Testimony by Martin O'Malley

Commissioner, Social Security Administration,

before the House Committee on Appropriations, Subcommittee on Labor, Health And Human Services, Education, and Related Agencies

November 20, 2024

Chairmen Cole and Aderholt, Ranking Member DeLauro, and Members of the Subcommittee:

My name is Martin O’Malley, Commissioner of the Social Security Administration (SSA), and I am deeply honored to be here today on behalf of the agency’s thousands of dedicated employees and the millions of Americans they serve.

Thank you for inviting me to discuss Social Security’s fiscal year (FY) 2025 budget request. And thank you for allowing me to explain why it is so essential to restore the level of customer service that taxpayers expect, deserve, and have already paid for.

I greatly appreciate your commitment to hold today’s hearing. This is Social Security’s first hearing before the Appropriations Committee in nearly 10 years.

SOCIAL SECURITY TODAY

Social Security is one of the most far-reaching acts of social and economic justice that the people of the United States ever enacted. It has been the honor of a lifetime to lead Social Security forward through these especially difficult days.

Since day one of my term, we have been improving customer service by driving transformational change within our current funding levels. Even within the brutal constraints of our increasingly inadequate funding, we have been able to make some meaningful progress. But given the ever-climbing levels of beneficiaries, our progress will be short-lived without your immediate help. While modernization and other efficiencies have helped for some things, there is no way around the fact that the agency cannot keep doing more with less.

But the good news is, this is a solvable problem. The American people have already paid into Social Security for their customer service, just as they paid into Social Security for their benefits. We can and must improve service by reversing severe funding and staffing losses since 2018, when we last received a budget that was at least 1.2 percent of the benefits we paid. We want to work with Congress to secure the increases in the President’s 2025 Budget, which is a big step in the right direction to enable SSA to improve service levels and reduce wait times.

RECORD HIGH CUSTOMERS, 50-YEAR LOW IN STAFF

We all agree that the public deserves the highest level of customer service from their government, especially in the case of Social Security.

But the current state of Social Security in the life of our Republic is this: Social Security, today, is serving more customers than ever before with one of the lowest staffing levels in 50 years.

Allow me to repeat this hard but central truth.

Social Security, today, is serving more customers than ever before with staffing levels Congress has reduced to 50-year lows.

This is a self-inflicted wound.

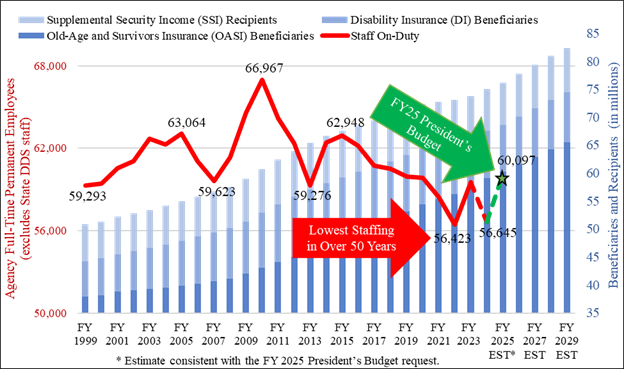

And the gap between growing numbers of beneficiaries and dwindling numbers of customer service staff will only get worse unless you act (Figure 1). In fact, SSA’s Chief Actuary projects the number of new applicants and total beneficiaries we serve will only continue to rise in the coming years.1

Figure 1. Serving More People with Fewer Staff

We are like a school system or a police department—if you have fewer teachers and more students, class sizes will be larger; if you have fewer police officers and more 911 calls, it will take longer to respond to each call. At Social Security, if we have more and more applicants and beneficiaries, with fewer and fewer staff to serve them, the result is that people will wait longer for their benefits and for their calls to be answered. In fact, our customer experience surveys show that once people finally reach an employee, they are satisfied with the service we provide; it’s the delay in getting served that is the challenge.

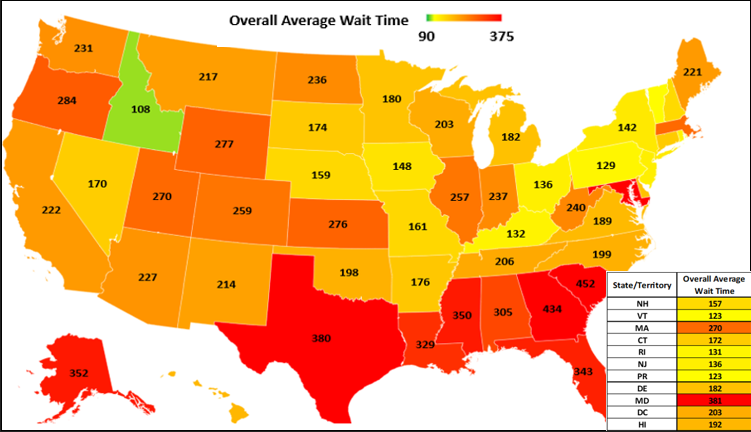

For instance, as our staffing levels dropped from FY 2017 to FY 2023, wait times on our National 800 Number nearly tripled and wait times for initial disability decisions doubled—particularly in some hard-hit States like South Carolina, Georgia, Maryland, and Texas, where the wait times for Americans seeking disability benefits are over a year.

While modernization and other productivity gains have helped Social Security keep its nose above water—our overall agency productivity increased 6.2 percent in FY 2024 over FY 2023—we cannot sugar-coat the severe damage that decades of staff reductions have done to Social Security’s customers.

Since FY 2018, Social Security’s budget has essentially been flatlined even as fixed costs increased like they do for everything else in the real world. Every year, your Social Security Administration faces $600 million in fixed cost increases—for things like employee pay, healthcare, postage, printing, phones, and rent. Therefore, so-called level funding amounts to a $600 million cut—a cut which we primarily must make up in staff reductions and customer service reductions, year after year after year.

As a result, we ended FY 2022 with our lowest staffing level in over 50 years. We made some progress in FY 2023, but much of that progress was erased when we had to start FY 2024 in a hiring freeze due to the extended continuing resolution. And the $100 million increase we later received for FY 2024 was not nearly enough to cover our increase in fixed costs, much less to rebuild staffing and improve customer service—meaning we ended the year with staffing well below where we ended FY 2023.2 And so, the mismatch between rising workloads and declining staffing continues to grow.

Much the same can be said of information technology (IT) funding, where increases in mandatory fixed costs must be absorbed by cutting our modernization efforts. As costs to maintain our legacy systems rise, we are left with less and less to upgrade to the new technologies that would better serve our customers.

CUSTOMER SERVICE CRISIS

The result of the growing gap between record high numbers of customers and 50-year lows in staffing is this: the customer service that Americans have already paid for has been allowed to decline to crisis-level lows. This crisis hits hardworking Americans every day, in every community across our country and in every one of our States.

Consider this:

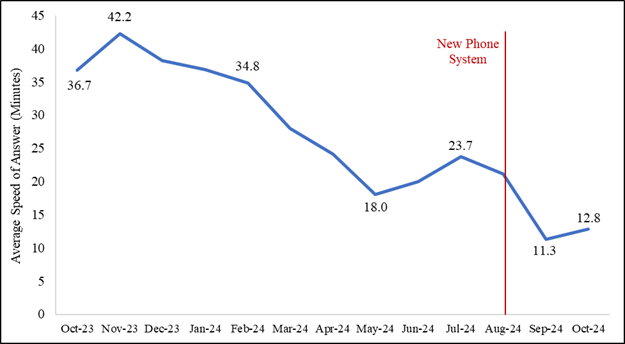

- Americans calling Social Security’s National 800 Number last year routinely experienced wait times of an hour or more. While we have now driven that average wait time down from 42.2 minutes last November to 12.8 minutes in October, customers who do not opt for the callback option are waiting far longer than the average, due to our historically low staffing levels.

- Our severe policies too often inflicted financial hardships on elderly people and our poorest families who were overpaid. Sometimes the overpayments were because we had insufficient staff to act promptly to prevent or catch up to an overpayment.

- The initial disability claims backlog is nearly a record high, with close to 1.2 million people waiting for a decision on their eligibility for benefits. Our Chief Actuary estimated that approximately 30,000 people died in 2023 while their application for Social Security or Supplemental Security Income (SSI) disability benefits, or both, was pending a decision at the initial, reconsideration, or hearing levels. While this is a small percentage of the people waiting for a decision, it remains critical that we issue decisions faster at every level. Disability applicants now wait on average nearly 8 months (227 days) as of October for an initial decision and almost 8 additional months (234 days) for those who request a reconsideration. In some States, these numbers are a year or more.

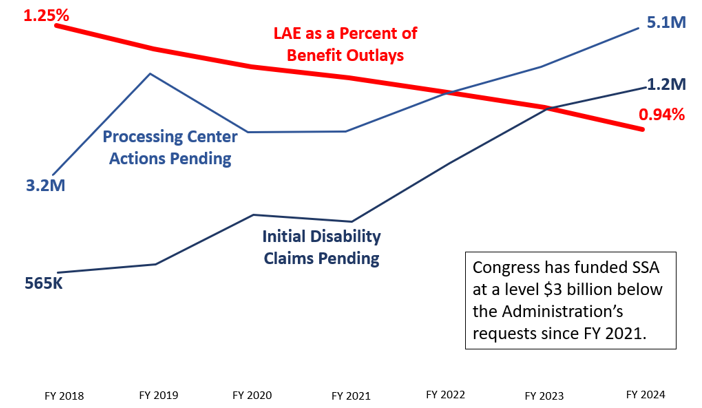

Consider also the numbers of cases we had pending at the end of October 2024: close to 1.2 million initial disability claims (nearly the highest level on record, and more than double our typical pending level of almost 600,000 prior to FY 2020); 333,000 disability reconsiderations (also a record high); and 5.7 million processing center actions (a historically high volume that includes issuing and adjusting more complex payments). The trend is clear: as our administrative funding is reduced, our backlogs increase (Figure 2).

Figure 2. Backlogs Grow as SSA Administrative Funding Is Reduced

Social Security touches every American from the moment they are born until after they pass. Behind each of these numbers is a real person, many of whom are depending on the benefits we provide. Surely your offices have heard the complaints. Surely you have heard the cries. The American people deserve better.

HOW WE’RE ADDRESSING THE CUSTOMER SERVICE CRISIS

Despite the brutal constraints of our funding, we remain committed to improving customer service from the current state of crisis. We do our very best every day with the limited resources we have to serve the public. Here is how we are beginning to drive change.

SecurityStat

In early February, we launched SecurityStat, a cross-cutting performance management regimen that gathers the top leaders in a room together for data-driven performance management and accountability.

In eight meetings rotating across every two weeks, we come together and focus intensely on the most important things we do for the American people and for you, their Members of Congress. For one blessed hour we focus, together, on each of eight key challenges:

- Field Operations

- Processing Centers

- Teleservice Centers

- Workforce

- Disability Initial Claims

- Hearings Operations

- Fraud

- Overpayments and Underpayments

We also offer a new and unprecedented level of transparency for Social Security’s customers and stakeholders, including Congress. Many of your staff have observed this new way of doing business at SSA; we appreciate your attention, your interest, and the presence of your staff at our side. Today, on our SecurityStat website (www.ssa.gov/securitystat), the public can easily view key metrics and track the progress we are making toward achieving our top customer service goals.3

Action Plan and Quick Wins

Since day one, I have been listening to and learning from people inside and outside the agency about the most important changes we can make. I have traveled to 50 cities in 21 states across all 10 of SSA’s regions around the country to meet with and learn from the dedicated employees on the front lines of serving the public. I sat side by side with teleservice center representatives taking calls and claims specialists taking claims in the field offices. I heard countless suggestions for improvements both big and small, many of which we are already implementing. In addition, I have met with dozens of Members of Congress and your staff to learn from your perspectives on our customer service crisis and to better understand your solutions and your greatest concerns.

Based on all the input, this summer we developed our 2024 Social Security Action Plan, which boils down the most impactful things we can accomplish into 27 strategic initiatives.4 We are now taking action on each of the initiatives, though many will take more than just the year to fully accomplish. But these efforts will also require important investments, including enactment of the FY 2025 President’s Budget.

Much has been accomplished. More progress is coming. But already, our quick wins to date include:

- The Automated Medicare Processing (AMP) tool: Based on an employee suggestion from Birmingham, we rolled out AMP nationwide in February to improve back-end processing for online Medicare claims. AMP reduces processing time from 7 minutes to 7 seconds, freeing up the equivalent of around 40 work years of people to do other critical pending work. To date we have processed nearly 426,000 Medicare claims through this streamlined, automated process.

- In February, we published formal notice of our plans to access and use information from payroll data providers.5 This long-awaited automated payroll information exchange (PIE) will reduce wage-related overpayments by ensuring we receive timely and accurate wage data. We are currently reviewing the public comments we received, and we recently interviewed customers to determine how we can make the PIE process meet their needs and expectations.

- We published and implemented three final rules to simplify and streamline the consideration of non-cash assistance within the SSI program.6 As of September 30, we no longer include food in In-Kind Support and Maintenance (ISM) calculations, have expanded our rental subsidy policy exception, and have expanded the definition of a public assistance household. With these changes, we are making SSI smarter, removing barriers to accessing payments, and reducing burden on the public and agency staff.

- We removed wet signature—or in some cases any signature—requirements where possible without compromising program integrity. In making these changes, our customers were a driving force behind the transformation; we interviewed and surveyed them along the way to ensure that we met their needs and expectations. The top 10 customer-signed paper forms result in submission of over 7.5 million signatures per year; 96 percent of this volume now has an electronic signature option. We now allow an electronic signature for more than 30 forms in total. This year, we also removed the signature requirement entirely for 13 of our most commonly used forms, totaling about 1 million submissions annually.

- SSA’s field offices remained open to limited in-person service throughout the pandemic. Today, our field offices continue to provide service in-person, over the phone, and online. To increase collaboration, engagement, and innovation, I returned most headquarters employees in Baltimore and Washington, as well as regional office employees, to work onsite at least two or three days a week. Only 1.3 percent of our workforce is fully remote, the lowest among CFO Act agencies.7

Small things done well make bigger things possible. Key customer service metrics are starting to improve. Employee engagement is up. Attrition is slowing, though still high. And most importantly, frontline workers see their voices are being heard, and they see positive changes are happening. On this year’s Federal Employee Viewpoint Survey, we increased our participation rate to an all-time high of 70 percent, and saw slight increases across all measures in the results. So our staff are most definitely reengaging. But we know that morale still has a long way to go in light of the heavy weight of shrinking staff and growing workloads.

THE EARLY RESULTS OF THESE EFFORTS

Through the agile, collaborative process of SecurityStat and relentless follow-up focus, we have made solid, measurable progress on two of our three biggest customer service challenges. We are steadily reducing wait times on our National 800 Number, and the policy changes we implemented on overpayments have provided immediate and sometimes life-changing relief for thousands of beneficiaries. But initial disability determinations remain a challenge of crisis proportions, with wait times averaging eight months, and more than a year in far too many States.

National 800 Number Wait Times

This year marks the 35th anniversary of our National 800 Number, and it has been a challenging one thanks to a woefully underperforming phone system that fell far short of our expectations, and a 16 percent attrition rate among staff answering the phones in our teleservice centers across the country.

The month before my confirmation, the average wait time for customers trying to reach us by phone was 42 long minutes. Around seven million people called our National 800 Number every month, and about 4 million of them hung up in frustration after waiting far too long.

We sprang into action and identified quick wins to reduce unnecessary calls on the front end, and improve first call resolution on the back end. Among those quick wins on the National 800 Number:

- We secured approval from the Internal Revenue Service (IRS) to accept phone attestations from beneficiaries wanting to change their voluntary tax withholding from their benefits. We can now resolve the action on the first phone call rather than making them wait to get a form, sign it, and send it back.

- We enhanced our online system to automatically provide more detailed claim status updates to the people representing disability applicants, eliminating their need to call us for frequent status updates.

- We revamped the training for new hires at our teleservice centers to improve employee engagement and reduce attrition of new hires.

The quick wins were beginning to help, but we needed to do more. So in August, we took the bold step of transitioning to a better-performing phone system. A transition like that would normally take 12-18 months, but we accomplished it in under 60 days. This data-driven decision has yielded immediate benefits for both callers and employees, including reduced wait times and more self-service options.

Approximately 75 percent of our callers use the new platform’s callback assist feature, letting them skip sitting on hold. They can go about their day until an agent is available to help them. As a result, customer satisfaction is up, and we’re serving more customers on a daily basis. However, even customers who opt for a callback are waiting longer than we’d like for that call back. And those who do not opt for a callback are waiting longer because of our historically low staffing level.

As a result of these actions and many more, we have begun to turn the tide in the right direction. In October, we answered calls in an average of under 13 minutes, a significant improvement from 42 minutes last November (Figure 3). We are successfully leveraging technology to improve our service, but there is only so far we can go without adequate funding to ensure we have the staff available to answer the calls.

Figure 3. National 800 Number Average Wait Times Are Improving

Overpayments and Underpayments

For 89 years, the hard-working employees of the Social Security Administration have strived to pay the right amount, to the right person, at the right time. And the agency has done this with a high degree of accuracy over a massive scale of beneficiaries; our overall accuracy rates are 99.34 percent for Social Security and 90.80 percent for SSI based on our stewardship reviews.8

But despite our best efforts, we sometimes pay beneficiaries more than they are due, creating an overpayment.

Sometimes we learn too late of work activity or other information that would have affected the payment amounts, although we are making strides to reduce the need for customer reporting through implementing more data exchanges. Sometimes, under the pressure of serving more and more customers with fewer and fewer staff, it takes us longer and longer to catch up to mistakes. As it takes us longer and longer, the amount our individual beneficiaries are required to repay becomes greater and greater.

Congress understandably requires that we make every effort to recover overpaid benefits, and we also take seriously our role as good stewards of taxpayer dollars. But doing so without regard to the larger purpose of the program was resulting in very real financial hardship for individuals. No one should lose their home because Social Security made a mistake and then intercepted 100 percent of their monthly benefit to recover the debt.

Starting last year, we embarked on a deep dive review of our overpayment policies and procedures, to identify the root causes of these overpayments and to take proactive steps to address these injustices. Our deeper understanding of the complexities of this problem has set us on the following course of actions accomplished over the past eleven months:

- Lower Withholding Rate: In March, we ceased the heavy-handed practice of intercepting 100 percent of an overpaid beneficiary’s monthly Social Security benefit by default if they fail to respond to our demand for repayment.9 Instead, we now use a much more reasonable default withholding rate of 10 percent of monthly benefits (but not less than $10 per month)—similar to the current rate in the SSI program.

We gave individuals who are currently repaying an overpayment at a rate greater than 10 percent the option to request a lower rate of recovery. So far about 37,000 people have contacted us and gotten a lower rate.

- Less Burdensome Repayment Process: We extended from 36 months up to 60 months our ability to make repayment plans without requesting proof of income and assets, for the vast majority of beneficiaries who request to work out a repayment plan.

- Waiver Process Simplifications: We are making it much easier for overpaid beneficiaries to request a waiver of repayment, when they believe they are without any fault and cannot repay. We are streamlining forms and simplifying processes, as well as shifting the burden of proof away from the beneficiary in determining whether there is any evidence that the beneficiary was at fault in causing the overpayment.

- Administrative Waiver Tolerance: Anyone who requests a waiver and is not at fault for the overpayment will see their debt waived where, on average, we would spend more on recovery activities than the amount we would recover. We updated this threshold from $1,000 to $2,000.

- Notice Improvements: As we develop solutions to the systemic issues that plague SSA notices, where our customer satisfaction is under 20 percent, we are particularly focusing on how we can clarify and simplify our overpayment notices. We are taking a comprehensive look at what we can do to reduce the confusion our customers have in understanding the complexities in the 375 million notices that we provide every year.

We have heard from countless beneficiaries how appreciative they are of these changes; for many, they are life changing. One beneficiary in Pittsburgh called us after receiving our outreach notice about the ability to request a lower withholding rate. He said he currently had no running water; now that he will no longer have his entire check withheld, he can pay his water bill and restore this basic necessity. Another beneficiary told us that under the new withholding policy she will no longer worry about potentially losing her home. These are just a few examples of how our overpayment policy changes are helping to restore the promise of Social Security.

There are some additional changes that can only be effectuated by the will and good judgment of Congress. I look forward to working with Members to discuss ideas that could address the root causes of overpayments.

On the flip side of overpayments are underpayments. We are working to increase our processing of SSI underpayments, particularly for the oldest and highest-priority cases. Through October, we have processed more than 100,000 underpayments and released approximately $270 million since the beginning of FY 2024 to our customers with these aged and priority underpayments. We are on track to complete our goal of processing 98 percent of them by the end of FY 2025. Like with overpayments, our focus on underpayments has a very tangible and often heart-warming effect on our beneficiaries, with countless individuals reporting to us that they were able to avoid eviction or purchase necessary medical supplies after finally receiving a long-awaited payment.

Disability Wait Times

Now we come to the biggest and most stubborn challenge of the big three—the unacceptably long wait times for an initial disability determination by the 52 State and territorial disability determination services (DDS) offices.

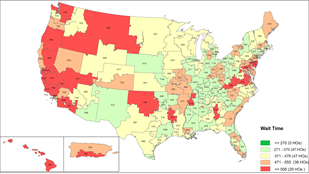

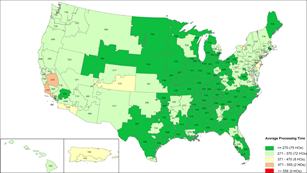

It now takes a shockingly long time for DDSs to make initial disability determinations. Ten years ago, when our appropriations represented a larger share of our annual outlays and we could hire and retain staff, we were able to make these determinations in 110 days. But today, operating with the staff we can afford on inadequate budgets, it takes an average of 227 days as of October to make the same initial determinations (Figure 4).

That means disability applicants are waiting on average nearly 8 months (227 days) for an initial decision and again for those who request a reconsideration. In some States, the wait times are a year or more. And not surprisingly, applying for disability receives the agency’s lowest customer satisfaction rating. We must do better, and our long-term goal is to reduce those waits to 4 months (120 days) each.

Figure 4. Initial Disability Average Processing Times, by State (FY 2025 through 10/25/24)

Actions we are taking to reduce disability processing times include:

- Earlier this year, we published a final rule reducing the amount of past work history we consider when making disability decisions, from 15 years to 5 years.10 Research indicates unused manual skills deteriorate before 10 years, and collection cycles for other occupational data suggest occupational requirements change on a 5 to 10 year cycle. This change in requested work history reduces processing times and increases accuracy of customer recollection of past job skills and tasks.

- In July, we returned to a commonsense application of what’s called “collateral estoppel,” which we used prior to 2018. Essentially, if we’ve already found the same beneficiary disabled under a different claim, we can generally adopt that prior finding without having to do it all over again. This change will serve our beneficiaries by significantly accelerating approvals and avoiding inconsistent findings of disability, and will provide relief to our overworked employees.

- We are increasing use of our Intelligent Medical Language Analysis Generation (IMAGEN) tool, which helps employees complete disability determinations by identifying and organizing medical evidence. Since I started, the share of DDS cases that use IMAGEN has more than doubled from 28 percent to 60 percent. We are now training all new employees to use IMAGEN. We also expanded the types of cases in which DDS employees can use IMAGEN, and we expanded IMAGEN for use at the hearing level.

- After significantly reducing wait times at the next level of appeal—Administrative Law Judge (ALJ) hearings—and driving down the number of hearings pending to an over 30-year low, we are now training and redeploying staff from the hearings office to attack the initial disability determination backlog.11

Our actions are beginning to turn the tide, very slowly. For the first time in many years, we have now cleared more disability cases than we received for 21 weeks in a row (as of the week ending November 8) and counting. We are driving down the disability backlog, but there is only so far we can go without adequate staffing.

So that is how we fight to serve an all-time high number of customers with some of the lowest staffing levels in 50 years. I remain encouraged that the hard-working people on the frontlines of this agency still wake up every day to serve their country by serving their neighbors.

SOLVING THE CUSTOMER SERVICE CRISIS TAKES ADEQUATE FUNDING

But we cannot do this growing body of work with less and less support, and fewer and fewer staff. We need your help. We need Congress to allow us the funding necessary to restore our customer service levels—the customer service for which the people of the United States have already paid.12

SSA Has Extremely Low Operating Expenses.

Members may be surprised to learn that your Social Security Administration operates on a ratio of less than one percent of annual benefits paid. This is extremely low for an insurance agency of any size—in fact, much lower than private insurance companies. For instance, Allstate operates on a ratio of 19 percent of its annual benefits paid, and Liberty Mutual operates on a ratio of nearly 24 percent of annual benefits paid.

The history of how we got here would I think be news to many Members, as it was to me.

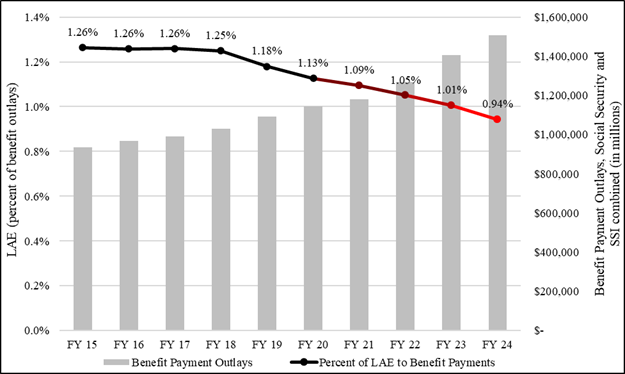

Social Security’s operating overhead, as a share of combined (Social Security and SSI) benefit outlays, has shrunk by 20 percent over the last 10 years. Just 10 years ago, Congress routinely allowed a customer service funding level that represented just 1.26 percent of benefit outlays for essential operating expenses. But that has now been steadily reduced by Congress to less than 1 percent (Figure 5).

The predictable result is the customer service crisis that I described above, with Americans suffering from the long wait times, larger overpayments, and extended backlogs in disability determinations.

I am not suggesting that this chronic funding shortage was done intentionally by Members of Congress. However, without dedicated budget hearings addressing the inadequacy of our administrative funding, our agency and the critical work we do have been out of sight, out of mind.

We can and must do better.

Figure 5. Administrative Funding Declining as Percent of Benefit Outlays

Our FY 2025 Budget

The FY 2025 President’s Budget request of $15.4 billion for SSA would allow us to restore staffing to FY 2023 levels (see Figure 1).13 With additional staff in our teleservice centers, field offices, and State DDSs, we would be able to:

- Restore our staffing levels to FY 2023 levels after dropping to one of the lowest levels in over 50 years in FY 2024;

- Keep average wait times on our National 800 Number under 12 minutes on average for the entire fiscal year;

- Reduce initial disability claims wait times to an average of 215 days and process an additional 185,000 claims;

- Reduce the claims backlog by 15 percent;

- Prevent the hearings backlog from recurring;

- Improve the timeliness of retirement and Medicare applications for over 200,000 seniors;

- Address overpayment and underpayment process improvements; and

- Increase our IT budget to help us modernize and provide more efficient and customer-focused service.

To do that, the President’s Budget funding level includes:

- $8.7 billion for personnel costs to increase our frontline staff—in field offices, teleservice centers, processing centers, and hearings offices—providing direct service to the public;

- $2.8 billion for State DDSs to reduce the initial disability claims backlog by allowing the DDSs to hire about 2,900 people;

- $1.7 billion to modernize the agency’s IT services and infrastructure for the future; and

- Over $2 billion to support other mission-critical costs such as office leases, guard services to protect those facilities and the customers who visit us in-person, postage for notices, and other necessary costs.

I want to be clear that any amount less than the President’s Budget level—or its equivalent for portions of the year during a CR—would have severe consequences for your constituents. People needing help from Social Security would face longer delays to get benefits and to get their calls answered. And, even with level funding, the tens of thousands of Social Security employees in your districts would face the possibility of furloughs and workloads even greater than what they already face.

Unfortunately, the current CR through December 20 does not include the anomaly funding requested to fully fund SSA and prevent deterioration in service for the millions who rely on us.14 While the CR allows us to continue serving the public without disruption, it also means that we are spending the first quarter of the year operating with a spending level that does not meet our significant needs. We cannot maintain our staffing levels or invest in IT development. In addition, we have essentially no overtime to serve customers who are still waiting in our lobbies late in the day or to clear workloads that we are unable to get to during core hours of operation.

A further CR without an anomaly would mean that we would hit a new 50+-year staffing low by around the end of March, and would lose over 2,000 staff in the first half of the fiscal year. As we lose staff, customer service would immediately worsen. We would likely have to reduce the hours field offices are open to the public and may even need to close offices over time, further extending wait times for seniors and individuals with disabilities. Already record-high wait times for initial disability claims would worsen; seniors applying for retirement and Medicare would face delays; and National 800 Number wait times would increase.

The House’s full-year proposal of $13.826 billion for SSA is a catastrophic $401 million reduction from our FY 2024 current operating level and almost $1.6 billion below the FY 2025 President’s Budget request. When combined with fixed cost increases, that means we would need to absorb about $1 billion in total reductions in FY 2025. At that level of funding, we would be forced to close all of our field offices for about four weeks, as well as shut down services on our National 800 Number and cease the processing of hearings and all other workloads during that time. Further, we would be forced to shorten the hours we are open to the public, cut all overtime, and freeze all hiring, further reducing our already record-low staffing levels. In short, the House funding level would devastate service for the public who rely on us.

And despite what some Members of this Committee have claimed, this half-billion dollar cut could not be absorbed by staff reductions at our headquarters locations in Baltimore and Washington. It would be operationally impossible to absorb this scale of cuts even if we were to entirely eliminate every job at both of those locations. Our headquarters staff perform critical functions such as cybersecurity, IT modernization, human resources, financial operations, and program integrity and anti-fraud work—not to mention keeping Congress informed and answering your questions.

Even the Senate’s proposal of $14.736 billion for SSA is not enough to fully cover our mandatory fixed cost increases. We would only be able to provide limited replacement hiring and may only be able to prevent further degradation in customer service, but not make significant improvements.

FY 2025 is a critical year for our agency’s recovery after years of chronic underfunding at the same time beneficiaries continue to grow. We cannot prevent further service degradation without an increase to our funding. I ask for your support of the FY 2025 President’s Budget for SSA, which would allow us to begin rebuilding the staffing and investing in modernized IT that we need to serve the American people.

IN CONCLUSION

The American people work their whole lives to earn the benefits of Social Security—and those benefits include the right to an appropriate level of customer service. I have every confidence that a restoration of service levels at Social Security will produce a dividend of trust for generations to come.

We can restore the excellent customer service that you and your constituents expect and demand from Social Security—but only if you in Congress do your part. The FY 2025 President’s Budget funding level would be a huge step in the right direction towards providing the American people with a level of customer service for which they’ve already paid, but have in recent years consistently been denied.

It remains my great honor to serve the people of our republic in my capacity as their Commissioner of Social Security. I look forward to answering your questions.

— Martin O’Malley

_________________________________________________

2 We lost a net of nearly 2,900 staff in FY 2024, not including DDS staff. From FY 2022 through FY 2024, Congress funded Social Security’s administrative expenses at a level almost three billion dollars below the President’s Budget requests.

3 SSA, “SecurityStat,” updated November 2024.

4 SSA, “Action Plan: Social Security Administration, 2024,” August 2024.

5 SSA, “Use of Electronic Payroll Data To Improve Program Administration,” Federal Register 89 FR 11773, February 2024. See also: SSA, “Social Security Publishes Proposed Rule for Payroll Information Exchange to Reduce Improper Payments,” February 2024.

6 SSA, “Helpful SSI Changes Reducing Customer Burden Take Effect,” September 2024.

7 Office of Management and Budget, “OMB Report to Congress on Telework and Real Property,” August 2024.

8 These overall accuracy numbers consider both overpayments and underpayments for FY 2022, the most recent data available. FY 2023 data will be available soon on PaymentAccuracy.gov.

9 SSA, “Social Security Eliminates Overpayment Burden for Social Security Beneficiaries,” March 2024.

10 SSA, “Intermediate Improvement to the Disability Adjudication Process, Including How We Consider Past Work,” Federal Register 89 FR 27653, April 2024.

11 People appealing at the next level for an ALJ hearing waited well over a year on average (450 days) to get a decision in FY 2023. In FY 2024 that dropped to 342 days, and by this October, it was down to 280 days, representing hard-won progress (see figures). Hearing offices across the country have also reduced the number of people who have a hearing request pending with us to about 263,000 people as of October—nearly the lowest number in over 30 years. We were able to achieve this progress thanks to the dedicated funding we received from Congress beginning in 2017. Even with the staffing reductions of more recent years, we are on track to prevent the hearings backlog from recurring and issue hearings decisions in 9 months (270 days) on average for this fiscal year.

Significant improvements in hearing wait times, from September 2023 (left) to October 2024 (right):

* Alaska is not shown separately as it is a satellite of the Seattle hearing office.

12 Funding can quickly lead to restored levels of customer service. The U.S. Department of Veterans Affairs (VA) received an infusion of funding and increased its satisfaction and trust among Veterans from 50 percent to nearly 80 percent. The IRS used additional funding to reduce its call wait times from 30 minutes to 4 minutes. SSA was able to dig out of the initial disability claims backlog during the Great Recession with significant funding provided through the American Recovery and Reinvestment Act of 2009. I am confident we can do it again, but it will take sufficient funding, just as it did for IRS and VA.

13 SSA, “Justification of Estimates for Appropriations Committee: FY 2025,” March 2024.

14 White House, “Statement of Administration Policy: H.R. 9747 — Continuing Appropriations and Extensions Act, 2025,” September 2024.