1948 Advisory Council

In late 1948 the Federal Security Agency published its Annual Report, including the Report of the Social Security Administration (SSA) on the operations of the Social Security programs. In this context, SSA used the occasion of the issuance of the Advisory Council Report to make the case for its vision of a comprehensive Social Security program.

Social Security Administration

A Comprehensive Social Security Program

THE SOCIAL SECURITY PROGRAMS for which the Social Security Administration has Federal responsibility under the Social Security Act operated during the fiscal year 1948 in a setting of full employment, a record peacetime production of goods and services, and rising prices. Fewer workers were without jobs than in the preceding year. Earnings were higher, and the aggregate volume of savings increased. Prices were also at a record high, increasing during the year more rapidly than did wages or industrial production.

The national income totaled $212 billion, as against $193 billion in the preceding 12 months. The Nation's total labor force, including the armed services, averaged about 62 million persons during the year, nearly a million more than in the fiscal year 1947. Civilian employment was about 1.5 million higher, on the average, than in the preceding period. The number of persons in jobs covered by old-age and survivors insurance and unemployment insurance was the largest in the history of the programs, and the taxable wages of these covered workers, to which their benefits are geared, also reached record levels.

Even a vigorously functioning economy produces its share of economic casualties. Businesses die, plants are shut down for reorganization or retooling or because of shortages of raw materials, throwing out of work several million earners during the course of a year. Unemployment averaged about 2.1 million, or 150,000 less than the preceding year's average. In relation to the number of workers covered by State unemployment insurance systems, the number of eligible workers who filed claims remained low throughout the year. In June 1948, for every 100 covered workers, less than 4 workers filed claims for benefits. Not all workers who filed claims received benefits, however. Of the 4.8 million who filed and had enough wage credits to qualify for benefits, about 3.8 million drew some benefits during the year. The average duration of the payment was 11 weeks. In the majority of cases, the other claimants who received no benefits were re-employed during the waiting period.

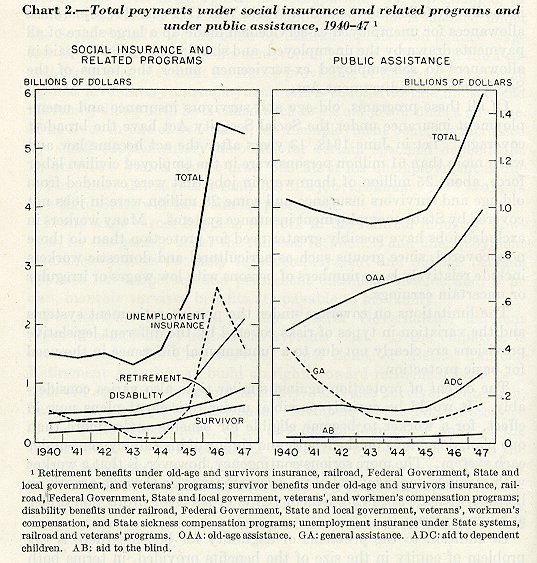

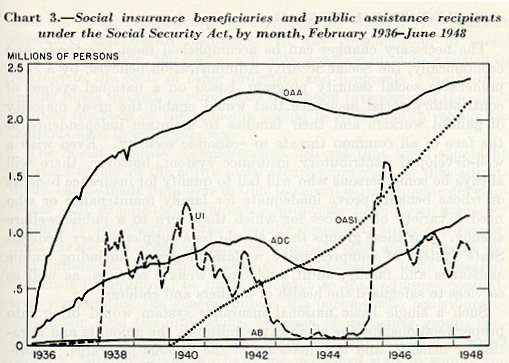

In June 1948, monthly benefits under old-age and survivors insurance were paid to almost 2.2 million beneficiaries--retired workers and their aged wives and dependent children, and widows, young children, and dependent parents of deceased insured wage earners. Public assistance payments were made in the same month to nearly 2.4 million needy aged persons, to 65,800 needy blind persons in the 47 States administering aid to the blind under the Social Security Act, and to nearly 1,150,000 children in 450,000 families receiving aid to dependent children. Both the number of mothers and children receiving services and the amount of services offered under the maternal and child health and child welfare services showed increases during the year as a result of the larger Federal grants made available by the 1946 amendments.

The gains in services to mothers and children would have been considerably greater, however, if the dollars expended for hospital and medical care and for welfare services had bought as much in goods and services as in previous years. The impact of high prices on the insurance and assistance programs was even more marked. In fact, during the year, as in the preceding fiscal year, Congress recognized the pressures of higher living costs by increasing Federal participation in public assistance payments, thus enabling the States to increase the level of payments under their State programs and to aid other persons who were forced to turn to the assistance programs to maintain themselves and their families. The increased Federal participation made it possible for a State to raise payments $5 per recipient of old-age assistance and aid to the blind and $3 per child receiving aid to dependent children, provided the State continued to spend as much per recipient from its own funds as before. The monthly benefit in old-age and survivors insurance, on the other hand, remained geared to the levels fixed in 1939. In view of the rise of some 70 to 75 percent in living costs since that year, the present benefits are no longer adequate in terms of purchasing power, nor do they represent an adequate replacement of wages.

In addition to the public assistance amendments, several other measures were enacted. For the sixth consecutive year, contributions under old-age and survivors insurance were held at 1 percent each for employers and employees. This time, the 1-percent rate was made effective for 1948 and 1949, and it was specified that the rate should increase to 1.5 percent each for 1950 and 1951, and to 2 percent for 1952 and thereafter.

Two other measures, enacted over presidential veto, affected the coverage of the insurance programs. The so-called News Vendors Bill (Public Law 492) excluded certain vendors of newspapers and magazines from coverage under old-age and survivors insurance and the Federal Unemployment Tax Act. Public Law 642 amended the definition of "employee" in the Social Security Act to exclude any individual (other than an officer of a corporation) who is not an employee under the usual common-law rules. Several hundred thousand persons who, as a matter of economic reality, were "employees" were thus reclassified as independent contractors and excluded from coverage under the insurance program. In vetoing both measures the President declared that they withdrew protection from persons now entitled to benefits and restricted coverage at a time when the program should be expanded.

Another enactment of administrative significance was the transfer of the United States Employment Service from the Department of Labor and its relocation in the Bureau of Employment Security of the Social Security Administration, where it had been when this country began to mobilize its manpower for defense and war. Similarly, Public Law 813, enacted June 29, transferred the administration of the Federal Credit Union Act to the Federal Security Agency, which established the Bureau of Federal Credit Unions in the Social Security Administration.

On April 8 the Advisory Council on Social Security, created by the Senate Committee on Finance, presented its first report to the Committee. The 17-member Council, chosen to represent all sections of the country and all walks of life, was appointed to assist and advise the Committee in studying the present programs under the Social Security Act. Its first report dealt with old-age and survivors insurance, and the Council recommended, among other changes, extension of coverage to all employments, increasing the tax base to $4,200, liberalization of benefit amounts, allowing a beneficiary to have supplementary earnings of as much as $35 a month without deduction from or loss of benefits, and reduction in the age at which women can qualify for benefits. A month later the Advisory Council submitted its second report, which recommended the adoption of an insurance program covering the risks of permanent and total disability and integration of that program with old-age and survivors insurance. As the fiscal year ended, the Council's reports on public assistance and unemployment insurance were pending.

PRESENT INSURANCE AGAINST WAGE LOSS

The reports of the Advisory Council and the economic and legislative developments of the past year have served effectively to confirm the Social Security Administration in its belief that the present limited system of social security, comprising the various programs operating under the Social Security Act and under other separate legislative measures, is an inadequate and inequitable way of providing the basic essentials of economic and social security for the Nation's gainfully employed persons and their families.

The assurance a wage earner and his family now have against the risk of wage loss arising from unemployment, old age, disability, or death of the family earner depends to a large extent on the provisions in effect for different types of occupations and the length of time the worker has been in the particular occupation. If, for example, he works in industrial or commercial employments, he is enabled under the Social Security Act to build up insurance protection against wage loss in his old age and for his survivors if he dies. Through the Federal-State unemployment insurance provisions of the act, he is insured against involuntary unemployment and is enabled to tide himself and his family along until he is called back to his old job or finds a new one. If he lives in one of five States, his unemployment benefit is increased by small supplementary amounts for certain specified dependents. In only two States can he draw benefits if his unemployment is due to temporary illness rather than loss of a job; in January 1949, workers in a third State will have similar protection.

If the wage earner happens to work in the railroad industry, however, he can qualify under the railroad retirement and unemployment insurance systems not only for unemployment and old-age benefits but also for temporary and permanent disability benefits and, if he dies, monthly survivor benefits are payable to his family.

For civilian employees of the Federal Government, different types of contributory retirement systems exist. If the employee is covered under the Civil Service, Canal Zone, or Alaska Railroad Retirement Acts, he can build up rights toward retirement benefits-- both old age and permanent disability--and also survivor protection, but not unemployment insurance. Members of the Foreign Service of the State Department, or of any one of four other units of the Government, are covered under still other systems set up for the specific establishment and varying in the type of benefit and eligibility - provisions in force. Still another group of Federal employees, including judges of the Federal courts, members of the various military services, and commissioned officers of the Public Health Service and of the Coast and Geodetic Survey, draw retirement pay under a non-contributory Federal system.

Employees of State and local governments are covered by the retirement systems of the State or municipality for which they work, if the unit has such a system, and there is considerable variation in the provisions of the separate systems. Some two-fifths of all State and local employees have no retirement protection.

Veterans, as a group, have probably the most extensive protection through public provision for retirement and disability payments, hospital and medical care, and compensation for their survivors. The extensive veterans' program comprises a substantial part of all Federal expenditures for disabled persons, a large part of all Federal expenditures for medical care, and a considerable portion of expenditures for aged persons and surviving dependents. In the years immediately following the end of World War II, Federal readjustment allowances for unemployed ex-servicemen made up a large share of all payments drawn by the unemployed, and sizable amounts were paid in allowances to self-employed ex-servicemen under the terms of the Servicemen's Readjustment Act.

Of all these programs, old-age and survivors insurance and unemployment insurance under the Social Security Act have the broadest coverage. Yet in June 1948, 13 years after the act became law and when more than 61 million persons were in the employed civilian labor force, about 25 million of them were in jobs that were excluded from old-age and survivors insurance and some 28 million were in jobs not covered by State unemployment insurance systems. Many workers in excluded jobs have possibly greater need for protection than do those now covered, since groups such as agricultural and domestic workers include relatively large numbers of persons with low wages or irregular or uncertain earnings.

The limitations on coverage under the present retirement systems and the variation in types of risks covered by the different legislative provisions are clearly not due to a fundamental difference in the need for basic protection.

The extent of protection against similar risks also varies considerably. It would be entirely possible, under retirement plans now in effect, for a worker to become eligible for benefits under more than one plan, depending on the length and timing of his employment under each system. The more serious contingency, however, is that a worker with earnings under several of the programs may go through a working lifetime without acquiring benefit rights or survivor protection under any one program.

In addition to the problems of eligibility for benefits there is the problem of equity in the size of the benefits provided, in terms both of comparability among the various systems and of current relationship to living costs.

These shortcomings of the present system are not caused by any fundamental conflict over the objectives of social security. They are due, instead, to the evolutionary development of public awareness of the need for adapting our social institutions to the changing needs of a highly industrialized country. As in the development of measures to promote educational opportunities and further the health and welfare of the population, the programs now included under the broad term of social security were adopted at different times to meet an emergent situation or the specific need of a group whose insecurity had gained public recognition. The legislation grew out of a positive need for action and fitted into a developing pattern of governmental responsibility. The inevitable result was a patchwork system, with major gaps in the protection afforded under the system and certain undesirable and unwarranted overlappings among the separate programs. Even the Social Security Act, significant as it was, was characterized by the Committee on Economic Security as a piecemeal approach, "dictated by practical considerations" but only a part of "the complete program which we must have ere long."

|

|

Over the years, as administrative experience has been acquired and as experimentation has proved the basic soundness of the programs, some progress has been made toward a more complete and comprehensive program. Certain legislative changes, on the other hand, have worked toward less comprehensive coverage and more stringent limitations of the basic objectives.

The need for a thoroughgoing review of the whole program was recognized by Congress in 1945, when the House of Representatives adopted a resolution authorizing the Committee on Ways and Means to obtain "information with respect to the need for the amendment and expansion of the Social Security Act." When the 1946 amendments were passed, both Houses of Congress affirmed the need for taking stock of the entire program. The reports of the Advisory Council to the Senate Committee on Finance, as well as other studies made by official groups during the past fiscal year and the studies made over the years by the Social Security Administration, provide a basis for action.

A SINGLE NATIONAL PROGRAM

The necessary changes can be accomplished most effectively and economically, the Social Security Administration believes, by a comprehensive social security program, based on a national system of contributory social insurance that would enable the great majority of gainful workers and their families to maintain independence in the face of all common threats to economic security. Even with a well-developed contributory insurance system, however, there will always be some persons who will fail to qualify for insurance benefits or whose benefits prove inadequate for family maintenance or who need a variety of services for which they turn to a public welfare agency. For these groups there should be a supplementary Federal-State system of comprehensive welfare programs, including public assistance and family, adult, and child welfare services, as well as services to safeguard the health of mothers and children.

Such a single basic national insurance system would bring into proper relationships the eligibility conditions, the amounts and duration of benefits, and the financing of the various programs. Moreover, the benefits paid would reflect more closely the wage loss actually suffered, since the individual's earnings in any job would be counted in computing his benefits.

Old-age and survivors insurance and unemployment insurance cover largely the same workers and should move in the direction of greater uniformity of coverage. A close relationship now exists between these insurance programs of the Social Security Act in the exchange of information on new employers and in preparation of data for estimates of employment and wages. As programs for permanent and temporary disability and health insurance are added to the social security program, the same wage records and the same central, area, and local office staffs can be utilized, thus assuring simplicity and economy of administration. Experience in operating old-age and survivors insurance has demonstrated the feasibility of decentralizing the day-by-day administration of a national program, to give individualized services through local offices that become closely interwoven with the life of the local community.

In the development of legislative and administrative provisions for a comprehensive system, there are innumerable elements, such as eligibility provisions, benefit formulas, dependents' benefits, claims and appeals procedures, and investment policies, that are common to more than one program. The development of temporary disability insurance, for example, involves close coordination with unemployment insurance, permanent disability insurance, and health and medical care plans. Problems of medical certification and rehabilitation are closely related aspects of temporary disability, permanent disability, and health insurance. In any consideration of social security legislation, the cost of a specific program must be weighed in relation to the costs of other programs and proposals. Methods of raising funds through pay-roll taxes or general revenues and the effect of these methods on the economy should be evaluated in relation to methods used in other programs.

The Social Security Administration believes that there should be constant review of the entire social security program, so that adjustments can be made from time to time to accord with economic developments and experience. Numerous proposals have been made for changes in the programs, which require continuing study and review. Such review and study demand an adequate staff and sufficient appropriations to carry on effectively the necessary basic research. Sufficient funds should be made available so that advisory committees, representing the general public, the persons who contribute to the system, and the professional interests of particular groups concerned with a program, can meet frequently and so that the Social Security Administration can have the necessary staff to supply the members of such committees with relevant and current information.

Experience with advisory councils in 1935, 1938, and 1948 indicates, the Administration believes, the desirability of having an over-all advisory council periodically study the operation of the program and make recommendations for legislative changes. The Administration believes that the basic statute should provide for such periodic review.

At the present time, more than 77 million living persons have built up wage credits under old-age and survivors insurance. Some 2.2 million persons are receiving regular monthly insurance benefits. Some 37 million persons are insured under State unemployment insurance laws. Approximately 4.4 million needy persons are receiving public aid. Next to national defense, expenditures for the social security program, broadly defined to include veterans' pensions, and health and related programs, are the largest single item in the Federal budget. Federal grants to the States for social security purposes amount to more than 60 percent of all Federal grants. State unemployment insurance contributions account for approximately one-seventh of total State tax collections.

The size and importance of such a major segment of all public expenditures warrant not only the appropriation of adequate funds for research but also the appropriation of sufficient funds for public information. Right now, many individuals are losing valuable benefit rights because they lack information about the program. In a Nationwide and dynamic program that affects actually or potentially the economic security and well-being of the vast majority of the wage earning population, such information must flow out in a continuing stream if the taxpayers, the beneficiaries, and the public as a whole are to know the provisions enacted by Congress for their protection and their rights and obligations under the law.

SUMMARY OF RECOMMENDATIONS

In presenting the following summary of the major recommendations for a comprehensive program, which are developed in more detail in subsequent sections of this report, the Social Security Administration once more reaffirms its conviction that current economic conditions offer an exceptional opportunity to develop a comprehensive program that will provide the basic essentials of social security for all persons in all parts of the Nation. It believes that a Nation with an annual income in excess of $200 billion cannot afford not to strengthen all the economic and social defenses of free citizens in a democracy.

A Comprehensive Program of Social Security

A comprehensive, basic national system of contributory social insurance.--This basic program, covering all major risks to economic independence and all workers and their dependents threatened by such risks, would include insurance against wage loss in periods of disability and against costs of medical care, for which no general provision now exists in the United States, as well as old-age and survivors insurance and unemployment insurance. Cash benefits would be related to past earnings and additional benefits provided for dependents. The program would be designed to eliminate existing gaps in the coverage of both persons and risks, to remove present inequities in the protection of workers and their families and in the financial burdens of employers, and to provide a consistent relationship, not only among the insurance provisions for the various risks covered but also between the provisions of the basic system and those of supplementary special systems now in effect for particular groups. As compared with separate programs to meet particular risks, such a system would reduce administrative costs and reporting burdens and simplify arrangements as they affect workers, employers, and public agencies.

A comprehensive program of public welfare, including public assistance and family and child welfare services.--Under this program, on a Federal-State basis, payments and services financed from Federal and State funds would be available to any needy person in the United States, irrespective of the reason for need or the place of residence. The Federal financial contribution to such a program should be designed to remove the great disparities now existing in the treatment of various classes of needy persons and to reduce the disparities in different parts of the country. The Federal Government should participate in payments made directly to individuals or agencies authorized to supply medical services to needy persons.

The role of public welfare agencies should be strengthened by Federal participation on a State-wide, comprehensive basis in welfare services for families and adults and children. Federal grants should be available likewise to assist the States in developing such services to families and individuals--whether recipients of assistance or others not needing or requesting financial assistance--who turn to the agencies for help that will enable them to keep the family together, to become self-supporting, to make use of community resources, or to solve individual problems in family or community adjustment. Research should be conducted-on the causes of dependency and other factors affecting family life.

A comprehensive program of health and welfare services for children and research in child life.--Such a plan should provide for the progressive development of the full range of health and welfare services essential to the physical, emotional, and social well-being of our children, to be available wherever they live and whatever their income or race. Research and investigation in child life are essential in supporting and guiding the development of these services and enriching our knowledge and understanding of the needs of children. Such research should approach the programs of child life from the point of view of the total child, his growth and development, and his place in society.

Legislative changes that would assist in the achievement of the objectives outlined above are discussed more fully in subsequent chapters. In brief, the recommendations include:

Old-Age and Survivors Insurance

Coverage of all gainful workers, including agricultural and domestic employees, public employees and members of the armed forces, employees of nonprofit organizations, railroad employees, and self-employed persons including farmers and small businessmen.

Repeal of the legislation eliminating certain salesmen and adult news vendors from coverage.

Changes in the average monthly wage and benefit formula to increase benefits materially, and increases in both minimum and maximum benefit amounts.

Increase to $4,800 a year in the maximum amount of earnings taxable and to $400 in the maximum average monthly wage on which benefits are computed; expansion of the definition of taxable wages to include all tips, gratuities, and dismissal wages.

Increase in the amount of earnings a beneficiary may receive in covered employment without suspension of monthly benefits.

Reduction of the qualifying age for all women beneficiaries from 65 to 60 years.

Changes in eligibility requirements to make it easier for persons in newly covered employments and persons of advanced age to qualify for benefits.

Greater uniformity and greater equity in defining, for purposes of the insurance system, family relationships and conditions of dependency that qualify members of an insured person's family for benefits, especially with respect to the rights of dependents of women workers.

Payment of a lump sum in the case of every deceased insured wage earner.

Adoption of a long-range plan for financing old-age and survivors insurance which looks toward an eventual tripartite division of costs among employers, employees, and the Federal Government.

Unemployment Insurance

Extension of the Federal Unemployment Tax Act to all employers of one or more workers in covered industries and to many excepted employments.

Repeal of the legislation eliminating certain salesmen and adult news vendors from coverage.

Provision of unemployment benefits for employees of the Federal Government.

Provision for a weekly benefit that approximates 50 percent of the weekly wage for a claimant without dependents, and provision for supplementary amounts for claimants with dependents.

Provision of a maximum weekly benefit amount that will be not less than $30 for a claimant without dependents and $45 for a claimant with three or more dependents.

Provision of 26 weeks potential duration of benefits for all claimants who meet the qualifying-wage requirement and whose unemployment extends over so long a period.

Provision that disqualifications for voluntary leaving without good cause, discharge for misconduct, or refusal of suitable work should entail only postponement of benefits for not more than 4 weeks rather than cancellation of benefit rights or reduction of benefits.

Definition of good cause for voluntary leaving or for refusing suitable work to include good personal reasons, not merely causes attributable to the job or the employer.

If unemployment insurance is made a part of a coordinated Federal social insurance system, reduction of the contribution for unemployment insurance to a level that will reflect cost experience and permit the proper utilization of reserves; if the present State-by-State reserve system is continued, a somewhat smaller reduction in contribution, with provision for a minimum employer contribution to State funds necessary to secure full credit against the Federal tax, with the States left free to modify their rates above the minimum contribution through experience rating, State-wide uniform tax rates, or some other way, and with a Federal solvency-guaranty fund. If tax-offset features are abolished, establishment of a grant-in-aid system for both benefits and administrative costs.

Earmarking the Federal share of the Federal tax for administrative expenses, with provision for a contingency appropriation and for advances to the States if their reserve funds run low.

Disability Insurance

Provision under Federal law for cash benefits to insured workers and their dependents during both temporary disability (less than 6 months) and extended disability (6 months and over).

Medical Care Insurance

Insurance against costs of medical care, including payments to physicians, dentists, nurses, hospitals, and laboratories, with provision for free choice of doctor and patient, decentralization of administration, and utilization of State administration.

Public Assistance and Welfare Services

Change in the basis of Federal financial participation to relate the Federal share more nearly to the financial resources of each State.

Increase in the maximums for aid to dependent children to conform substantially to the maximum in old-age assistance and aid to the blind.

Specific requirement that a State, as a condition of plan approval, shall apportion Federal and State funds among localities in accordance with their need for funds.

Grants-in-aid to States for general assistance to any needy person, as well as for the special types of public assistance.

In aid to dependent children, authorization for Federal financial participation in assistance to parents or other relatives who assume responsibility for parental care or support of any needy child and who maintain a family home for the child; such payment to be made without regard to the cause of the child's need.

As a condition of plan approval, no person to be denied aid to the blind because of age.

Approval of the State plan to be conditioned on the absence of any residence or citizenship requirement.

As a condition of plan approval, no State plan to require transfer of title or control of applicant's or recipient's property to the State or locality. The State would not be precluded from making a recovery from the estate of a deceased recipient for assistance that he had received, or from imposing a lien to secure this claim provided the applicant or recipient retained title and control of the property.

Authorization of Federal financial participation in payments made directly to individuals or agencies supplying medical services to needy persons.

Federal participation in assistance payments made to or in behalf of needy persons living in public medical institutions, except tuberculosis or mental-hospitals. States to be required to establish and maintain suitable standards for all institutions of the types specified in the State plans as institutions in which recipients of assistance may reside.

Explicit provision, as a condition of plan approval, that a State shall define a standard of living to be achieved through the individual's own resources and assistance, and shall develop standards for evaluating income and resources, including only such income and resources as are actually available to the individual; such standards to be objective and State-wide in application.

Federal financial participation in all types of welfare services administered by the staff of the public welfare agency designed to help families and individuals become self-supporting, to keep families together in their own homes, and to reduce the need for institutional care; such services to be available, when requested, both to recipients of assistance and to others without regard to their economic status.

Extension to Puerto Rico and the Virgin Islands of Federal grants-in-aid for all assistance and welfare programs in which the Federal Government participates.

Study of the causes of dependency and other factors affecting family welfare, with a view to the development of suitable programs by public and private agencies for the advancement of family welfare.

Children's Services and Research in Child Life

Adequate funds to be made available to strengthen and broaden the work of the Children's Bureau as a center of information related to child life; to assist in financing specific research projects in child growth and development and in child life by universities, schools, child research centers, agencies, and individuals; and to undertake original research and investigations that require Nation-wide study or that have Nation-wide significance to State and community programs for mothers and children.

To replace the present limitations in annual appropriations for child health and welfare services by an authorization for appropriations in amounts which are sufficient to provide for expansion of such services for children as rapidly as States can use additional funds effectively. State planning to proceed at a rate consistent with the availability of personnel and facilities that meet standards. Progress to be made year by year toward the goal of child health and child welfare services available in every local subdivision of the country.

Priority to be given by the States in developing their programs to groups of children in most urgent need--for example, children needing prolonged and expensive medical care; prematurely born infants; children with vision and hearing defects; children in need of health services and medical care in families receiving public assistance or social insurance; school children in need of health services and medical care; children in need of foster-home care; children in need of temporary or emergency care away from their own homes; children in need of day care; and children of migratory workers.

Legislation to provide that a definite percentage of the funds available for maternal and child health, crippled children, and child welfare services can be used by the Children's Bureau to promote effective measures on a national basis for carrying out the purposes of the programs, by demonstrations and evaluations of the means of carrying programs forward and by paying the salaries and expenses of personnel requested for temporary assignment by the State or local agencies, and for the administration of the programs.

Substantial Federal funds to be made available to the Children's Bureau to increase the number of professional and technical personnel through grants to such educational institutions as medical, dental, nursing, social work, and public health schools, and through a system of fellowships and scholarships to individuals who will specialize in services to children.

Coordinated Administration

Federal administration of all social insurance programs as a coordinated system.

Advisory committees for all programs, the committees to be composed of representatives of beneficiaries, employers, and the public.

Adequate appropriations and staff for research and program planning.

Adequate appropriations and staff for informational services to inform beneficiaries, employers, and the public of their rights and obligations under the Social Security Act and related laws.

THE MAJOR RISKS TO SECURITY IN 1947-48

Annual inventory of the social security status of the population is helpful in ascertaining the size of the groups experiencing income losses and the extent to which existing measures compensate wholly or partly for the losses sustained, and in throwing additional light on the reasons for the recommendations of the Social Security Administration for broadening and strengthening the country's social security program.

Unemployment

During the fiscal year 1948 a weekly average of 2.1 million persons were unemployed, somewhat more than were out of work during the acute manpower shortages of the war years but a smaller number than in 1946-47 and a record low for any peacetime year since 1929. Economists regard unemployment of 3 to 4 percent of the labor force as a normal contingency of the movement between jobs that is characteristic of a healthy economy and a free and mobile labor force. In 1947-48, unemployment receded to 3 percent of the labor force. The average unemployed worker was out of a job for a relatively brief time.

Perhaps two-thirds of the unemployed during an average week in 1947-48 were in receipt of unemployment benefits. The others were ineligible for benefits because they had not been in covered employment or had insufficient wage credits in covered employment, or they failed to draw benefits because they obtained new jobs before the waiting period had expired or because they had already exhausted their benefit rights.

| Program | Average weekly number of beneficiaries (in thousands) |

||

| 1946-47 | 1947-48 | Percentage change | |

| State unemployment insurance | 902 |

815 |

-10 |

| Railroad unemployment insurance | 61 |

44 |

-28 |

| Servicemen's Readjustment Act | 1,126 |

534 |

-53 |

The number of unemployment insurance beneficiaries is only a partial measure of the protection afforded by the program. During the calendar year 1947 about 37 million persons earned sufficient wages to be eligible for benefits under the State unemployment insurance systems. The 3.8 million different individuals who drew benefits in 1947 under these systems thus represented one in every nine persons with potential benefit rights.

Old Age

In June 1948 about 44 in every 100 men 65 years and over were working; 16 percent were receiving old-age and survivors insurance; 10 percent were the beneficiaries of the railroad and government retirement programs or were in receipt of veterans' pensions or compensation; and 22 percent were on the old-age-assistance rolls. There is some duplication among these groups, and the number with income from other sources exclusively--industrial pensions, privately purchased annuities, investments, and aid from friends or relatives--is not known, but it is doubtful whether it exceeded 20 percent.

Since the establishment of the old-age and survivors insurance program in 1935 was motivated in part by a desire to retire older workers in order to make jobs available for younger people, it may seem surprising at first glance that the most important source of income for aged men in 1948 was employment. It is well to remember in this connection that two out of every three men are still in the labor force at age 65 and that the ratio does not drop below one in two until age 70. It is true that workers who have had sufficient earnings in covered employment are eligible for old-age and survivors insurance at age 65, and some retirement programs fix the eligibility age even lower. But, even with relatively attractive retirement provisions, pride in the retention of one's physical and mental vigor, habit, and a need to feel useful keep many aged persons at work. When the primary benefit averages $25.13 a month, as it did in June 1948, it is largely the sick and enfeebled workers who retire; the aged earners who can stay at work do so. On January 1, 1948, of the 1.8 million persons who were aged 65 years and over and who were eligible for primary benefits by reason of age and wage credits, slightly fewer than half were in receipt of benefits.

The social security status of aged women presents many contrasts to that of aged men. Relatively few aged women are in the labor force; the great majority are dependent on others for support and their economic fortunes hinge largely on their marital status. About 55 in every 100 women aged 65 and over are widows; available information indicates that relatively large numbers are living with and dependent on their children. Their failure to qualify for social security benefits reflects to a large extent the relatively late start of the old-age and survivors insurance program and the present limitations in program coverage.

|

| Source of income | Persons aged 65 and over (in millions) |

||

| Total | Men | Women | |

| Total | 10.9 |

5.2 |

6.7 |

| Employment | 3.7 |

2.3 |

l .4 |

| Earners | 2.8 |

2.3 |

.5 |

| Wives of earners | .9 |

-- |

.9 |

| Social insurance and related programs: | |||

| Old-age and survivors insurance | 1.5 |

.8 |

.6 |

| Other programs | .9 |

.5 |

.4 |

| Old-age assistance | 2.4 |

1.1 |

1.2 |

The major development during the year was the steady growth in the old-age and survivors insurance beneficiary load. Monthly benefits were paid to about 1.2 million aged persons in June 1947 and almost 1.5 million in June 1948, an increase of 22 percent. The old-age assistance load also increased, but only by 97,000 or 4 percent. A slight increase was experienced in the number of beneficiaries of the railroad and government programs. The number of aged earners remained at approximately the same level during the period.

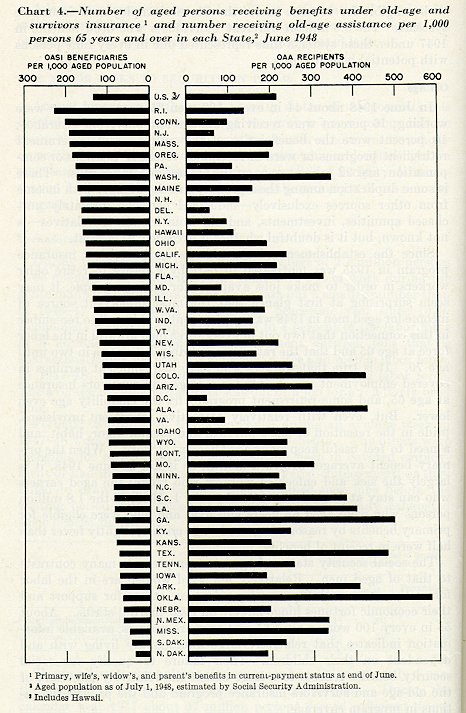

As has been true for each year since old-age and survivors insurance monthly benefits were first paid in 1940, the number of insurance beneficiaries grew more rapidly than the number of assistance recipients. In the 3 years June 1945-June 1948 the ratio of old-age assistance recipients to aged beneficiaries of old-age and survivors insurance dropped from three to one to about one and a half to one. This shift in the relative importance of the two programs has been more pronounced in some parts of the country than in others. In June 1948, 11 States had more aged persons on the insurance rolls than on the public assistance rolls. As might be anticipated from the coverage provisions of the insurance program, these were mostly industrial States. As the insurance program matures, an increasing number of aged persons will qualify for benefits. On January 1, 1948, approximately 37 million persons were fully insured under old-age and survivors insurance, including 25 million men, or more than half the male labor force in the country. Extension of coverage to all employments, as recommended by the Social Security Administration, may be expected to enable relatively more of these individuals to retain their insurance status until age 65, and to help workers now in noncovered employment to acquire insured status.

Death of the Family Earner

Improved mortality experience has reduced the relative number of fatherless children and young widows in recent years, but death still takes a large toll of men in the prime of life. In 1947-48, perhaps one-third of a million women under age 65 became widowed. All told, the country had in June 1948 about 3.4 million widows under 65 years of age. Employment constituted a major source of income for almost half the total. Somewhat more than half a million received benefits from social insurance or related programs, including 140,000 beneficiaries under old-age and survivors insurance and about 400,000 under the veterans' program. Slightly less than 100,000 were in families receiving aid to dependent children.

Young widows qualify for benefits under most survivor programs only when they have in their care children under 18 years. Among such widows the proportion with income from social insurance and related programs is therefore much higher than among widows as a group. Of the estimated 0.7 million widows in June 1948 under age 65 and with children under 18 years, between one-half and two-thirds were beneficiaries under old-age and survivors insurance, the veterans' program, or the-railroad retirement program or were members of families receiving aid to dependent children.

Fatherless children under 18 years of age numbered approximately 2.6 million in June 1948, of whom 530,000 or 20 percent were receiving old-age and survivors insurance. Close to 300,000 or about 11 percent were beneficiaries of the veterans' program and some 32,000 were receiving payments under the recently established survivor program of the Railroad Retirement Board. About 260,000 were receiving aid to dependent children.

| Source of income | Fatherless children under age 18 (in millions) |

Widows under age 65 (in millions) |

| Total | 2.6 |

3.4 |

| Employment | .2 |

1.5 |

| Social insurance and related programs: | ||

| Old-age and survivors insurance | .5 |

.1 |

| Other | .3 |

.4 |

| Aid to dependent children | .3 |

.1 |

Since 1943, more fatherless children have been receiving old-age and survivors insurance than aid to dependent children. From 1943 to 1948 the proportion of fatherless children benefiting from old-age and survivors insurance rose from approximately 7 to roughly 20 percent of the total. This proportion is likely to grow, since the 28 million men who were fully or currently insured on January 1, 1948, and whose death could give rise to survivor benefits, included in their number more than half the men in the country with one or more children under 18 years.

Disability

Compensation for wage loss suffered as a result of industrial injury was one of the earliest forms of social insurance in the United States, but 40 years after the enactment of the first operating workmen's compensation act the country still does not have any generally available insurance against wage loss caused by temporarily disabling illness or permanent total disability of non-industrial origin. Existing disability insurance programs are limited in coverage to particular areas, particular employments, or particular types of disability.

In the field of temporary disability, most of the earnings lost by the daily average of about 2 million persons recently in the labor force but with a disability that keeps them from working remain uncompensated. Some replacement is effected through formal and informal sick leave plans in industry, private group and individual insurance, and the benefits administered by mutual benefit associations and unions. Public cash sickness insurance systems have been in operation in Rhode Island since 1943 and in California since 1946. These provide limited benefits for temporary disability for approximately the same workers as are covered by unemployment insurance. In 1947-48, beneficiaries averaged 4,900 per week in Rhode Island and 18,500 per week in California. Under legislation adopted in June 1948, New Jersey begins paying benefits under its temporary disability program on January 1, 1949.

Workers suffering from prolonged total disability are exposed to greater economic hazards than those whose wages are temporarily interrupted by illness or injury. For individual families the result is frequently the complete loss of all family resources. In the United States there are 2 million or more persons who have been totally disabled for longer than 6 months and who, but for their disability, would be in the labor force. The proportion with compensation against wage loss is even smaller than in the case of temporarily disabled workers.

Government workers have some protection against loss of earnings due to permanent disability under provisions which permit retirement for either age or permanent disability, although the benefits for disability may be very low unless the worker has had substantial prior periods of employment. In June 1948 approximately 35,000 persons were receiving benefits under the Federal program and 27,000 under programs administered by State and local governments. The railroad social insurance program provides benefits for temporary as well as permanent disability and for maternity. Persons retired for permanent disability numbered 62,000 in June 1948. Temporary disability beneficiaries averaged 27,000 per 14-day benefit period in 1947-48. An average of 1,000 drew maternity benefits.

In 1947, $290 million was paid in cash benefits for temporary or permanent disability of a work-connected origin. Disabilities arising out of employment constitute, however, less than 5 percent of all disabling illnesses and injuries.

Of a rather different character is the program for veterans. Somewhat more than 2 million veterans were receiving pensions or compensation for disability in June 1948. However, most of these beneficiaries were only partially disabled and were engaged in some employment; they are not included in the estimated 4 million persons, cited above, who are too disabled to work.

In the absence of general insurance systems for either temporary or permanent disability, a substantial number of disabled individuals or their dependents are cared for through public assistance. Aid to the blind went to 83,000 persons in June 1948. In the same month the families of about 90,000 incapacitated men received aid to dependent children. More than one-third of the cases opened for general assistance in large cities are in need because of the illness or disablement of the chief earner, suggesting that, among the 366,000 cases throughout the country receiving general assistance in June 1948, perhaps 120,000 contained a disabled wage earner.

Medical Care

Many people go for relatively long periods without a single illness, but the average individual is ill once during the course of a year. Most illness is not disabling; some is disabling but does not require bed care; perhaps one illness in five confines the patient to bed. The more severe the illness, the less frequent is its occurrence and the more expensive it becomes. Somewhere early along the scale of lessened frequency but greater severity, the cost of an illness slips beyond the ability of the average family to pay out of current income. And since no individual knows when severe or expensive illness will strike, saving money on an individual basis to pay for large medical bills is impractical and economically unsound for most families. For middle and low income groups, inability to pay for medical care extends even to the more common conditions requiring a doctor's attention.

Whether the sick person is a subsistence farmer living from hand to mouth or a skilled worker with a savings account to fall back on in an emergency, the consequences of paying for medical care on an individual and fee-for-service basis are generally the same--hesitance and reluctance to seek medical advice in the early stages of illness when it can be most useful, inroads into family resources, a strain on family living standards, and a mortgage on the family's future earnings. In poor areas it means fewer doctors and fewer hospitals, since local funds are often too meager to finance and support hospitals, and doctors are unable or reluctant to practice in areas where remuneration is low and diagnostic and treatment facilities are inadequate.

It was to avoid such consequences that plans for prepaying hospital and medical costs were devised. An insurance plan to pay for hospital care for merchant seamen was established by Congress as long ago as 1798. The modern use of the insurance approach to the problem of medical care costs originated in this country in the need to provide medical services for work-connected injuries to people in hazardous industries or in areas remote from medical facilities. In time, the employees affected, chiefly in the railroad, lumbering, and mining industries, increased their contributions to finance medical service for all illness regardless of origin and to cover the illness of dependents as well. Somewhat later, groups of physicians operating private clinics undertook to furnish medical care on a prepayment basis. As the idea spread, it was taken up by consumer-sponsored groups, by fraternal organizations, by unions, and by State and county medical societies. In June 1948 about 28 million persons were members of voluntary prepayment hospital service plans. Nearly 10 million persons, including many with prepaid hospital coverage, were protected against the cost of some or most of their medical care through voluntary prepayment medical care plans. About 15 million persons, including dependents, were covered for part of their hospital expenses through group contracts written by commercial insurance companies. Almost as large a number, about 12 million, were insured for surgical expenses through group commercial insurance contracts. An unknown number of persons have some indemnity insurance against medical costs through individually purchased accident and health insurance policies.

The voluntary prepayment plans have been useful in demonstrating the feasibility of the insurance approach to medical care costs. They have developed a body of experience in the administration of such plans. They have accustomed millions of Americans to the idea of meeting medical care costs not on an emergency basis but through periodic budgeting. They have acquainted large numbers of persons with the value of having access to medical service as needed, without the barrier interposed by cost. In plans with employer participation, they have reduced the financial burden which illness throws on low income families.

Voluntary plans, however, have not met, and they do not promise to meet in the foreseeable future, the needs of the American people. The groups least able to purchase medical care in the existing market are likely to be the last to be reached, if ever, by voluntary plans. To bring them protection, a national health insurance plan is needed.

The voluntary plans, furthermore, offer only partial protection in the great majority of cases, being limited either to hospital care up to a maximum number of days per year, or to specified surgical services in hospitalized cases. They do not adjust contributions to income and are relatively costly. The voluntary insurance plans have achieved their present coverage in large measure by keeping the premiums down through provision of only partial and limited benefits.

A national health insurance plan would bring comprehensive medical care within the reach of every American, encourage increases in medical personnel and facilities and their availability in areas now inadequately served, and provide continuity of insurance protection to persons moving from job to job or from one area to another.

Health insurance is not a public salaried medical service, and is not, therefore, "socialized medicine" in the customary and proper sense of this phrase. It makes use of the existing system of private competitive practice. The significant change from present arrangements is the substitution of payment from an insurance fund for individual payment by patient to doctor. The patient remains free to select the doctor of his choice, and the doctor retains his freedom to accept or reject patients. Doctors are free to choose the method by which payments are made to them from the insurance fund. Hospitals remain under their customary ownership, control, and management, as when they make contracts with voluntary insurance plans to be reimbursed for services to insured persons. In its administration, health insurance can and should be highly decentralized, adapted to local needs and conditions. Subject to national standards, State and local agencies would participate in the administration of the programs. Maximum utilization would be made of existing facilities and personnel, and arrangements could be made with private groups and organizations to provide services to insured persons.

Such a national health insurance program need not increase the Nation's present medical bill, currently running about 4 to 5 percent of the national income. It would promote the more effective use of this expenditure, would distribute each year's cost over the whole population instead of permitting it to fall only on those who suffer illness, and encourage a more adequate supply and a better distribution of medical personnel and facilities. In conjunction with proposals looking toward the construction of additional hospitals and related facilities, expansion of public health and maternal and child health services, governmental aid for medical education and research, and protection through insurance against the loss of wages from sickness and disability, it should enable the country to move forward with accelerated speed toward the conquest of illness and alleviation of its social and economic consequences.