|

|

|

THE SOCIAL SECURITY PROGRAM TODAY

|

THE basic idea of the social security system in the U.S.A. is a

simple one.

During working years employees, their employers, and self-employed

people pay social security taxes which go into special funds; and

When earnings have stopped because the worker has retired, or died,

or is severely disabled, benefit payments are made from the funds

to replace part of the earnings the family has lost.

- Nine out of ten working people are now building protection for

themselves and their families under the social security law.

- More than four-fifths of all the people past 65 are protected

by social security and more than 90 percent of those now reaching

65 are protected.

- Nine out of ten mothers and children can look to the program

for a regular income if the head of the family dies.

- About 53 million people now meet the work requirements for monthly

disability benefits. If they are disabled, monthly benefits can

be paid to them and their families.

- Almost twenty million men, women, and children are now drawing

benefits under this program-benefits totaling more than $1.25 billion

a month.

Retirement benefits. Benefits are payable to retired workers

at age 65, or reduced-rate benefits may be paid as early as age

62. Benefits may also be paid to the following family members: a

wife or a dependent husband age 62 or over; children under age 18,

and older sons and daughters who have been disabled since before

age 18; and a wife of any age caring for a child entitled to benefits.

Survivors benefits. Upon the death of an insured worker,

monthly benefits are payable to a surviving widow or dependent widower

age 62 or over, children under age 18 or disabled before 18, a mother

who has such a child in her care, and dependent parents age 62 and

over. A lump-sum death payment is also made.

Disability benefits. Monthly benefits are payable to workers

who are totally and permanently disabled and to the same dependents

as for retirement benefits. The law encourages rehabilitation of

disabled workers under the Federal-State program of vocational rehabilitation.

|

|

Miss Ida Fuller of Ludlow, Vermont, received

the very first monthly social security benefit check in January

1940. The retired legal secretary, who is now 90 years of

age, has received a check every month since. Miss Fuller's

family had settled in Vermont in 1635. She was born on a farm

a few miles from her present home and was the oldest of four

children. She attended the Black River Academy and was a freshman

there when Calvin Coolidge, later to become the President

of the United States, was a senior. At 17, she passed an examination

for a teacher's certificate and spent the next 12 years as

a teacher. At that point, she decided to change careers and

enrolled at a Boston business college to learn shorthand,

typing, and bookkeeping. On her return home, she was employed

by Stickney, Sargent, and Skeele, a Ludlow law firm, where

she worked until her retirement on November 1, 1939.

Miss Fuller lives alone in her own home and does her own housework.

She supplements her social security benefits with the rental

of an apartment and income from some bank stock she owns. |

Amount of Work Required

The worker earns his social security protection by working in covered

employment or self-employment; he pays social security taxes out

of his earnings. To qualify for retirement benefits, including benefits

for his wife and any dependent children, he must have credit for

a certain amount of work covered by social security. The amount

of work he needs depends upon when he was born--the older he is,

the less time he needs to have worked under the program. Those who

were born earlier need to have worked under social security for

a period equal to one-fourth of the time between 1950 (or age 21,

if later) and the year in which they reach 65 (62 in the case of

a woman). A man born in 1926 or later (or a woman born in 1929 or

later) will need a total of 10 years of work under social security

to qualify for retirement benefits. Covered work at any time after

1936 can be credited toward this requirement. The minimum is a year

and a half of work under social security for men born in 1892 or

earlier (or women born in 1895 or earlier).

If a worker dies, benefits can be paid to the widow (or

widower), dependent children, and aged dependent parents if he (or

she) has social security credit (earned at any time after 1936)

for a period equal to at least one-fourth the time between 1950

(or age 21, if later) and the year of death.

To provide protection for the families of younger workers who may

die before they have met this requirement, the law makes monthly

survivors benefits payable to dependent children and to their widowed

mothers if the worker had social security credit for at least a

year and a half out of the three years just before he died.

If a worker becomes totally disabled before age 65, he

and his wife and children may be paid monthly benefits if he has

worked under social security for at least 5 out of the 10 years

before his disability began and also for one-fourth of the time

between 1950 (or age 21, if later) and the year in which he becomes

disabled.

Kinds of Work Covered

Almost every kind of employment or self-employment is covered by

social security. Theprincipal groups not covered are doctors of

medicine in practice for themselves; Federal employees in jobs covered

by a special Federal retirement system; and most policemen and firemen

with their own retirement systems. Also not covered is work done

by a child under 21 for his parent, by a husband for his wife, or

by a wife for her husband. Work done by a parent for a son or daughter

is covered only if it is in the course of a trade or business.

Amount of Benefits

The amount of a worker's monthly benefit is based on his average

earnings. The more regularly he works in employment or self-employment

covered by the program and the higher his earnings, the higher his

benefit will be. The amount of his retirement benefit will also

depend on whether he starts to collect benefits at age 65, or because

of ill-health, unemployment, or personal reasons, decides to take

them earlier (he can begin to get benefits as early as age 62).

To take account of the longer period over which payments will be

made, the monthly retirement benefit is reduced if the worker chooses

to take his benefits before he is 65.

The amount of the benefits payable to a worker's dependents or

survivors is based on the amount of the worker's benefit.

Social Security is Income Insurance

A social security beneficiary who works and earns $1200 or less

in a year can collect his benefits for all 12 months of the year.

But if he works and earns more than $1200 in a year while he is

still under 72, some or all of his benefits will be withheld.

For each $2 he earns above $1,200 and up to $1,700, $1 of his benefits

is withheld; and for each $1 he earns over $1,700, $1 in benefits

is withheld.

The law, however, takes into account the situation of many people

who retire in the middle of the year and of those who can do just

an occasional job at reasonably good wages. A beneficiary, regardless

of how much he makes in a year, gets benefits for any month in which

he earns wages of $100 or less, and is not active in a business

of his own. Thus, a person who retires during the year, after he

has already earned well over $1,200, can still get benefits for

the months after his retirement--if, in those months, he does not

earn wages of over $100 and is not active in a business of his own.

The reason a beneficiary under 72 cannot get benefits regardless

of the amount of his earnings is that social security is insurance

against the loss of earnings. Generally, if a beneficiary

has substantial earnings, the benefits are not payable because that

loss of earnings against which the worker and his family

are insured has not occurred.

Beginning with the month he reaches age 72, a beneficiary gets

all his monthly benefits no matter how much he earns. This provision

recognizes that some people go on working and paying social security

taxes to the end of their lives and might otherwise never get any

monthly benefits.

How the Program is Financed

The social security taxes paid by employees and their employers,

and by self-employed people, go into two trust funds, which are

kept separate from all other funds in the U.S. Treasury. The Federal

Old-Age and Survivors Insurance Trust Fund, the older and larger

of the two social security trust funds, was set up in 1939 to finance

the payment of old-age and survivors insurance benefits. The newer

of the two funds is the Federal Disability Insurance Trust Fund.

This fund was set up in 1956 to finance the benefits payable to

workers who become totally disabled for any substantial work before

they reach 65. Under amendments to the law, benefits are also payable

from this fund to the dependents of disabled persons. A fixed part

of the social security tax is earmarked to pay these disability

benefits.

|

|

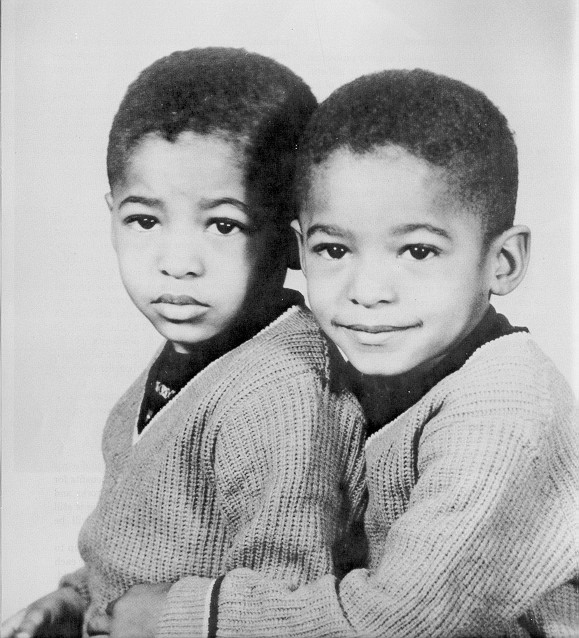

| In December 1962, Mrs. Mary Lee Payne of Springfield,

Tennessee, burned to death trying to save her five children

from their burning home. She was able to save only her twin

sons, Jimmie and Timmie. They now live with Mrs. Payne's parents,

Mary and Roosevelt Lucas. Jimmie and Timmie are receiving

monthly social security benefits based on their mother's earnings

as a household employee. Their grandfather said, "I want

to care for the twins the best I can and send them to school.

The social security payments will be a great help." |

|

|

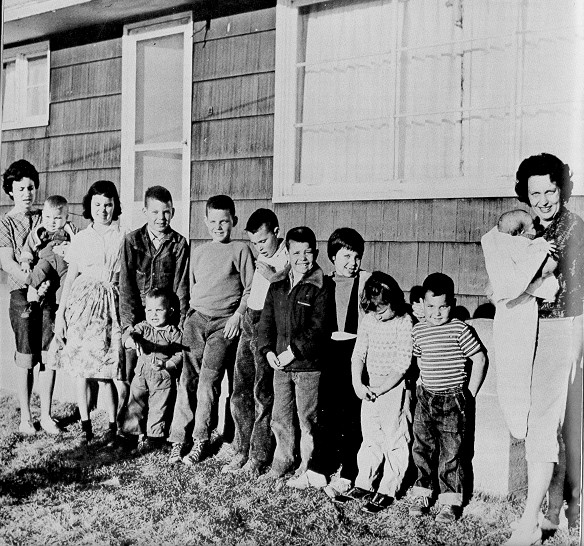

When a 1961 airplane crash left Mrs. Beth Scheib

and her I I children without a husband and father, the future

looked dark. Expecting her twelfth child, Mrs. Scheib felt

sure that the family would lose their farm and might have

to be broken up. But with a steady income of $212 in social

security survivors benefits and a monthly check based on her

husband's military service, the family has been able to stay

together. Mrs. Scheib, I 3-year-old Steve, and Grandfather

Lawrence H. Scheib, run the farm machinery. Jim, 10, Clifford,

12, and Jerry, 11, help in the fields. Teenagers Linda and

Cathy help take care of the house and the younger children

with the help of Grandmother Agnes Scheib.

The social security law, as originally enacted in 1935, provided

only retirement benefits for the worker himself. But in 1939,

before any monthly payments had yet been made, Congress changed

the law to provide benefits also for the widows, children,

and aged dependent parents of deceased workers and also for

the dependents of retired workers. |

By law, the assets in these two trust funds can be used only for

the payment of benefits and administrative expenses. The money in

the funds not needed currently for the payment of benefits and operating

expenses is invested in interest-bearing U.S. Government securities.

The interest earned on these investments is added to the trust funds.

The trust funds serve two important purposes--

1. The interest income on the invested assets of the funds helps

to keep the social security taxes lower than they would have to

be if the money in the trust funds were not invested.

2. They can be drawn on in temporary situations when current income

is less than current outgo.

To cover the cost of paying benefits to an increasing number of

people, the law provides for

gradual increases in the social security tax rates, with the last

scheduled increase going into effectin January 1968. This schedule

of tax rates is shown below. Of the tax rate shown, a fixed percentage

of taxable earnings--one-quarter of one percent each for employers

and employees, and three-eights of one percent for self-employed

persons--is credited to the Federal Disability Insurance Trust Fund.

Only the first $4800 of a worker's annual earnings is taxable.

| Calendar Year |

Employee Percent |

Employer Percent |

Self-Employed Percent |

| 1963-65 |

3 5/8

|

3 5/8

|

5.4

|

| 1966-67 |

4 1/8

|

4 1/8

|

6.2

|

| 1968 and after |

4 5/8

|

4 5/8

|

6.9

|

The social security taxes, along with the interest earned on invested

assets of the funds, are expected on the basis of actuarial estimates

to be enough now and in the future to pay all benefits provided

for in the present law.

|

|

William Bach, 37, of St. Cloud, Minnesota, had

worked for a local department store and as a food route salesman

until 1959, when he was stricken with polymyositis, resulting

in muscular dystrophy. He applied to have his social security

record frozen to protect his future benefit rights; at that

time the payment of cash disability benefits was limited to

disabled workers aged 50 or over. When the law was changed

in September 1960, to remove the age limitation, Mr. Bach,

his wife and his three children became eligible for benefits

of $254 a month. He has since taken a correspondence course

in orchestra arrangements and hopes to get some work in this

field in the future. When his health permits, he plays the

clarinet and baritone saxophone in the municipal band.

Protection against the risk of income loss resulting from

disability was provided in 1954 when provision was made to

preserve the benefit rights of disabled workers. In 1956,

cash benefits were provided for disabled workers between the

ages of 50 and 65 and for the disabled children of retired

or deceased workers, if their disabilities began before their

18th birthdays. Amendments in 1958 added benefits for the

dependents of disabled workers, and in 1960, disability benefits

were made available at any age. |

|