. You focused bipartisan actions; you've lifted your

state out of fiscal crisis; you've erased a $155 million deficit, and

you've done it two years ahead of schedule. Today South Carolina families

are planning for the future with confidence.

I found this to be an interesting statistic about your state: More than

76 percent of the people in your state own their own home, one of the

highest rates in the United States. Small businesses are investing and

expanding, exports are on the rise. Thanks to your leadership, thanks

to your hard work, thanks to your willingness to set aside partisan differences,

jobs are coming back to the great state of South Carolina. (Applause.)

In Washington, we're moving forward with an ambitious agenda to keep

this country safe, prosperous and free. The war on terror goes on. There

are still ruthless enemies that would like to do harm to our people. We

will continue to keep the pressure on these folks. We'll work with our

friends and allies to be unrelenting in our search to bring them to justice.

We will not rest until America is safe. (Applause.)

We'll continue to work to improve security here at home, but in the long-term,

in the long run, the best way to protect America and to keep the peace

is to change the conditions that give rise to hopelessness and extremism.

And the best way to do that is to spread freedom around the world. (Applause.)

I don't believe freedom is America's gift to the world. I believe freedom

is the Almighty God's gift to each man and woman in this world. (Applause.)

My administration will continue to pursue pro-growth policies to ensure

that America is the best place in the world to do business. To keep the

economy growing and create jobs, we will keep the taxes low. (Applause.)

We'll continue to confront the problems of junk lawsuits by pushing for

meaningful asbestos and medical liability reform. We'll work with Congress

to pass an energy bill that will make America less dependent on foreign

sources of energy. (Applause.)

I sent to Congress a disciplined federal budget, and both the House and

the Senate have passed budget resolutions. And now they need to work out

their differences and send me a budget that meets America's priorities,

that restrains federal spending, and that keeps us on track to cut the

deficit in half by 2009. In Washington, and in Columbia, South Carolina,

government needs to follow a straightforward principle, a taxpayer's dollar

must be spent wisely, or not spent at all. (Applause.)

Strong leadership means rising to the challenges of the day. It also

means looking down the road. There will always be problems that arise

unexpectedly; yet problems -- some problems are completely predictable.

And as leaders, you and I have a responsibility to confront those problems

today, and not pass them on to future generations. (Applause.)

Over the past few weeks I've been traveling around the country talking

about one of the most serious and most predictable challenges which face

our nation, and that is the long-term fiscal health of Social Security.

Social Security has been a great success. Franklin Roosevelt did a really

smart thing in setting up the Social Security system. It has provided

an important safety net for millions of Americans. Seniors in South Carolina

and seniors across this country depend on their monthly checks as an important

part of their lives, as an important source of income for their retirement.

And today I have a message for every senior in South Carolina, and every

senior across this country: Do not pay attention to the propaganda and

scare ads. If you're receiving a Social Security check this month, you

will continue receiving a Social Security next month, and the month after

that, and every month for the rest of your life. (Applause.)

There are other Americans who are now approaching retirement and have

been paying into Social Security throughout their lives. These workers

are counting on Social Security as part of their retirement plans, and

there's money in the system for them. If you were born prior to 1950,

America will honor the promise of Social Security for you. The problem

is that the government is making promises for younger Americans that it

cannot pay for. In other words, there's a hole in the safety net for younger

Americans.

See, Social Security is a pay-as-you-go system -- you pay and we go ahead

and spend here in Washington. (Laughter.) We spend on -- to provide benefits

for current retirees, and with money left over, we have spent your payroll

taxes on government programs. Some people think there's a Social Security

trust, where the government is holding your money, in an account with

your name on it. It just doesn't work that way. That's not the way the

system works. There is no vault holding your cash, waiting for you to

retire. Instead, because we spend Social Security taxes on current retirees

and other government programs, all that is left over in the so-called

security trust is a bunch of filing cabinets with IOUs in them.

As a matter of fact, I went to West Virginia the other day to look at

the filing cabinets, to make sure the IOUs were there -- paper. And it's

there. And it's, frankly, not a very encouraging sight. It's not encouraging

especially when you consider that times are changing in America, that

the math for Social Security is changing significantly. By the math I

mean this: In 1950, there were about 16 workers paying taxes for every

beneficiary -- 16 workers for beneficiary. And today, there's 3.3 workers

for every beneficiary. By the time our children and grandchildren are

ready to retire, there will only be 2 workers paying for every beneficiary

in the system.

That's only part of the problem. To compound the problem, the first baby

boomers will soon start retiring. I happen to be one of them. As a matter

of fact, I'm eligible to start collecting benefits in 2008 -- which happens

to be a convenient year for me. (Laughter.) The retirement of the baby

boomer generation is going to have a huge impact on Social Security, because

my generation is about 50-percent larger than my parents' generation.

Today there are about 40 million retirees receiving benefits. By the time

all the baby boomers have retired, there will be more than 72 million

retirees receiving benefits. And thanks to advances in modern medicine,

these retirees will live longer and collect benefits over longer retirements

than the previous generation.

And to compound the problem even further, Congress has ensured that

benefits to my generation will grow faster than our economy or the rate

of inflation. In other words, people went around the country saying, vote

for me, I'll make sure your benefits are higher. And so this sets up an

enormous fiscal challenge facing Social Security. With each passing year,

there will be fewer workers paying ever higher benefits to a larger number

of retirees who are living longer.

And so here's the result: Three years from now, when the first baby boomers

start collecting Social Security benefits, the system will start heading

toward the red. Less than a decade later, in 2017, Social Security will

go negative. And by that I mean it will be paying out more in benefits

than it collects in payroll taxes. More money going out than coming in.

And every year after that the shortfall will get worse.

In the year 2027, the government will somehow have to come up with an

extra $200 billion to fund the system -- $200 billion more going out than

coming in through payroll taxes. In 2034, the annual shortfall will be

more than $300 billion a year. And by the year 2041, the entire system

will be bankrupt. Now, think about that. If we don't do something to fix

the system now, the students graduating this spring from the University

of South Carolina, or, in deference to the Speaker, Clemson -- (laughter)

-- will spend their entire careers paying Social Security taxes only to

see the system go bankrupt a few years before they retire.

And I don't care if you're a Republican or Democrat, these are the facts.

And the question is, do we have the will to do something about them. Now,

in South Carolina, you know that once you're in the red, the options of

getting out are never very appealing. If we allow Social Security to continue