Greenspan Commission

Appendix J

FINANCIAL STATUS OF THE SOCIAL SECURITY PROGRAM

As a background for the discussion of the extent of the financing problems of the Old-Age and Survivors Insurance program (OASI), and recommendations for dealing with them, this appendix will deal with the operational procedures of the Social Security trust funds, their funding bases, the measures of actuarial or financial soundness, and the past and estimated future financial status of each trust fund.

There are four Social Security trust funds -- the OASI Trust Fund, the Disability Insurance Trust Fund (DI), the Hospital Insurance Trust Fund (HI), and the Supplementary Medical Insurance Trust Fund (SMI). The National Commission has considered almost exclusively the first three of these trust funds, which are financed primarily from payroll taxes. The SMI Trust Fund deals with that portion of the Medicare program which primarily provides partial reimbursement for the cost of physician services; it derives its financing from premiums paid by the enrollees and from payments from the General Fund of the Treasury.

NOTE: This appendix was prepared by Robert J. Myers, Executive Director. Any views expressed herein are those of Mr. Myers, and not necessarily those of the members of the National Commission.

OPERATIONAL PROCEDURES OF THE TRUST FUNDS

All four of the trust funds function as separate, closed entities. All sources of their financing (including any interest earned on their invested assets) go into the funds, and all benefit payments and related administrative expenses are paid from them. As a general principle! if a particular trust fund has insufficient assets to meet outgo, there is no way under the permanent law that it can borrow from any of the other three trust funds or from the General Fund of the Treasury. (A temporary borrowing authority, which exists for 1982 only, will be discussed later.) Any assets of the trust funds which are not needed for immediate payment of benefits or administrative expenses are invested in interest-bearing government obligations, and relatively small working cash balances are maintained.

The income from payroll taxes for the OASI, DI, and HI Trust Funds tends to be spread rather evenly throughout each month (although not equally throughout the months of the year, with somewhat more being collected in the early months than in the later ones, due to the effect of the maximum taxable earnings base). The vast majority of the benefit payments from the OASI and DI Trust Funds are made at the beginning of each month. In contrast, the outgo of the HI and SMI Trust Funds tends to be more or less evenly spread throughout the month.

As a result of these different flows of income and outgo, the three trust funds which are supported primarily by payroll taxes have somewhat different financial situations during the month. The OASI and DI Trust Funds must have sufficient assets during the first few days of each month to meet the full amount of monthly benefit checks sent out then. Benefit checks cannot be transmitted to the beneficiaries unless sufficient payroll-tax and other income has been received to build up the trust-fund balance to the necessary level. The HI Trust Fund need have only a very small balance at the beginning of the month in order to reimburse hospitals and other providers of services in a proper manner, because both its income and outgo are evenly spread throughout the month.

The SMI Trust Fund, too, need have only a very small balance at the end of each month, because it receives the vast majority of its enrollee-premium income at the beginning of the month (through automatic deductions from monthly OASDI benefit checks).

FUNDING PROCEDURES FOR THE TRUST FUNDS

Under present law, the OASI, DI, and HI Trust Funds are financed almost entirely from the OASDI-HI taxes levied on employers, employees, and the self-employed. Each of these trust funds receives relatively small payments from the General Fund of the treasury as reimbursement for the cost of benefits for certain special closed groups of persons.(1) This self-supporting financing principle has, on the whole, been applicable to the OASI, DI, and HI programs ever since their inception. For a short period in the late 1940s, the financing basis was rather indeterminate, because provision was made for payments from the General Fund of the Treasury, if needed. This provision was never used, and it was repealed in 1950.

In the early years, the OASI program was funded on a modified-reserve basis. It was intended that a sizable fund would be built up, so that interest earnings could help to finance the outgo. This basis would by no means result in a "fully-funded" system.

Over the years, the original emphasis on building up and maintaining a large fund was reduced. Gradually, the funding basis shifted, in practice, to what might be called a current-cost or pay-as-you-go basis. The intent under such a basis is that income and outgo should be approximately equal each year and that a fund balance should be maintained which will be only large enough to meet cyclical fluctuations both within the year and also over economic cycles which have durations of several years. There is no established rule as to the desirable size of a contingency fund, although the general view is that it should be an amount equal to between 6 and 12 months' outgo.

The financial status of the OASI, DI, and HI Trust Funds has always been evaluated over a long future period. For the OASI and DI Trust Funds, 75 years is used (although prior to 1965, a longer period -- namely, into perpetuity -was used). The valuation period for the HI program is 25 years. although estimates for a 75-year period have been made. The shorter valuation period for the HI program was adopted because of the greater uncertainty about future trends of hospital costs.

The actuarial valuation of the SMI program is on an entirely different basis, because it is, in essence, a "one-year term" plan. The valuation procedure used compares the assets on hand with the accrued, but unpaid claims (and associated administrative expenses).

MEASURES OF ACTUARIAL OR FINANCIAL SOUNDNESS

Several measures have been developed to determine the actuarial status or financial soundness of the programs. Some of these relate essentially to the short-range period (the next 5-10 years), whereas others relate to the valuation period used for the particular program.

Short-Range Measures of Soundness

Undoubtedly, the primary measure of short-range soundness is that the particular trust fund should always have at least enough assets to meet current expenditures.

A measure frequently used for measuring both the short-range and long-range financial status of the OASI, DI, and HI Trust Funds is the "fund ratio". This is defined as the trust-fund balance at the end of a month expressed as a percentage of total outgo during the next 12 months.(2)

It is usually stated that the OASI and DI Trust Funds must have fund ratios of at least 8% or 9% as the minimum possible for monthly benefits to be paid on time. Much more desirably, the "bare minimum" size should not be below some higher figure, such as 15% (or perhaps 20%) so as to provide a "cushion" against the effects of adverse economic conditions. The 8-9% figure for the OASI and DI Trust Funds is derived from the fact that, if outgo during the year were spread equally over each month, the monthly disbursements would be 8-1/3% of annual outgo. Accordingly, this amount would have to be on hand at the beginning of the year in order to meet the benefit payments due in a few days.(3)

Benefit outgo tends to rise during a calendar year (primarily because of the automatic increase in benefits for June and the gradual growth of the number of persons on the benefit rolls). Also, in the early months of a calendar year, tax income tends to be relatively higher than in later months of the year (due to the effect of the maximum taxable earnings base and the payment of a relatively large portion of the self-employment taxes in April). Accordingly, the fund ratio could be as low as 7% at the beginning of a year, and yet the program could meet all of its benefit obligations as they fall due if the level of tax income during the year (which does not enter into the computation of the fund ratio) is sufficiently high. This could occur either because of an increase in the tax rate or because of better economic conditions. The crucial factor under such circumstances would be the fund ratio which would be reached at the end of the year, which should be at a level of at least 8-9%.

The minimum fund ratio for the HI Trust Fund can be considerably lower than the 9% used as the standard for the OASI and DI Trust Funds. It could be argued that a relatively large fund ratio for the HI Trust Fund might be desirable, because of the somewhat greater possible cost fluctuations and uncertainties of this program as compared with the OASDI program. However, the minimum fund ratio at the beginning of a year needed in order to assure prompt reimbursement of providers of services can be as little as 1% -- as long as, in the coming year, tax income will be at least as large as outgo during the year.(4)

Long-Range Measures

One measure of the long-range financial status of the OASI, DI, and HI Trust Funds is to compare the "average cost rate" with the "average tax rate" over the valuation period. The "cost rate" for any particular year is the outgo for benefits and administrative expenses expressed as a percentage of effective taxable payroll.(5) The "average cost rate" is the sum of the annual cost rates for the valuation period divided by the number of years therein. Similarly, the "average tax rate" is the average of the combined employer-employee tax rates for each of the years in the valuation period. When the average cost rate exceeds the average tax rate for the valuation period, there is a lack of actuarial balance, expressed as a percentage of taxable payroll.

FINANCIAL STATUS OF OASI AND DI TRUST FUNDS

This section will examine the financial status of the OASI and DI Trust Funds in past years, their current status, and their outlook over both the short range and the long range.

Past Operations

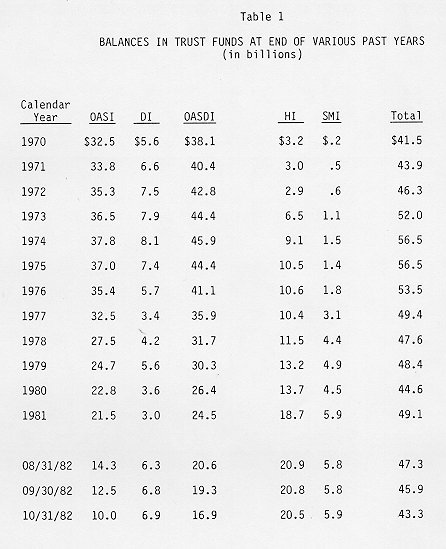

Table 1 shows the year-end balances of each of the four trust funds for various past years. The OASI Trust Fund increased slowly during the early 1970s, reaching a maximum in 1974. Thereafter, its balance decreased steadily. The decline would have been even more rapid in 1980-81 if it had not been for a reallocation of the combined OASDI tax rate, so that a larger proportion went to the OASI Trust Fund (P.L. 96-403, October 9, 1980). As a result, almost $9 billion was, in essence, transferred from the DI Trust Fund to the OASI Trust Fund.

Table 1: BALANCES IN TRUST FUNDS AT END OF VARIOUS

PAST YEARS

At the end of October 1982, the balance in the OASI Trust Fund amounted to $10.0 billion -- about $1 billion less than the amount needed to pay benefits in early November. As a result, the inter-fund borrowing of $.6 billion from the DI Trust Fund, authorized by P.L. 97-123 (December 29, 1981), was utilized to make up the difference. In early December, $3.4 billion was borrowed from the HI Trust Fund. In late December, an additional $13.5 billion was borrowed -$4.5 billion from the DI Trust Fund, and the remainder from the HI Trust Fund. From this time on (until corrective legislative action is taken), the OASI Trust Fund will, in fact, have a negative balance in at least part of each month -- when the assets on hand are measured against the outstanding loans from the DI and HI Trust Funds.

It was not at all unexpected that borrowing would occur in late 1982. In fact, the 1982 OASDI Trustees Report contains estimates which indicate that the total borrowing of the OASI Trust Fund from the DI and HI Trust Funds during 1982 would amount to about $7-11 billion. The actual amount borrowed in 1982 was $17.5 billion. Almost all of this will be utilized in the first six months of 1983, because the legislative action permitted no more to be borrowed in 1982 than would be necessary to meet the estimated outgo requirements through June 1983.

The DI Trust Fund had a balance of $7.5 billion at the end of 1972, but this decreased steadily thereafter, reaching $3.4 billion at the end of 1977. Then, as a result of the reallocation of the OASDI tax rate in the 1977 Amendments (P.L. 95-216) to give more of the OASDI tax rate to the DI Trust Fund (as discussed in more detail later), the balance increased -- reaching $5.6 billion at the end of 1979. Such balance was lower at the end of both 1980 and 1981, as a result of the further revised allocation of the OASDI tax rate for 1980-81 mentioned previously -- reaching $3.0 billion at the end of 1981. The DI Trust Fund increased during most of 1982 and had a balance of $6.9 billion on October 31. However, by the end of the year its working balance (considering only investments and cash accounts) was lower -- as a result of the loans made to the OASI Trust Fund. From an accounting standpoint, however, the assets of the DI Trust Fund should include the amount of such loans, and so its "true" year-end balance will be significantly higher than its balance on October 31.

The balance in the OASI Trust Fund at the beginning of 1970 was approximately equal to annual outgo -- i.e., a fund ratio of about 100% (see Table 2). The fund ratio steadily decreased thereafter, reaching 15% at the beginning of 1982. In the absence of inter-fund borrowing -- or, equivalently, if the loans from the DI and HI Trust Funds were paid back at the beginning of 1983 -- the fund ratio then would be only about 4-6% (which would be insufficient to pay benefits on time).

The DI Trust Fund had a fund ratio of 126% at the beginning of 1970. This fell to 26% at the beginning of 1978 and then rose to 35% at the beginning of 1980. As a result of the revised allocation of the OASDI tax rate, it decreased to only 16% at the beginning of 1982. However, at the beginning of 1983, the fund ratio would be about 40% if the loans to the OASI Trust Fund are considered as assets.

| Table 2: TRUST-FUND RATIOS AT BEGINNING OF VARIOUS PAST YEARS |

|||||

| Calendar Year |

OASI |

DI |

OASDI |

HI |

OASDI-HI |

| 1970 |

101% |

126% |

103% |

47% |

96% |

| 1971 |

94 |

140 |

99 |

54 |

93 |

| 1972 |

88 |

140 |

93 |

47 |

87 |

| 1973 |

75 |

125 |

80 |

40 |

76 |

| 1974 |

68 |

110 |

73 |

69 |

73 |

| 1975 |

63 |

92 |

66 |

79 |

68 |

| 1976 |

54 |

71 |

57 |

77 |

60 |

| 1977 |

47 |

48 |

47 |

66 |

50 |

| 1978 |

39 |

26 |

37 |

57 |

41 |

| 1979 |

30 |

30 |

30 |

54 |

34 |

| 1980 |

23 |

35 |

25 |

52 |

29 |

| 1981 |

18 |

21 |

18 |

45 |

23 |

| 1982 |

15 |

16 |

15 |

53 |

22 |

NOTE: The "trust-fund ratio" is the ratio of the balance in the Trust Funds on a particular date to the outgo in the next 12 months.

Actual Experience in 1978-81 as Compared with Estimates Made in 1977

The 1978 OASDI Trustees Report stated that the 1977 Amendments would "restore the financial soundness of the cash benefit program throughout the remainder of this century and into the early years of the next one." It was further stated that, beginning in 1981, the short-range and medium-range annual deficits of the trust funds would be eliminated. However, this did not occur -- because of the adverse economic conditions during 1979-81, when prices rose more rapidly than wages and unemployment was substantially higher than anticipated (and despite the actual disability experience being more favorable than had been estimated to occur).

The intermediate cost estimates for the OASDI Trust Funds that were made in 1977 for the law as then amended showed decreases in the fund balance in 1978-80 (a total drop of $8.0 billion), but a significant build-up in 1981 ($7.4 billion). In actuality, there were decreases of $9.4 billion in 1978-80 and of $1.9 billion in 1981. The pessimistic estimate made in 1977 showed that income and outgo would be in very close balance in 1981-84, but the actual economic conditions have been worse, so that a substantial deficit occurred in 1981 instead, and much larger ones apparently are ahead.

Short-Range Cost Situation

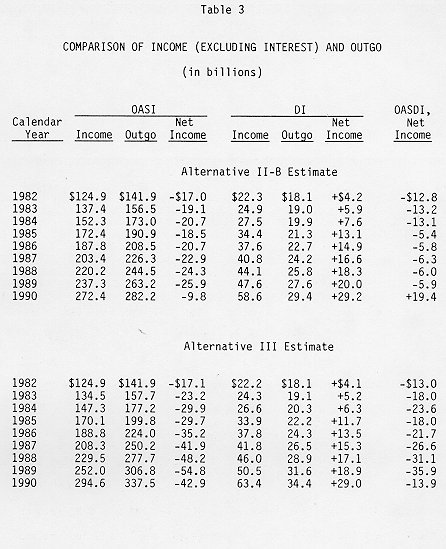

Under present law, the OASI Trust Fund will very likely be unable to pay benefits on time beginning in July 1983. Table 3 compares the income (exclusive of interest payments) and the outgo of the OASI Trust Fund for 1982-90, under the intermediate cost estimate (Alternative II-B) and under the pessimistic cost estimate (Alternative III). Under the intermediate estimate, the deficit of income as against outgo is about $20 billion in most years. Under the pessimistic estimate, the annual deficit increases from about $20 billion in the early years to $55 billion in 1989 (and even in 1990, when there is a higher tax rate, it is $43 billion).

The bleak picture for OASI changes somewhat when the DI program is also considered. It will be recalled that, in the 1977 Amendments, the portion of the OASDI tax rate which is allocated to the DI Trust Fund was increased significantly, because of its unfavorable and worsening situation during 1970-75 and the expectation that this adverse trend would continue. Instead, beginning in 1976, the disability experience became more favorable (although this was not recognized in the cost estimates made at the time of the 1977 Amendments). In addition, several legislative changes were made in 1977 and 1980 which resulted in lower costs for the DI program. As a result, the DI Trust Fund had, following 1977, very favorable net-income experience.

Table 3: COMPARISON OF INCOME (EXCLUDING INTEREST)

AND OUTGO

Both the intermediate and pessimistic cost estimates for 1982-90 show that the DI Trust Fund will have steadily increasing annual net income (as shown in Table 3). When the OASI and DI Trust Funds are considered in combination,(6) deficits of income over outgo remain, but of a much smaller magnitude than for the OASI Trust Fund alone.

As Table 3 shows, even under the intermediate cost estimate, the net income of the combined OASDI Trust Funds shows deficits during the remainder of the 1980s -- about $13 billion per year in 1982-84 and about $6 billion per year in 1985-89. In 1990, however, with the scheduled increase in the tax rate, a positive net income of almost $20 billion is shown.

However, a quite different picture for the combined OASDI Trust Funds during 1982-90 is shown under the pessimistic estimate. The annual deficits are about $20 billion in the early years of the period and increase to $36 billion by 1989. In 1990, even with the tax-rate increase, a deficit of $14 billion is shown.

A somewhat more precise way to examine the financial status of the OASI Trust Fund in the 1980s is to consider the increase in tax income -- or, alternatively, the reductions in benefit outgo -- that would be required during the period to reach certain alternative target levels of the fund ratios for the OASDI Trust Funds by the beginning of 1988.(7)

Tables 4a and 4b present the estimates of the increase in tax income needed for the OASDI Trust Funds -- or, alternatively, the decrease in benefit outgo needed -- according to the intermediate and pessimistic cost estimates of the 1982 Trustees Report. The figures are only slightly different whether there are increases in tax income or decreases in benefit outgo. Table 4c gives similar data for two other pessimistic sets of economic assumptions.

To achieve a trust-fund ratio of 15% by 1988 would require additional tax income or decreased benefit outgo (or a combination of both) of about $200 billion under the pessimistic estimate. If a trust-fund ratio of 25% were desired, the corresponding figure would be about $225 billion under the pessimistic estimate. Under the intermediate cost estimate, the corresponding figures are about $75 billion for a 15% fund ratio and $100 billion for a 25% fund ratio. Quite obviously, if the additional financing were provided on the basis of the pessimistic estimate, and if the economic experience is more favorable, the trust-fund ratio which would be obtained by the end of the period would be higher than the target -- a not undesirable result.

In some ways, the economic assumptions underlying Alternative III do not seem to be realistic in view of current economic events, because both the assumed CPI and wage increases are relatively high as compared with current experience. Accordingly, it seems desirable to test the effect of lower assumed future increases in the CPI and in wages, but with a pessimistic real-wage differential (as is the case, for example, in Alternative III).