Testimony by Stephen C. Goss

Chief Actuary, Social Security Administration,

before the House Committee on Ways and Means, Subcommittee on Social Security

June 4, 2024

Chairman Ferguson, Ranking Member Larson, and members of the committee, thank you very much for the opportunity to speak to you today about the Social Security program, past, present, and future.

Social Security started paying monthly benefits to qualifying retired workers and their family members and survivors in 1940. Benefits for disabled workers and their families started in 1957. Over the 85 years through 2024, all scheduled benefits have been paid in full. In December 2023, nearly 67 million people received benefits from the OASDI program. Social Security provides this fundamental insurance against loss of earned income due to old-age, disability, and death for nearly all current and past workers and their families.

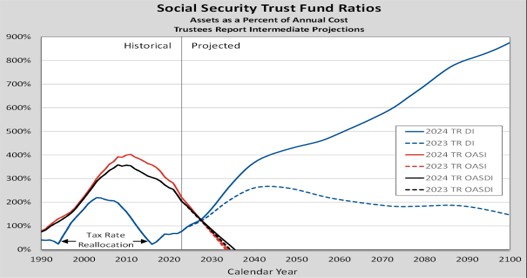

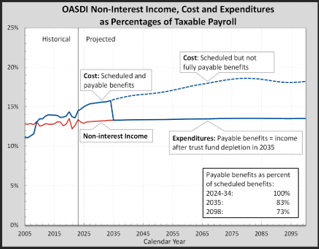

At the start of 2024, reserves in the combined OASI and DI Trust Funds total $2.8 trillion, nearly double the amount of annual benefit payments. However, under the intermediate assumptions of the 2024 Trustees Report, revenues to the combined OASI and DI Trust Funds are projected to be less than program cost in 2024 and in future years, so that combined OASI and DI reserves would become depleted in June 2035, 13 months later than in last year’s report, at which time 83 percent of scheduled benefits would still be payable. The OASI Trust Fund alone is projected to deplete reserves in November 2033, 7 months later than in last year’s report, with 79 percent of scheduled benefits then payable. The DI Trust Fund alone is projected to be fully financed and able to pay all scheduled benefits through 2100 and beyond.

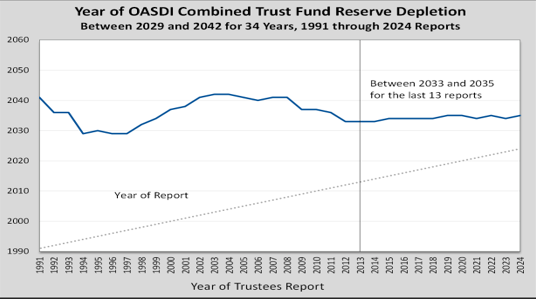

The assessment of the actuarial status of the combined OASI and DI Trust Funds provided in the annual Trustees Reports since 1941 tells us by when, and to what degree, changes in scheduled revenue and/or scheduled benefits will be needed. The Trustees’ assessment has been remarkably consistent and stable over past decades. The year of projected combined OASI and DI Trust Fund reserve depletion has been in the range of 2029 to 2042 in the last 34 annual reports, and in the range of 2033 to 2035 in the last 13 reports.

The fundamental nature of these trust funds is important. These funds are credited all income to the OASDI program on a daily basis and provide the sole source for paying benefits and administrative expenses. If at any point reserves were to become depleted with program cost still exceeding continuing income, then scheduled benefits would not be fully payable on time. The OASDI program and the Trust Funds do not have any authority to borrow from the General Fund of the Treasury or the public and never have.

What Is New in the 2024 OASDI Trustees Report: Three Primary Changes

There are three primary changes in the 2024 Trustees Report that affect the actuarial status of the OASI and DI Trust Funds:

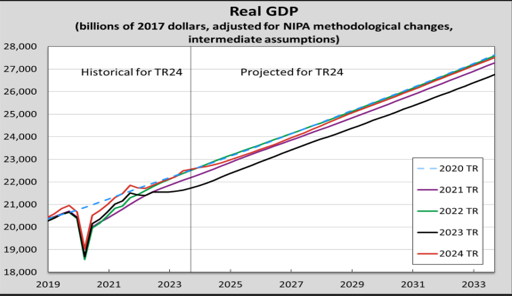

- Economic: Given the unanticipated strength of the economy through 2023, the Trustees increased the level of labor productivity and the employment rate over the entire 75-year projection period. This offsets the 3-percent permanent drop in the level of labor productivity and GDP that was assumed in last year’s report.

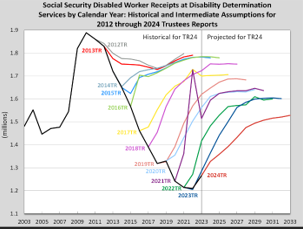

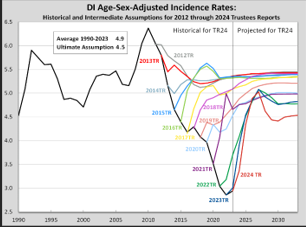

- Disability: The assumed ultimate disabled worker incidence rate was lowered from 4.8 to 4.5 per thousand, as applications for and awards of disability benefits have continued at historically low levels.

- Demographic: The assumed ultimate total fertility rate (TFR) was lowered from 2.0 children per woman reached in 2056 to 1.9 children per woman reached in 2040, given continued low level of the TFR in recent years.

The net effect of these changes is a reduction in the OASDI 75-year actuarial deficit from 3.61 percent of taxable payroll in last year’s report to 3.50 percent in the 2024 report. In the absence of these changes and other updates, the actuarial deficit would have risen to 3.67 percent of taxable payroll just due to the change in the valuation period.

As shown in the figure below, the economic slowdown that was widely expected for 2023 in late 2022 did not materialize, and growth through 2023 was strong. In addition, the Bureau of Economic Analysis (BEA) in the Department of Commerce revised the level of real GDP upward for 2019 through 2022 based on the latest data. The intermediate assumptions for the 2024 report assume a period of slowed growth in 2025 with recovery back to a level 3 percent above that projected for last year’s report by 2029, with the growth rate in GDP thereafter the same as assumed in last year’s report. The further good news is that reported growth in GDP since the assumptions for the 2024 report were set in December 2023 has been stronger than expected for late 2023 and so far in 2024.

The change in the assumed levels of GDP, labor productivity, and employment explains why the projected OASI and OASDI combined Trust Fund reserve depletion years are now later than in last year’s report. It also reduced the OASDI actuarial deficit by 0.13 percent of payroll.

The second primary change for the 2024 report is a further incremental change in the ultimate disabled worker incidence rate from the level of 4.8 new awarded beneficiaries per thousand “exposed” workers (those who are insured and not receiving benefits) to a level of 4.5 per thousand for the 2024 report. This change is the most recent in a series of reductions over the last several years reflecting the continued decline in disability applications, awards, and beneficiaries since 2010. (See further explanation below.) This reduced level of disability has not only reduced program benefit cost, but it also contributes to higher employment rates, thus reducing the OASDI actuarial deficit by 0.12 percent of taxable payroll.

Applications for disability benefits and incidence rates have been declining steadily since 2010 and have continued to be below our prior projections. We and the Trustees continue to assess the reasons for these declines and the likelihood that rates will rise to levels not seen since the period immediately after the 2007-09 recession.

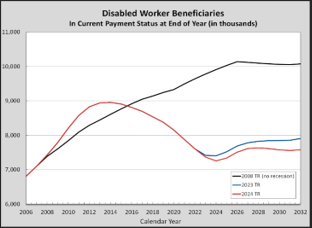

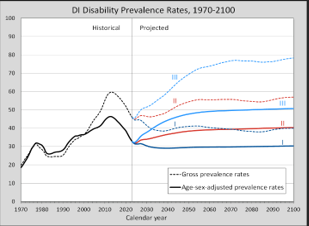

The total number of beneficiaries paid from the DI Trust Fund has now been falling since 2013. As a result, the disability prevalence rate (recipients in current payment status as a percent of the insured population) has also dropped to levels not seen for 20 years. Only with the assumed return of disability incidence rates back to much higher levels will the prevalence rate rise to the level seen before the 2007-09 recession.

Many factors have played a role in the lower disability incidence rates and prevalence rates. Among these are the changing nature of work and the increasing accommodation of workers with some limitations, given the changing age distribution of the adult population.

The combination of the positive economic and disability experience and change in assumptions is largely responsible for the extended reserve depletion dates—the dates through which the OASI Trust Fund and the combined OASDI Trust Fund are projected to be able to provide full payment of scheduled benefits on a timely basis.

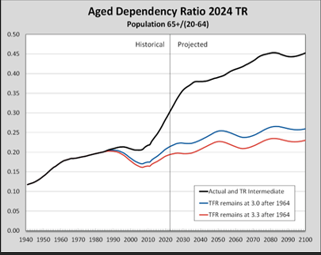

The third primary change the 2024 report is a reduction in the ultimate total fertility rate (TFR) from 2.0 children per woman over her lifetime reached in 2056 in the 2023 report to an ultimate level of 1.9 children per woman reached in 2040 for the 2024 report. The history of the TFR shows a level averaging more than 2.5 births through 1965. For the period 1966 through 2008, the TFR was at an average level of 2.0. Since 2008, however, the TFR has declined below 2.0, as it did between 1975 and 1990. The most recent birth expectations survey from CDC indicates that women still expect to average 2 children over their lifetime. But due to the persistence of the historically low level since 2008, the Trustees have assumed an incremental reduction in ultimate TFR for the 2024 report increases the OASDI actuarial deficit by 0.13 percent of taxable payroll.

Actuarial Status in the 2024 OASDI Trustees Report

The cost of providing scheduled benefits under current law has been rising as a percent of taxable payroll (all covered earnings below the annual taxable maximum amount) since 2008, and it will continue to rise through 2030 with a slower rise thereafter through about 2080.

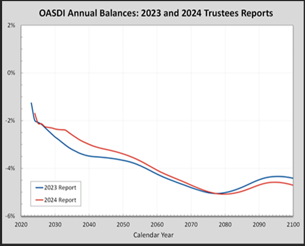

The projected OASDI annual balance (the difference between the income rate and the cost rate) has been improved significantly through 2045, due to the changes in the economic outlook and disability assumptions for the 2024 report. However, by 2077, this positive effect is offset and then reversed due to the lower assumed TFR for the 2024 report. The net effect is a more gradual increase in the OASDI cost rate in the 2024 report.

The financial shortfall over the next 75 years as a whole for the OASDI program, or unfunded obligation, amounts to $22.6 trillion in present value. However, this shortfall must be met with changes over this period of 75 years as a whole, and thus represents 3.32 percent of taxable payroll and 1.2 percent of GDP over the entire period.

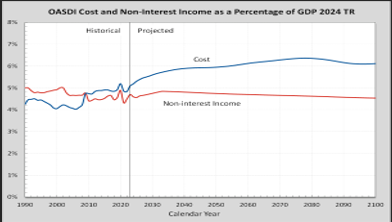

Similar to the trend in the OASDI program cost as percent of taxable payroll is the trend in cost as a percent of GDP. Cost rises to a relatively stable level of GDP due to the changing age distribution of the population.

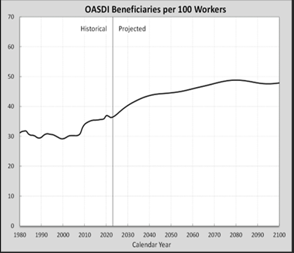

There are two primary reasons for this fundamental rise in cost as a percent of payroll and GDP. First, the age distribution of the adult population has been changing substantially due largely to reduced birth rates that were well-recognized in 1983. This change in age distribution is also increasing the ratio of OASDI beneficiaries to workers. Had birth rates remained at levels seen before 1965, the increases in cost relative to payroll and GDP would have been much less.

Social Security is financed primarily from payroll taxes paid by current workers, which pay benefits for current beneficiaries. Because of the drop in birth rates from 3.3 children per woman in the baby boom period (1946 through 1965) to about to 2 children per woman for 1966 through 2008, the ratio of adults over age 65 to those at “working ages” (between 20 and 64) will rise through about 2040, increasing OASDI cost as a percent of both taxable payroll and as a percent of GDP. Further reduction to just 1.8 children per woman for 2009 through 2022 would make the effects of the changing age distribution even more challenging if such low birth rates persist. While the most recent surveys of birth expectations still suggest a level closer to 2.0 is plausible for the future, the Trustees have made an incremental change in the ultimate assumed total fertility rate to 1.9 this year, as was assumed prior to the rise back to 2.0 in 1990. The question we now face is whether recent very low birth rates are due to delay in births to higher ages as in the 1980’s, temporary concerns that have reduced marriages and births, or a more fundamental and permanent reduction in births.

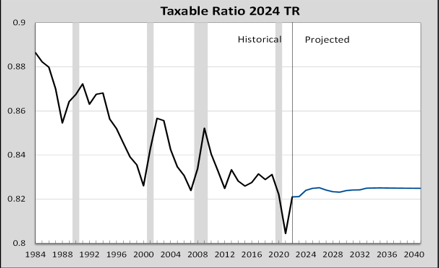

The other reason for increase in cost as percent of taxable payroll since 1983 is that the percent of total covered earnings that is below the taxable maximum amount declined from about 90 percent in 1983 to about 82.5 percent in 2000. This change was not anticipated in 1983. In 1983, the taxable maximum was scheduled to rise in the future with the average wage, with this indexing expected to maintain the taxable ratio at 90 percent. However, wage levels rose much faster than average for high earners. Between 1983 and 2000, average earnings for the top 6 percent of earners rose 62 percent more than price inflation, while average earnings for the other 94 percent of earners rose only 17 percent more than price inflation. Since 2000, the ratio has stayed at about 82.5 percent, except for temporary spikes during economic recessions. As a result of this increased dispersion in wage levels, Social Security payroll tax income is about 8 percent less than it would have been if the taxable ratio had remained at 90 percent. This change, along with the effects of the deep recession of 2007-2009 and slow recovery, are primarily responsible for moving the expected year of OASDI Trust Fund reserve depletion from 2063 in the 1983 Trustees Report to 2035 currently.

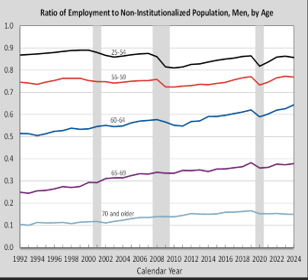

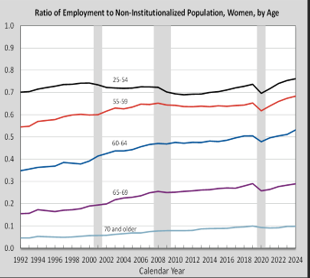

Additional evidence of the effect of the changing age distribution is the increased employment of those over age 60 since 1990.

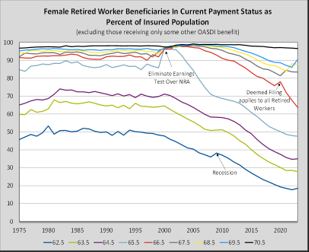

With the changing age distribution and demand for workers, age at retirement continues to rise, with a declining share of insured workers starting retirement benefits early.

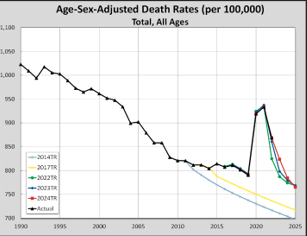

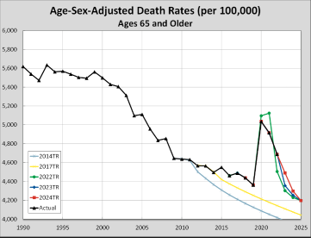

Mortality is also an important factor in the cost of the Social Security program. Declines in death rates slowed considerably after 2009, and as a result, life expectancy at age 65 reached the level projected in the 1983 Trustees Report for 2015, and not the higher level expected more recently.

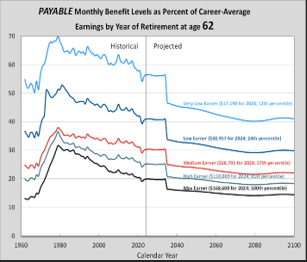

Benefit levels scheduled in current law vary by workers’ career average earnings levels. Monthly benefits are designed to replace a larger percentage of career average earnings for lower earners. The “replacement rates” shown below for benefits as a percent of career average earnings at selected levels indicate the impact that trust fund reserve depletion could have in the absence of a future change in law, assuming that benefits would be reduced for all by the same percent if reserves were allowed to become depleted. Benefit levels are shown for retirees at the earliest eligibility age (62) and the average age of starting retired worker benefits (65). Benefits in 2035 would be reduced by 17 percent overall if there is no change in law, even if the allocation of payroll tax rates between OASI and DI were adjusted as was done to maintain DI benefits in 1995 and 2015.

The importance of the retirement income provided by Social Security is as important as ever, with the percent of private-sector workers participating in an employer-based retirement plan still at only one-half, with defined benefit plans that provide annuities becoming increasingly rare.

Conclusion

Based on the experience of the past year and the intermediate assumptions of the 2024 Trustees Report, there are three main points I would like to make.

- First, the reserve depletion date for OASI Trust Fund is projected for November 2033, 7 months later than in last year’s report, due largely to the Trustees’ reassessment of the future level of GDP, labor productivity, and employment. The reserve depletion date for the combined OASI and DI Trust Funds is projected for June 2035, 13 months later than projected in last year’s report, for the same reason. These are positive, but incremental, improvements.

- Second, the long-known and understood shift in the age distribution of the United States population will continue to increase the ratio of beneficiaries to workers, and in turn increase the cost of the OASDI program as a percentage of taxable payroll and GDP. With this shift, which reflects the drop in the birth rate after 1965, the cost of the program will rise from just over 4 percent of GDP seen prior to 2008 to a relatively stable level around 6 percent of GDP.

- Third, the actuarial status of the combined OASI and DI Trust Funds is similar to the assessment of reports over the last 34 years, and even more consistent with the assessment of the last 13 reports. As the Trustees have indicated consistently, legislative change will be needed prior to reserve depletion, requiring about a one-third increase in scheduled revenue, a one-fourth reduction in scheduled benefits, or a combination the two over the balance of the 75-year projection period.

We look forward to working with this Committee and others in developing the adjustments to the law that will be needed to keep the Social Security program in good financial order, providing retirement, disability, and survivor benefits for future generations.

Again, thank you for the opportunity to talk about the fundamental aspects of the Social Security program. I will be happy to answer any questions you may have.